For years, we’ve known big companies like Walmart have been shifting their health care costs onto taxpayers. Now a new report from the U.C. Berkeley Center for Labor Research shows just how widespread the problem is, projecting that as many as 380,000 workers for big companies will end up on the state’s Medi-Cal program by 2019.

For years, we’ve known big companies like Walmart have been shifting their health care costs onto taxpayers. Now a new report from the U.C. Berkeley Center for Labor Research shows just how widespread the problem is, projecting that as many as 380,000 workers for big companies will end up on the state’s Medi-Cal program by 2019.

For taxpayers, that’s a pretty tough pill to swallow. In 2011, Walmart made $447 billion in revenue. The company’s CEO raked in nearly $21 million last year. And yet, Walmart and other large companies don’t think twice about cutting workers’ hours and wages to such a low level that workers have to get health care through taxpayer-funded Medi-Cal. Even more infuriating, Walmart and companies like Darden restaurants (owner of Olive Garden, Red Lobster and other chains) have openly flouted the Affordable Care Act’s (ACA) requirement — which mandates that companies either provide affordable health care to their workers or pay a penalty —

» Read more about: Assembly Bill Would Close “Walmart Loophole” »

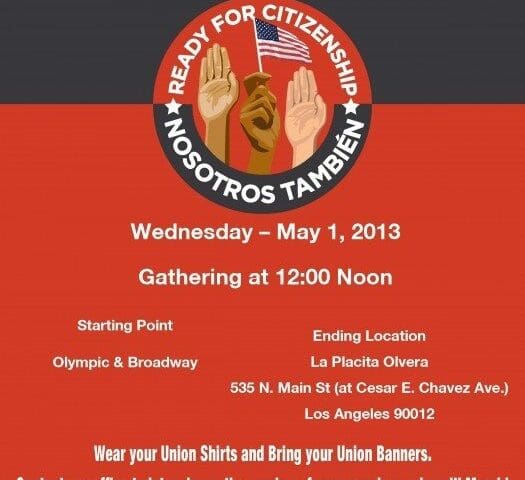

The “Gang of 8” has finally introduced a bill in the U.S. Senate, giving millions of undocumented workers hope for an immigration reform in 2013. One of these workers is Anabella Aguirre who arrived from Guatemala over 13 years ago. As a single mother of three children, her choice to migrate to the United States was a difficult one. It meant she would have to leave her children and family members behind.

Anabella remains undocumented to this day because our immigration system is broken. During all these years, Anabella has worked as a janitor in Los Angeles. She is also a committed union member of SEIU United Service Workers West. Anabella is fighting with us for immigration reform. Her main motivation is her children’s education. “I hope one day to be able to send my daughters to college here in the United States,” says Aguirre.

Let’s kick off Mother’s Day month with a huge Labor turn-up on May Day.

» Read more about: All Out May Day for Immigration Reform! »

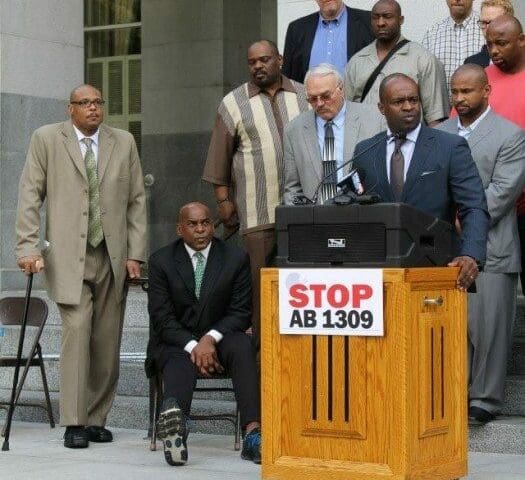

There is no question that the game of football is dangerous. National Football League players get injured on the job – so many that an “injury report” section is ubiquitous in our sports pages. In fact, a study run by the National Institute for Occupational Safety and Health (NIOSH) found that the risk of death associated with neurodegenerative disorders is about three times higher among NFL players than the rest of the population.

NFL athletes are not merely players, they are also employees.

Their employers are now trying to take away their collectively bargained right to workers’ compensation benefits in California. It is not right, and it sets a dangerous precedent.

Assembly Bill 1309 singles out one group of workers, professional athletes, and treats them differently than other employees by denying them the right to file for California Workers’ Compensation benefits.

AB 1309 is an attempt by the insurance companies and professional teams to shift the cost of care for injured players from the companies to state agencies like Medi-Cal and federal agencies like Medicare.

» Read more about: Assembly Bill to Kill Athletes’ Workers’ Comp Claims »

(Jack Lavitch and Henry Lee are two West L.A. retirees who are also part-time, second-hand car buyers. They were lunching at Philippe the Original sandwich diner near central Chinatown when asked about the coming mayor’s race.)

Jack Lavitch

“First and foremost, the next mayor should fix up our city streets. There are potholes everywhere and they are a danger to us all. This would be something everyone could easily see — it would make a huge difference for everyone. That’s something [the mayor] could actually accomplish. It wouldn’t cost that much and it would make us all feel better about the whole city.”

