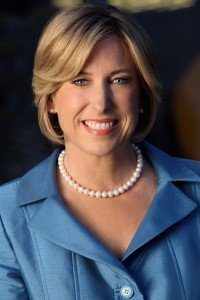

Today we continue our series of interviews with Los Angeles’ front-running mayoral candidates, with the second part of a talk with City Controller Wendy Greuel. (Next week: Kevin James. See also, Part One of the Wendy Greuel interview, as well as Parts One and Two of our Eric Garcetti interview.)

Today we continue our series of interviews with Los Angeles’ front-running mayoral candidates, with the second part of a talk with City Controller Wendy Greuel. (Next week: Kevin James. See also, Part One of the Wendy Greuel interview, as well as Parts One and Two of our Eric Garcetti interview.)

Frying Pan News: Corporate lobbyists spent more than $30 million last year to influence decisions at City Hall – far more than unions or any other group. Do you think that big business has too much power over local government?

Wendy Greuel: Thirty million dollars is a lot of money. I will, as mayor – as I do as controller and as I did as councilmember — ensure that there is a transparent process and that no one has more access than another to the kinds of decisions that are made in the city.

» Read more about: Wendy Greuel on Lobbyists, Developers and Big Box Stores »

The Los Angeles County Metropolitan Transportation Authority (aka L.A. Metro) needed new, clean buses. If L.A. Metro had simply followed current buying protocol, its single focus would have been on finding a company to deliver the lowest-cost buses. In all likelihood, this would have resulted in jobs going overseas (but for some final assembly jobs on U.S. soil).

Instead, in January, L.A. Metro awarded a $305-million contract for 550 clean-fuel buses to New Flyer Industries, a Canadian company with dedicated manufacturing plants in the U.S. The bus order means that the company will expand its factory operations in St. Cloud, Minn., add a third shift, hire 150 women and men from the local community and create another 50 jobs in Los Angeles. L.A. Metro took a longer-term view of how “big-ticket” transportation purchases — most of them supported by federal funds — can stimulate high-quality jobs and manufacturing in the United States.

» Read more about: L.A. Metro Bus Contract Creates Jobs, Lifts Economy »

I was born in 1946, just when the boomer wave began. Bill Clinton was born that year, too. So was George W. Bush, as was Laura Bush. And Ken Starr (remember him?) And then, the next year, Hillary Rodham was born. And soon Newt Gingrich (known as “Newty” as a boy). And Cher (Every time I begin feeling old I remind myself she’s not that much younger.)

Why did so many of us begin coming into the world in 1946? Demographers have given this question a great deal of attention.

My father, for example, was in World War II — as were the fathers of many other early boomers. Ed Reich came home from the war, as did they. My mother was waiting for him, as were their mothers.

When it comes down to it, demographics is not all that complicated.

Fast-forward.

» Read more about: Immigration Reform Can Help Solve the Retirement Crisis »

Today we continue our series of interviews with Los Angeles’ front-running mayoral candidates, with the first part of a talk with City Controller Wendy Greuel, who has previously served as an L.A. City Councilmember. (Tomorrow: Wendy Greuel interview, Part Two. See interviews with Eric Garcetti, Part One and Part Two.)

Today we continue our series of interviews with Los Angeles’ front-running mayoral candidates, with the first part of a talk with City Controller Wendy Greuel, who has previously served as an L.A. City Councilmember. (Tomorrow: Wendy Greuel interview, Part Two. See interviews with Eric Garcetti, Part One and Part Two.)

Frying Pan News: If your opponents are capable and honorable people, why are you running for mayor – why not just sit back and let one of them take the office?

Wendy Greuel: I have the unique experiences that none of the other candidates have. I’ve worked for Tom Bradley, one of the greatest mayors we’ve had in Los Angeles. On the federal level I worked with Henry Cisneros at the Department of Housing and Urban Development – not only on national homeless programs but [by] being here after the Northridge earthquake.

