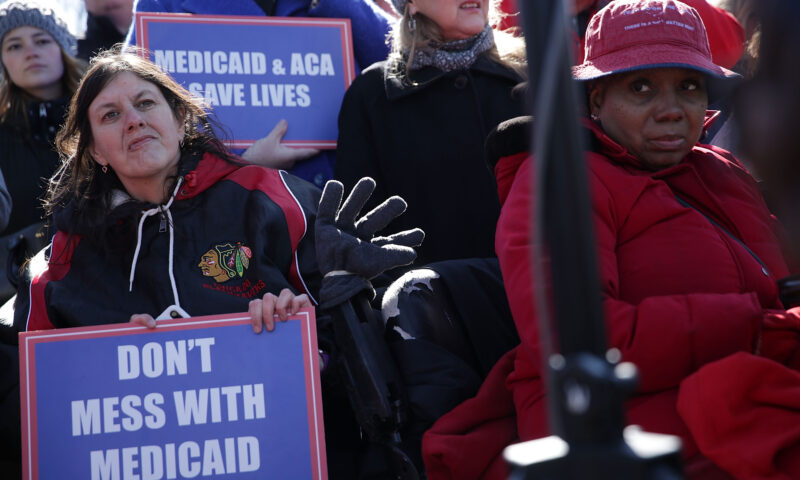

Experts warn that Trump’s return could mean drastic cuts to public assistance programs from Medicaid to food assistance, while low-income voters want Harris to offer more support.

A new study finds 1.6 million undocumented workers created 1.25 million jobs and produced 5% of the state’s GDP.

The long COVID crisis exposes a disability claims system in disarray.

The future is coming into view. Donald Trump’s victory strengthened the decades-long attack on the role of government. But we’ve got the tools to fight back, and we’re not alone.

Consuelo Mendez was 23 when she arrived in the United States 45 years ago, looking for work. In Ventura County she found it, harvesting strawberries, tomatoes, cabbage, parsley and spinach.

As soon as Anastasia Flores’ children were old enough, she brought them with her to work in the fields. “Ever since 1994 I’ve always worked by myself, until my children could also work,” she recalls.

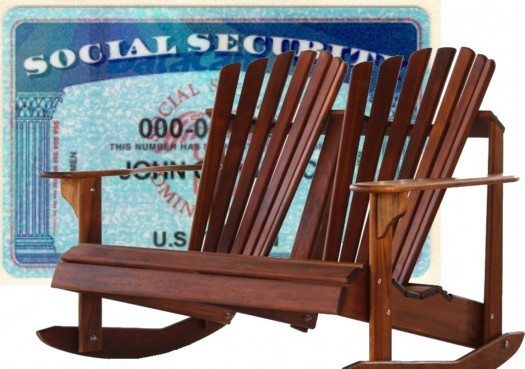

Sue Poucher, 64, is a Navy veteran from Michigan who joined the paid workforce at age 18, and left it in April 2014, due to a lack of job openings in her field, retail sales. She was one of 200 people who attended a daylong conference in Sacramento Oct. 15. The gathering, called “Tomorrow’s California: New Visions for Retirement Security,” focused on the release of a new report on aging, economics, public resources and policy solutions.

“I get Cal-Fresh, live in U.S. Housing and Urban Development subsidized senior housing and rely solely on my $943 monthly Social Security check,” Poucher told Capital & Main at the conference. “When food prices go up, what are you supposed to do, not eat?”

Nearly two-thirds of California’s private-sector workers lack employer-sponsored retirement plans.

The Sacramento resident has no savings to fall back on,

» Read more about: Conference Sees Hard Road for Retiring Californians »

Four years ago I retired from active ministry in the United Methodist Church. My wife Susan and I now live a comfortable, middle-class life based upon the three pillars of retirement. We both receive Social Security. We get a monthly check from my pension plan. We hold some savings. But that’s not true for most Americans.

Yes, retiring workers can look forward to Social Security if they have paid into it. But that automatically excludes some. Government employees, for example, get pensions, but not Social Security. Undocumented workers may have the Social Security tax deducted from their paychecks, but the funds likely go to an account that does not bear their names – therefore, they will not get those payroll taxes returned to them when they age into eligibility.

