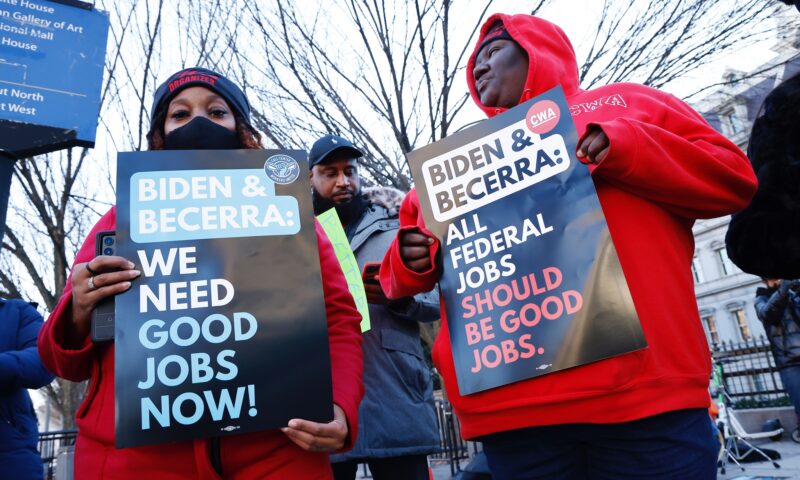

Federal call center workers continue their fight after the Biden administration dialed back support for it.

Officials withdrew a rebid of a $6.6 billion contract requiring “labor harmony” 25 days after the $5 billion corporation holding it filed suit.

A new contract that requires “labor harmony” could be a model to empower millions who work for federal contractors nationwide.

Health care exchange workers say the Biden administration should force their employer to provide good jobs.

Workers cite low wages and disrespect at work; union alleges illegal union-busting.

Even the safest hospitals still display wide gaps in health outcomes based on patients’ skin color.

Here are five ways the president-elect will seek to break with the policies of the past four years.

The Senate tax proposal could add over $1.4 trillion to the federal deficit by 2027, and Republicans are already targeting entitlements. Cutting Medicare and Medicaid may change how some people are allowed to die.

Three people tell Capital & Main that the Affordable Care Act repeal and proposed cuts to Medicaid will decimate their finances and their quality of life. BY LARRY BUHL

When President-elect Donald Trump announced he had chosen Rep. Tom Price, a Georgia Republican, to head up the Department of Health and Human Services, he sent a clear signal that most pieces of the Affordable Care Act r will be dismantled, including even some of the provisions his voters like.

The future is coming into view. Donald Trump’s victory strengthened the decades-long attack on the role of government. But we’ve got the tools to fight back, and we’re not alone.

Fifty years ago this month, on July 30, 1965, President Lyndon Johnson signed into law an amendment to the Social Security Act that established Medicare, providing health insurance to people 65 and older regardless of income or medical history, and dramatically changed the landscape of senior health care for the better. As we celebrate this important anniversary, all of us should take a moment to consider how Medicare, the nation’s most successful and efficient health insurance program, continues to protect millions of seniors who might otherwise live without adequate health care or who might face bankruptcy because of medical bills.

As Medicare has been weaved into the fabric of our society, it’s hard to fathom a time when America placed its aging population at such risk, but prior to Medicare only 50 percent of Americans 65 and older had health insurance, and more than a third lived in poverty.

» Read more about: Celebrating Medicare’s 50th by Ensuring Medicare for All »

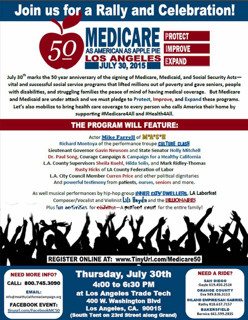

When Medicare was signed into law on July 30, 1965, nearly half of Americans over 65 had no health insurance, and many more lacked adequate coverage. Today, only 2% of senior citizens in the U.S. are uninsured. To celebrate the success of Medicare and rally for universal expansion of the program, events are being held in more than 2 dozen cities across the country.

The Los Angeles version will predictably have strong entertainment. There will be musical performances by Lili Haydn, who’s been called the “Jimi Hendrix of the violin,” along with Latino Hip-Hop group the Inner City Dwellers and musical parody group Billionaires for Wealthcare.

Also on the program are actor Mike Farrell of M*A*S*H, Richard Montoya of the performance troupe Culture Clash, State Senator Holly Mitchell, L.A. County Supervisors Sheila Kuehl, Hilda Solis, and Mark Ridley-Thomas, Dr.

» Read more about: This Thursday: Medicare is Having a Birthday Party »

Every year Los Angeles’ Cedars-Sinai Medical Center releases a glossy brochure called Report to the Community. Among the doctor profiles and research-breakthrough stories are several dry metrics dealing with the number of beds, total patient and outpatient days and, perhaps most impressively, the year’s dollar value for something called “community benefit contributions.”