» Read more about: Wendy Greuel on Apathy, Big Money and Being a Jobs Tsar »

Last week the L.A. Bureau of Sanitation released its initial draft implementation plan for moving to an exclusive franchise for businesses and large apartment buildings in the City of Los Angeles. As you recall, at the November vote, the L.A, City Council asked the Bureau to return in 90 days to provide an update on how to implement an exclusive franchise. The product released today demonstrates that the Bureau has taken to heart the resounding message from L.A. City Council that it wants an environmentally forward-thinking plan that protects workers and communities, in addition to stabilizing chaotic waste rates. Even though I have only had a little bit of time to review it, I am very impressed with the initial draft implementation plan.

Last week the L.A. Bureau of Sanitation released its initial draft implementation plan for moving to an exclusive franchise for businesses and large apartment buildings in the City of Los Angeles. As you recall, at the November vote, the L.A, City Council asked the Bureau to return in 90 days to provide an update on how to implement an exclusive franchise. The product released today demonstrates that the Bureau has taken to heart the resounding message from L.A. City Council that it wants an environmentally forward-thinking plan that protects workers and communities, in addition to stabilizing chaotic waste rates. Even though I have only had a little bit of time to review it, I am very impressed with the initial draft implementation plan.

The stakes are high as outlined in the report. A little under 70 percent of the waste L.A. sends to landfills comes from businesses and large apartment buildings.

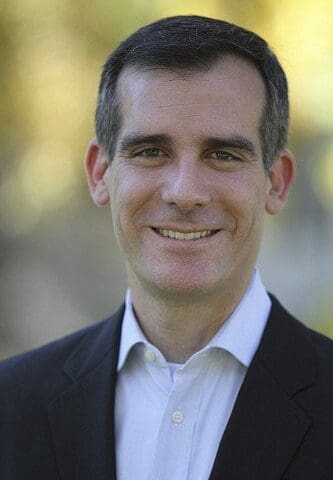

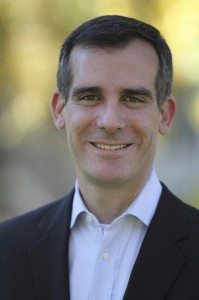

Frying Pan News continues its series of interviews with the leading mayoral candidates, who will face off in the March 5 primary. Part Two of our interview with City Councilmember Eric Garcetti appears today (click here to read Part One), followed Thursday by a conversation with City Controller Wendy Greuel.

Frying Pan News continues its series of interviews with the leading mayoral candidates, who will face off in the March 5 primary. Part Two of our interview with City Councilmember Eric Garcetti appears today (click here to read Part One), followed Thursday by a conversation with City Controller Wendy Greuel.

Frying Pan News: Many in the business community would prefer the mayor to be a cheerleader for business, but in the last few years we’ve seen what happens when the economy is left to big corporations and financial institutions. How will you balance the interests of the business community and those who are desperately trying to find a path into the middle class?

Eric Garcetti: There’s no question that business is absolutely critical to our economic strength here, and by business it’s not necessarily just the large corporations – we’re talking about the mom and pop store,

» Read more about: Eric Garcetti on Pensions, Privatization and Port Trucking »

Today Frying Pan News launches a series of interviews with the leading mayoral candidates, who will face off in the March 5 primary. Beginning with City Councilmember Eric Garcetti, we posed questions about what we think are the most pressing issues our next mayor must confront. Part One of our interview with Garcetti appears today; Part Two will run tomorrow, followed by a conversation with City Controller Wendy Greuel.

Today Frying Pan News launches a series of interviews with the leading mayoral candidates, who will face off in the March 5 primary. Beginning with City Councilmember Eric Garcetti, we posed questions about what we think are the most pressing issues our next mayor must confront. Part One of our interview with Garcetti appears today; Part Two will run tomorrow, followed by a conversation with City Controller Wendy Greuel.

Frying Pan News: A lot of the mayoral debate so far has focused on challenges with the city budget and whether we should cut benefits for city employees. Can you paint your broad vision of how we bring good jobs, clean air and healthy communities to all of Los Angeles?