Besides, Social Security was from the beginning expected to provide supplemental income only, not the sole basis for a livelihood.

Republicans may not have succeeded in defunding the nations’ newest social insurance program, Obamacare, but they now are aiming at the foundational programs, Social Security and Medicare. And this time, they’ll have the President on their side. It would be a mistake for progressives to assume that a grand budget bargain will fall apart once again, even if that remains likely. Instead, we need to turn the debate from cutting social insurance to strengthening both the finances and benefits of both big retiree programs. The best way to do that is by championing simple, bold solutions.

In his post shutdown press conference, President Obama repeated his call for changes in Social Security and Medicare. His 2014 budget included cuts to benefits for both. That aligns him with House Speaker John Boehner, who called for savings in Social Security and Medicare during the shutdown battle. Senators from both parties have shown their willingness to support benefit cuts as part of a big budget deal.

» Read more about: Saving Medicare, Social Security: Block That Grand Bargain! »

(Note: George Zornick’s post was originally published by The Nation and is republished with permission.)

We’ve seen this movie before: Republicans force a showdown in Congress over funding the government, the debt ceiling or, in the present case, both. Then a “grand bargain” is proposed to solve the impasse—one that includes serious reductions to social insurance programs.

That’s just how the GOP would like the current drama to play out. Wednesday, National Review’s Robert Costa reported that House Speaker John Boehner and Representative Paul Ryan are rallying nervous Republicans by telling them that while Obamacare may not end up getting defunded, GOP leadership is cooking up another big budget deal that includes cuts to the safety net so cherished by many conservative members. “It’s the return of the grand bargain,” one member told Costa. “Ryan is selling this to everybody;

» Read more about: The Shutdown: Will Safety Net Programs Be Shredded? »

The reason President Obama’s proposal to cut Social Security benefits is tragic is that it is simply not necessary. His plan is to use a different method to compute how much benefits are raised to offset inflation. But Social Security will add very little to federal spending over the next 30 to 40 years. As a proportion of national income (GDP), It will rise from five percent to six percent. At the same time, retirees are set to get much less money from their pensions because so many were forced to depend on 401(k)s and defined contribution plans rather than traditional pensions with defined benefits.

But a new report from Goldman Sachs economists puts the Obama decision in an even harsher light. The federal deficit is coming down rapidly on its own. In a piece entitled, “The Rapidly Shrinking Federal Deficit,” Goldman notes that the deficit averaged 4.5 percent of GDP in the first calendar quarter,

» Read more about: The U.S. Deficit Is Down — So Why Cut Social Security? »

To the let’s-cut-entitlements crowd, what’s wrong with America is that seniors are living too high off the hog. With the cost of medical care still rising (though not as fast as it used to), the government is shelling out many more dollars per geezer (DPG) than it is per youngster (DPY). The solution, we’re told, is to bring down DPG so we can boost DPY.

We do indeed need to boost DPY. And we need to rein in medical costs by shifting away from the fee-for-service model of billing and paying. But as for changing the way we calculate cost-of-living adjustments for seniors to keep us from overpaying them — an idea beloved of Bowles, Simpson, Republicans and, apparently, the White House — this may not be such a hot idea, for one simple reason: An increasing number of seniors can’t afford to retire.

Nearly one in five Americans age 65 and over — 18.5 percent — were working in 2012,

In societies across the globe, men demonstrate their manhood in different ways. There are many wonderful tracts on the topic. However, in the culture of Washington DC, the best way to demonstrate your manhood is to express your willingness to cut Medicare and Social Security. There is no better way to be admitted into the club of the Very Serious People.

This is the reason that we saw White House spokesman Jay Carney tell a press conference. He told the reporters that President Obama is still willing to cut Social Security benefits by using the chained Consumer Price Index as the basis for the annual cost of living adjustment (COLA). This willingness to cut the benefits of retirees establishes President Obama as a serious person in elite Washington circles.

While most of the DC insiders probably don’t understand the chained CPI, everyone else should recognize that this technical fix amounts to a serious cut in benefits.

» Read more about: Why the Chained Consumer Price Index Threatens Our Elderly »

As Senator Bernie Sanders has warned, “Social Security faces an unprecedented attack from Wall Street, the Republican Party and a few Democrats. If the American people are not prepared to fight back, the dismantling of Social Security could begin in the very near future.”