Cedars, which is the state’s third highest-earning nonprofit hospital, claimed $640.3 million as its 2012 community benefit contribution.

This number turns out to be the real point of the report. Because under state law all not-for-profit hospitals must justify their continuing tax exemption as charitable institutions by demonstrating that they are providing a community benefit — free charity care to indigent patients and what California calls “activities that are intended to address community needs and priorities primarily through disease prevention and improvement of health status.”

Whether Cedars and California’s other nonprofit hospitals have been living up to that charitable obligation is a question that Assembly Bill 503,

» Read more about: Sweet Charity: The Truth Behind Hospitals’ Community Benefits Windfall »

Republicans may not have succeeded in defunding the nations’ newest social insurance program, Obamacare, but they now are aiming at the foundational programs, Social Security and Medicare. And this time, they’ll have the President on their side. It would be a mistake for progressives to assume that a grand budget bargain will fall apart once again, even if that remains likely. Instead, we need to turn the debate from cutting social insurance to strengthening both the finances and benefits of both big retiree programs. The best way to do that is by championing simple, bold solutions.

In his post shutdown press conference, President Obama repeated his call for changes in Social Security and Medicare. His 2014 budget included cuts to benefits for both. That aligns him with House Speaker John Boehner, who called for savings in Social Security and Medicare during the shutdown battle. Senators from both parties have shown their willingness to support benefit cuts as part of a big budget deal.

» Read more about: Saving Medicare, Social Security: Block That Grand Bargain! »

In societies across the globe, men demonstrate their manhood in different ways. There are many wonderful tracts on the topic. However, in the culture of Washington DC, the best way to demonstrate your manhood is to express your willingness to cut Medicare and Social Security. There is no better way to be admitted into the club of the Very Serious People.

This is the reason that we saw White House spokesman Jay Carney tell a press conference. He told the reporters that President Obama is still willing to cut Social Security benefits by using the chained Consumer Price Index as the basis for the annual cost of living adjustment (COLA). This willingness to cut the benefits of retirees establishes President Obama as a serious person in elite Washington circles.

While most of the DC insiders probably don’t understand the chained CPI, everyone else should recognize that this technical fix amounts to a serious cut in benefits.

» Read more about: Why the Chained Consumer Price Index Threatens Our Elderly »

On November 6, 2012, the people sent a message: Americans cannot be bought. We do believe there is a place for government in providing services that the private sector is ill-equipped to provide.

We have experienced a change in attitude across the country, demonstrated by many of the Tea Party politicians losing their seats and more progressive Democrats winning seats. But we need to stay vigilant. The end of the year did not bring major tax increases for working people and spending cuts, but everything could change in the coming months. The fight hasn’t ended.

I don’t mind the Bush tax cuts expiring for everyone if that is what it takes for the richest One Percent to start contributing more to our economy. But I strongly disagree with the cutting of essential benefits, especially Social Security, Medicare and Medi-Cal. I also reject the notion that there must be a “balanced approach”

(The following post first appeared on Unionosity and is republished with permission.)

A group of 200 CEOs known as the Business Roundtable made some unsurprising recommendations for debt reduction [Wednesday], suggesting cutting entitlement programs and pushing the age of eligibility for Medicare and Social Security to 70. The recommendations, which the group plans to make to both Congress and the President, also resist any increased Social Security taxation on wealthy Americans.

[Reuters] reports:

The group would push the age at which full Social Security benefits are paid to 70 for those now aged 54 and under. Currently, the age for collecting full benefits depends on year of birth. Someone born between 1946 and 1953 can take full benefits at age 66. That will rise to age 67 for individuals born in 1960 or after.

The group is explicit in its goals to use the debt ceiling debate as an impetus to push radical policy initiatives.

» Read more about: "We Didn't Vote to Cut Medicare and Social Security!" »

I want to vote for a comprehensive bipartisan plan to address the fiscal cliff. I’m willing to take a tough vote. I’m willing to make sacrifices. I’m willing to feel the heat. But I’m not willing to solve the fiscal cliff by throwing seniors over the cliff. I draw the line at cutting benefits in Medicare and Social Security.

This week, House Republicans unveiled their fiscal cliff counterproposal. While they continue to call for an extension of the Bush tax cuts for millionaires and billionaires, they propose offsetting this cost by gutting Medicare benefits, including raising the age of Medicare eligibility to 67. I won’t go there. As California’s Insurance Commissioner for eight years, I know this would be horrible policy, throwing millions of seniors into the rapacious hands of an insurance industry interested only in profits for its shareholders.

Medicare is a promise we made to seniors more than four decades ago.

» Read more about: Fiscal Cliff Notes: Protecting Medicare and Social Security »