Eric Garcetti: Our recovery can’t be just about how we are going to cut more, tax more. My greatest fear is that we will have those who will do well no matter how bad things get – the highly educated,

» Read more about: Eric Garcetti on Walmart, Waste and Living Wage Laws »

You have to feel a little bad for Texas Gov. Rick Perry. He came all the way to California this week to “poach jobs” and left empty-handed. Maybe Perry hasn’t read the studies that show very few jobs move from California to other states. Or maybe he wasn’t aware that California is on the rebound in a big way, now leading the nation in job creation. At the end of the day, Perry’s trip really was all hat, no cattle.

You have to feel a little bad for Texas Gov. Rick Perry. He came all the way to California this week to “poach jobs” and left empty-handed. Maybe Perry hasn’t read the studies that show very few jobs move from California to other states. Or maybe he wasn’t aware that California is on the rebound in a big way, now leading the nation in job creation. At the end of the day, Perry’s trip really was all hat, no cattle.

Over the last week, there’s been a lot of silly media coverage comparing Texas to California. It’s almost like a sports rivalry at this point. Perry says his low-regulation, low-government service, low-wage economic model is the way to go.

As a native Texan, I know better. I still remember going to the beach in Galveston and having to use turpentine to clean my feet before I left because of the oil.

» Read more about: State’s Enterprise Zones Make Rick Perry Look Smart »

The GOP’s inviolate article of faith is that big government is inherently evil. The GOP has been stupendously successful through much of the last century in tagging any Democrat that champions increased regulatory powers, higher taxes on corporations and the rich, greater public spending on health, education and job programs, and bolstering entitlement programs as a reckless, tax-and-spend enemy of private enterprise. Franklin Roosevelt was no exception to the maligning. Often forgotten in the historic lionizing of FDR for standing government on its head to blunt the hard edge of the Great Depression, was that the GOP (with some help from a small but pesky clique of Democratic congressional conservatives, big industrialists and conservative newspaper moguls) fought FDR tooth and nail on every one of his reform proposals from Social Security to tighter industry regulation. Also forgotten, is that FDR had to tweak, compromise and water down his proposals, even the successful ones, to get passage.

» Read more about: Can Obama Do an FDR in His Second Term? »

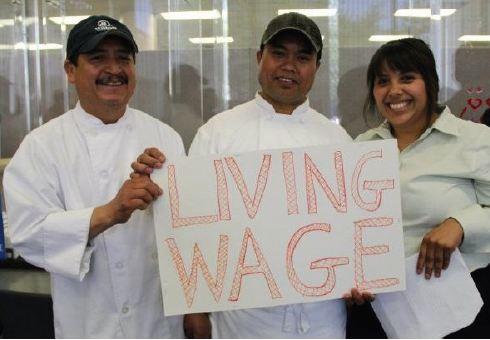

(The following appeal comes from the Long Beach Coalition for Good Jobs and Healthy Communities.)

(The following appeal comes from the Long Beach Coalition for Good Jobs and Healthy Communities.)

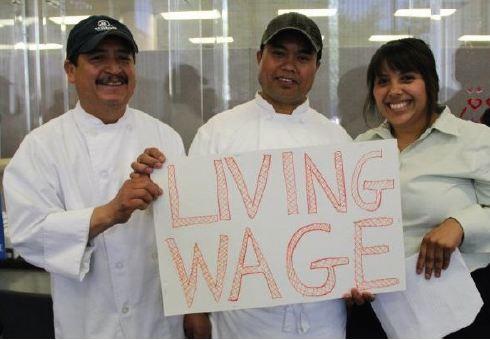

On November 6, Long Beach voters overwhelmingly approved a minimum wage for hotel workers in their city. The law guarantees that these workers will be paid about $2,000 a month for full-time work and receive five paid sick days a year. (Fact sheet.)

These modest provisions would help hotel workers and their families, while boosting the economy for everyone in Long Beach. The hotels, many of which are owned by wealthy out-of-state corporations, have been thriving and could easily afford to pay the minimum wage while maintaining healthy profits. However, they are doing everything in their power to thwart the will of the voters and punish their own employees – putting a few extra dollars of profit ahead of the interests of Long Beach residents and businesses,

» Read more about: Tell Long Beach’s City Council to Enforce the Will of Voters »