What exactly does the 99 Percent need to know to defend Social Security against the Wall Street One Percenters who want to profit by destroying it?

First, know our adversaries. Listen closely to the corporate-funded Heritage Foundation, headed by Tea Party hero and former Senator Jim DeMint. They want to turn part of our retirement and disability savings over to the same Wall Street firms that crashed our economy.

Heritage’s Social Security plan would

» Read more about: Wall Street’s Newest Hedge Fund: Social Security »

On November 6, 2012, the people sent a message: Americans cannot be bought. We do believe there is a place for government in providing services that the private sector is ill-equipped to provide.

We have experienced a change in attitude across the country, demonstrated by many of the Tea Party politicians losing their seats and more progressive Democrats winning seats. But we need to stay vigilant. The end of the year did not bring major tax increases for working people and spending cuts, but everything could change in the coming months. The fight hasn’t ended.

I don’t mind the Bush tax cuts expiring for everyone if that is what it takes for the richest One Percent to start contributing more to our economy. But I strongly disagree with the cutting of essential benefits, especially Social Security, Medicare and Medi-Cal. I also reject the notion that there must be a “balanced approach”

(The following post first appeared on Unionosity and is republished with permission.)

A group of 200 CEOs known as the Business Roundtable made some unsurprising recommendations for debt reduction [Wednesday], suggesting cutting entitlement programs and pushing the age of eligibility for Medicare and Social Security to 70. The recommendations, which the group plans to make to both Congress and the President, also resist any increased Social Security taxation on wealthy Americans.

[Reuters] reports:

The group would push the age at which full Social Security benefits are paid to 70 for those now aged 54 and under. Currently, the age for collecting full benefits depends on year of birth. Someone born between 1946 and 1953 can take full benefits at age 66. That will rise to age 67 for individuals born in 1960 or after.

The group is explicit in its goals to use the debt ceiling debate as an impetus to push radical policy initiatives.

One of the proposals floated for months in the fiscal bluff debate in Washington, D.C., is a change to the formula used to measure inflation for Social Security Cost-of-Living Adjustments (COLAs) called the “chained” CPI. Let’s be clear: This is a benefit cut. These COLAs make sure seniors’ income keeps pace with the rising costs of housing and food. The “chained” CPI would cut future Social Security benefits by as much as $2,432 for someone who is 17 years old today. Studies from the Center for Economic and Policy Research (CEPR) show that not only is the “chained” CPI a benefit cut, it eventually will lead to higher taxes for most working people.

For instance, CEPR estimated that the change to the “chained” CPI would lead to a cut in benefits of three percent after 10 years, six percent after 20 years and nine percent after 30 years.

» Read more about: Chained CPI: Proposed New COLA Leaves Bad Taste »

President Obama must remember the message of election night and back away from cutting Social Security benefits.

That didn’t last nearly as long as I had hoped. I put on my Obama baseball cap – the one I picked up from a street vendor walking to the inauguration four years ago – a few weeks before the November election. I’ve worn it every day since, to both celebrate his victory and cheer on the president for keeping to a progressive promise in the fiscal negotiations. Part of that promise was telling the Des Moines Register that Social Security benefits should not be cut. But it looks like my cap is going back on the shelf if reports that Obama is willing to cut Social Security benefits prove to be true.

There are three things to keep in mind about the president agreeing to cuts in Social Security benefits.

» Read more about: "We Didn't Vote to Cut Medicare and Social Security!" »

In the recently convened “lame-duck” session of Congress, senators and representatives will take on a number of issues that could have major consequences for working families and retirees. Congress is considering benefit cuts for Social Security, Medicaid and Medicare and members are looking at cutting taxes for the wealthy even further. Any deal that Congress makes, though, should be based on facts and not the myths that have sprung up around taxes, the deficit and the earned benefit programs. Here are a few of the key myths and the truth behind them.

Myth: Extending the Bush tax cuts for the wealthiest two percent is important because the economy is weak.

Economists agree that cutting taxes on the wealthy is one of the least effective ways to stimulate the economy. A much better use of the $1 trillion cost of those tax cuts would be to invest in infrastructure or extend unemployment benefits.

» Read more about: Lame-Duck Session of Congress: Myths and Facts »