In the recently convened “lame-duck” session of Congress, senators and representatives will take on a number of issues that could have major consequences for working families and retirees. Congress is considering benefit cuts for Social Security, Medicaid and Medicare and members are looking at cutting taxes for the wealthy even further. Any deal that Congress makes, though, should be based on facts and not the myths that have sprung up around taxes, the deficit and the earned benefit programs. Here are a few of the key myths and the truth behind them.

Myth: Extending the Bush tax cuts for the wealthiest two percent is important because the economy is weak.

Economists agree that cutting taxes on the wealthy is one of the least effective ways to stimulate the economy. A much better use of the $1 trillion cost of those tax cuts would be to invest in infrastructure or extend unemployment benefits.

» Read more about: Lame-Duck Session of Congress: Myths and Facts »

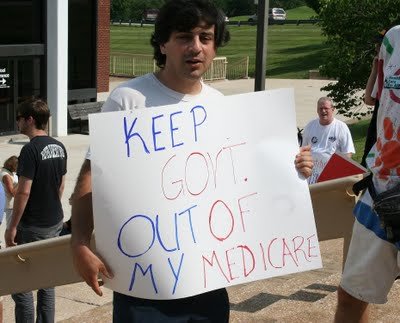

Within the padded walls of the House of Representatives, few agenda items consume more time than figuring out how to overturn President Obama’s health care reform law – and, looking down the road a little, how to scuttle Medicare as we know it. These two causes, along with countering the daily menace of Sharia law at the county courthouse, are what make certain conservatives get up early in the morning. Yet now a Commonwealth Fund survey shows that when it comes to Medicare, at least, most senior citizens are quite happy with the government-provided service they receive.

According to the survey, “Only eight percent of Medicare beneficiaries age 65 or older rated their insurance as fair or poor, compared with 20 percent of adults with employer-sponsored insurance and 33 percent of adults purchasing coverage in the individual market.”

Who would want to fix something so obviously not broken?

» Read more about: WebHot: Seniors Don't Agree With Right's Medicare Vision »