“Oh yes,” he adds, biting into his sandwich. “He could get everyone free French dips like this one every Friday. I am joking.”

Jack is skeptical about official claims stating the city is nearing bankruptcy. “Maybe they actually are but they haven’t convinced me or the public.

» Read more about: L.A. Mayor’s Race: The View from Philippe’s »

(Note from Warehouse Workers United: Please take action now — workers like Javier, whose blog appears below, should not be fired with impunity. We will deliver this petition to Walmart today, April 29, 1 p.m., PDT.)

One month ago my son Alex was born. Yesterday I was fired from my job as a forklift driver at a warehouse where we move 100 percent Walmart merchandise.

I am outspoken. I defend my coworkers. I alert management about broken and unsafe equipment. I teach my coworkers about their rights, like what minimum wage is and what they should do when they are injured on the job.

I have been a target of management for a while. They watch everything I do, but it’s not my nature to be silent or scared. I know when I am right. Last year I went on strike to protest the retaliation my coworkers experienced when they spoke to the media and the public about the dirty water (if we had any water at all) that we were given to drink,

» Read more about: Help Reinstate Walmart Contract Worker Javier Rodriguez »

We come together as Americans when confronting common disasters and common threats, such as occurred in Boston, but we continue to split apart economically.

We come together as Americans when confronting common disasters and common threats, such as occurred in Boston, but we continue to split apart economically.

Anyone who wants to understand the dis-uniting of America needs to see how dramatically we’re segregating geographically by income and wealth. Today I’m giving a Town Hall talk in Fresno, in the center of California’s Central Valley, where the official unemployment rate is 15.4 percent and median family earns under $40,000. The so-called “recovery” is barely in evidence.

As the crow flies Fresno is not that far from California’s high-tech enclaves of Google, Intel, Facebook, and Apple, or from the entertainment capital of Hollywood, but they might as well be different worlds.

Being wealthy in modern America means you don’t come across anyone who isn’t, and being poor and lower-middle class means you’re surrounded by others who are just as hard up.

We all know that sequestration and the automatic $85 billion in federal cuts “across the board” for discretionary spending jeopardize our very delicate recovery from the Great Recession. Though slow, fragile and incremental, the recovery is real, thanks in part to an unsung legislative action — that now is in danger of being undermined by congressional inaction.

We all know that sequestration and the automatic $85 billion in federal cuts “across the board” for discretionary spending jeopardize our very delicate recovery from the Great Recession. Though slow, fragile and incremental, the recovery is real, thanks in part to an unsung legislative action — that now is in danger of being undermined by congressional inaction.

In 1998, Congress passed the Workforce Investment Act (WIA), which greatly improved unemployed people’s lives. The WIA focused on providing employment and training services for youth and adults, preparing them for jobs in industries using a model that encouraged self-sufficiency and widespread access to resource centers and training. The goal was to help people learn the skills for life-long career advancement.

What made WIA special was that that it proactively engaged with business, education and labor (as the drivers of local economies) to guide the direction of workforce development programs in a way that would specifically address geographical needs.

» Read more about: It’s Time to Reinvest in Workforce Development »

Progress, like beauty, is in the eye of the beholder. Witness the reaction to today’s landmark L.A. City Council vote, approving the implementation plan for a far-reaching overhaul of the city’s multi-family and commercial waste and recycling system.

Progress, like beauty, is in the eye of the beholder. Witness the reaction to today’s landmark L.A. City Council vote, approving the implementation plan for a far-reaching overhaul of the city’s multi-family and commercial waste and recycling system.

The plan, which passed 10-3, puts L.A. squarely in the forefront of a growing national movement to transform the way cities deal with waste. For the first time companies will have to meet a set of environmental and labor standards in order to operate. Under this exclusive franchise system, the city will be divided into 11 zones, with companies competing to be the sole operator within each zone.

Among those celebrating the City Council’s decision were environmentalists, waste workers and small business owners, who as part of the Don’t Waste LA coalition have driven the campaign to reform L.A.’s waste and recycling industry. Less enthusiastic were certain industry lobbyists and big business advocates,

(Art Sweatman is a City of Los Angeles tree surgeon. His post is a response to Los Angeles Times columnist Steve Lopez’s April 24 article, “Time for public employee unions to pick up the tab.” The post first appeared on SEIU Local 721’s site and is republished here with permission.)

Dear Steve:

I sat down with you a couple of years ago and discussed the impact that “givebacks” would have on our SEIU 721 members who work for the City of Los Angeles.

You seemed to care then, and city workers eventually agreed to help L.A. save money. One year later we also agreed to contribute more towards our pension benefits, so we could keep our spouses on our benefits after we retire.

Your commentary is short-sighted. You acknowledge but ignore the fact that the politicians keep lying about the city’s deficit.

» Read more about: Union Worker to Steve Lopez: We’ve Picked Up the Tab! »