Labor & Economy

Two Years Later: What Has Trump’s Tax Law Delivered?

Since the law’s passage, the federal government has seen the largest year-over-year drop in corporate tax revenue outside of a recession.

Two years ago President Donald Trump signed the Tax Cut and Jobs Act into law. Republicans are touting the legislation as a boon to the economy, which has managed to pair record low unemployment with rising income inequality and an overabundance of low-paying jobs. The consequences of the legislation, which is expected to add $1.5 trillion to the federal deficit over a decade, could play out over years. Economic studies and conversations with experts allow us to measure the reality of the legislation’s effects against the promises made by supporters of the law.

Co-published by Newsweek

Promise: The corporate tax break will “in the medium term boost the average U.S. household income annually in current dollars by at least $4,000, conservatively,” according to President Trump’s Council of Economic Advisers in October of 2017.

Reality: This prediction assumed a boom in business investment that never occurred. The windfall businesses received largely went to wealthy investors in the form of stock buybacks and dividends. Only one-fifth of the tax gains was directed toward capital and research and development expenditures, according to one study.

After the law’s passage, companies announced worker bonuses with much fanfare. But those one-time bonuses amounted to only two cents per hour on average, according to the Economic Policy Institute, and did not provide lasting employee benefits. “Businesses have been electing to give workers short-term payouts for retention and morale, rather than longer-term wage increases the economy had experienced in previous decades,” according to a June 2018 article in the Wall Street Journal.

Promise: “Our focus is on helping the folks who work in the mailrooms and the machine shops of America — the plumbers, the carpenters, the cops, the teachers, the truck drivers, the pipe fitters.” – President Trump, November 29, 2017

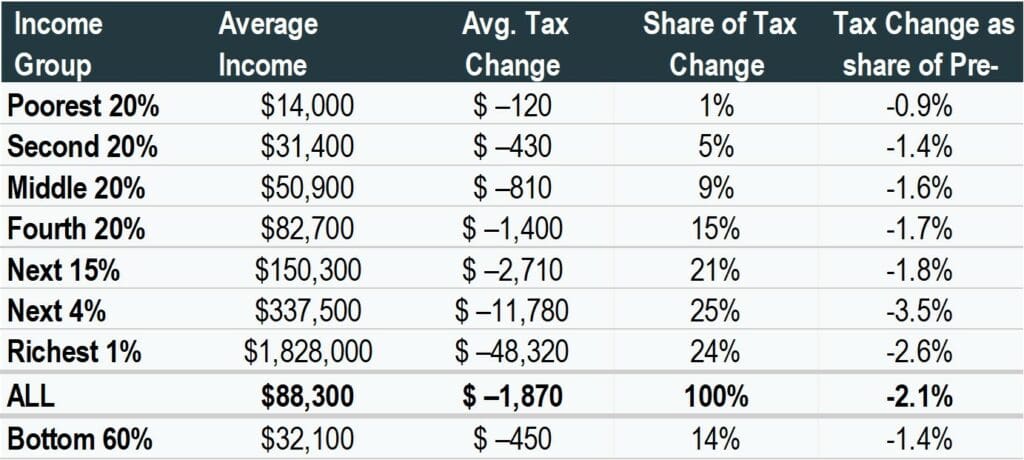

Reality: The richest five percent of Americans—those individuals making more than $232,000 per year–received almost half of the benefits of the tax bill last year, while the bottom 60 percent—those families earning less than $64,000 annually—received only 14 percent of the benefits, according to the D.C.-based Institute on Taxation and Economic Policy. In 2018, families in the top one percent of income earners received, on average, a $48,000 tax break, while families in the bottom 20 percent received, on average, a $120 break on their taxes.

The tax law also lowered the corporate tax rate from 35 percent to 21 percent, providing a windfall for corporations.

The Richest 5% Received Almost Half of the Trump Tax Cut Benefits in 2018

Promise: “We’re also going to eliminate tax breaks and complex loopholes taken advantage [of] by the wealthy.” – President Trump, November 29, 2017.

Reality: The law kept tax loopholes in place and added new ones, including for the commercial real estate industry and wealthy heirs. In 2018, a group of the most profitable corporations paid an effective tax rate of 11.3 percent, the lowest rate in decades and almost half the rate set by the new law. “The problem of special breaks and loopholes was not addressed,” said Steve Wamhoff of ITEP whose study examined the filings of 379 Fortune 500 companies.

Promise: “Every decision on trade, on taxes, on immigration, on foreign affairs, will be made to benefit American workers and American families.”– President Trump, January 20, 2017, inaugural address

Reality: Under two provisions of the tax law, firms can reduce their tax liability by locating factories and equipment overseas. “If you’re producing in Lordstown you pay a 21 percent tax rate, if you move to Mexico you pay a 10.5 percent tax rate,” Ohio Senator Sherrod Brown told CNN last November as General Motors was moving to shut down as many as five North American factories. A May 2019 study found evidence that the law is producing more investment overseas than in the United States, contrary to the intent of the law.

Promise: “[W]e’re planning revenue-neutral tax reform, which means you have to take away loopholes and special interest deductions if you’re going to lower tax rates.” – House Speaker Paul Ryan, PBS NewsHour, February 8, 2017

Reality: Since the law’s passage, the federal government has seen the largest year-over-year drop in corporate tax revenue outside of a recession. The federal budget deficit rose by $113 billion between 2017 and 2018, with corporate tax receipts accounting for nearly 80 percent of the deficit increase, according to the Center for American Progress.

Copyright Capital & Main

-

The SlickJanuary 27, 2026

The SlickJanuary 27, 2026The One Big Beautiful Prediction: The Energy Transition Is Still Alive

-

Column - State of InequalityJanuary 29, 2026

Column - State of InequalityJanuary 29, 2026Are California’s Billionaires Crying Wolf?

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Dirty MoneyJanuary 30, 2026

Dirty MoneyJanuary 30, 2026Amid Climate Crisis, Insurers’ Increased Use of AI Raises Concern For Policyholders

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit