Uber-rich say they’ll flee if wealth tax proposal passes. History suggests otherwise.

Department of Labor “walked away from” rule that expanded overtime to 4 million workers, says former agency head.

Experts say that policies such as higher taxes on the wealthy and expanded child care are both effective and popular.

Researchers say new data shows need to pull back tax breaks for the wealthy to spend on aid.

Though most Americans think the rich don’t pay their fair share, conservatives still want to lower their taxes.

As billionaires blast off into space, Americans increasingly support federal and state wealth taxes.

Despite record job losses during the pandemic, the 1% have left the state flush with cash.

Trump’s second term would likely triple down on his first term’s trends: tax cuts for the rich and attacks on the Affordable Care Act.

Since the law’s passage, the federal government has seen the largest year-over-year drop in corporate tax revenue outside of a recession.

Post-WWII reforms like the New Deal and the ensuing consolidation of the labor movement increased income equality in the U.S., but the playing field started to tilt in the 1970s due to the forces of globalization and pro-corporate government policies that hurt the working class.

A French economist finds that America’s tax structure lies at the heart of inequality.

Swarthmore students shutter scandal-wracked fraternities. Business interests fight L.A.’s school parcel tax. The wage penalty sapping teachers’ salaries.

Co-published by Fast Company

The ability to force the rich to pay their taxes is at least as monumental a challenge as the political project to increase taxes on the wealthy.

The failure of this homeowners’ tax-break measure might have been predictable–its creators didn’t mount much of a campaign, and evidently left it for dead.

The state Legislative Analyst’s Office estimates that California schools and local government losses will run $1 billion annually if voters approve a new property tax measure.

In an interview with Capital & Main, the California State Controller offers her assessment of the president’s proposal, and concludes that it is not genuine tax reform but largely a giveaway to the wealthy.

Most people don’t realize that when corporations are hit with massive punitive-damage awards, they actually pay far less than the amounts reported in news accounts. The financial sting of those awards can be eased because companies can deduct the amount paid from their taxes.

The last time California enacted comprehensive tax reform, FDR was president, Babe Ruth was still playing baseball and the Golden State was five years away from seeing its first freeway open.

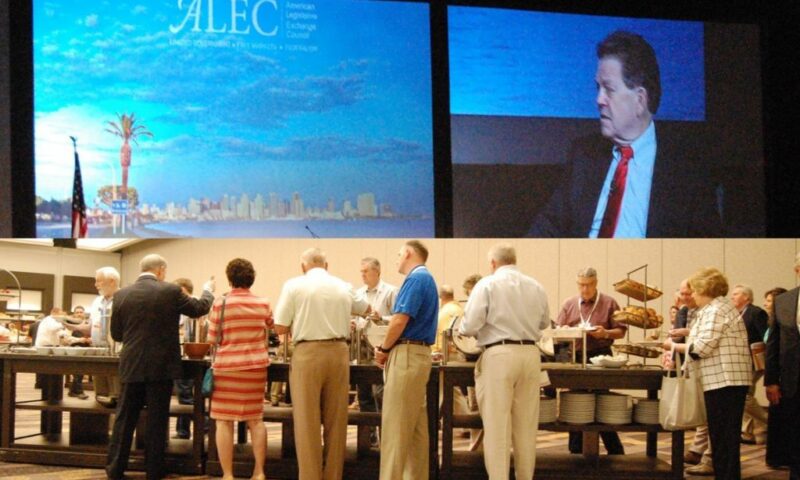

“The biggest scam of the last 100 years is global warming!” thundered Stephen Moore to ALEC’s plenary breakfast club this morning. “It’s no surprise that when you give these professors $10 billion, they’re going to find a problem.” Moore then singled out North Dakota for its regulatory-free attitudes toward the fracking industry: “I just have one message for you — drill, baby, drill!”

See more of our coverage of the ALEC Annual Meeting

The annual meeting of the American Legislative Exchange Council began wrapping up business in San Diego Friday on this defiant note from Moore, a former Wall Street Journal writer. This newly hired Heritage Foundation economist is an apostle of completely eliminating state income taxes and has been in a running feud with liberal economist and New York Times columnist Paul Krugman, over Moore’s casual regard for accurate reporting.

Moore’s speaking partner today was fellow supply-sider Arthur Laffer,

» Read more about: ALEC Confidential: Tales from the Supply-Side »

In How Enterprise Zones Are Killing the California Dream, Frying Pan investigative reporter Gary Cohn looked at the impact of the controversial program, including workers who lost their jobs while their former employers received tax breaks for hiring lower-paid replacements. He also reported on two strip clubs revealed to have benefited from the secretive program. Other media have picked up the story as well, building momentum for an overhaul. A more detailed overview of the Governor’s plan can be found here. The following post first appeared in the blog Labor’s Edge.

To some politicians, economic development means giving hundreds of millions of taxpayer dollars to strip clubs, fast food joints and retail giants like Walmart. Gov. Brown, thankfully, has a better idea. Today, the Governor announced a broad coalition of labor, business and others in support of his good jobs plan that will flip the broken enterprise zone program into real incentives for creating quality,

» Read more about: Governor Brown Outlines Plan for Good Jobs »