I have a friend who is intelligent, thoughtful and holds a responsible position in a major firm. From time to time we exchange ideas about the condition of American society, particularly how the economy shapes our democracy these days. We often agree about the dimensions of the problem, but disagree about what should be done about it. When it comes to the inheritance tax, we stand at opposite poles.

He thinks that what a person has accumulated in their lives is theirs to do with as they please, period. If they want to hide it offshore in the Virgin Islands, fine. If they want to give it all away, fine. And if they want to just pass it along to their children, no problem. As far as he is concerned the 400 who own as much as half the American population can do whatever they want – it’s their money.

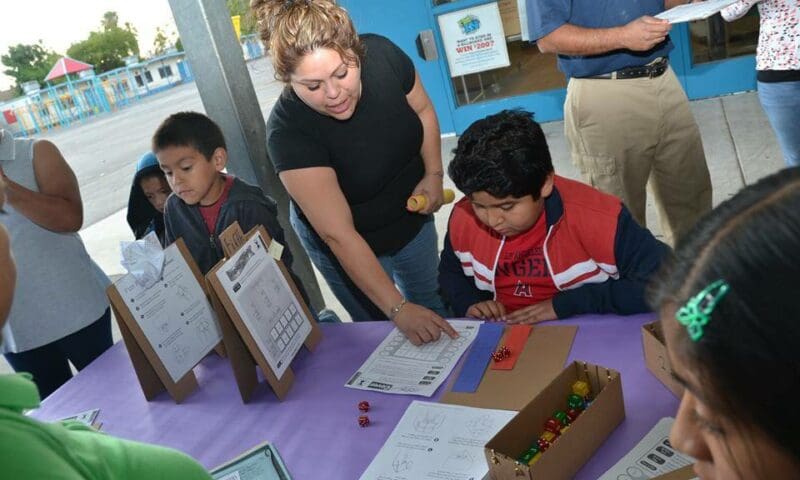

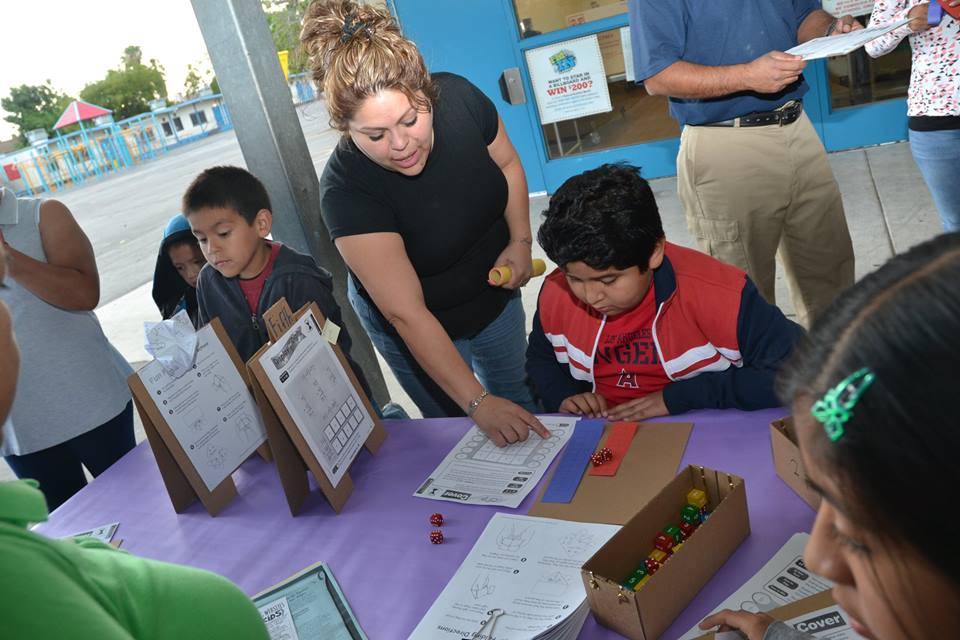

America’s education system is unequal and unfair. Students who live in wealthy communities have huge advantages that rig the system in their favor. They have more experienced teachers and a much lower student-teacher ratio. They have more modern facilities, more up-to-date computer and science equipment and more up-to-date textbooks. They have more elective courses, more music and art offerings and more extracurricular programs. They have better libraries, more guidance counselors and superior athletic facilities.

Not surprisingly, affluent students in well-off school districts have higher rates of high school graduation, college attendance and entry to the more selective colleges. This has little to do with intelligence or ability. For example, 82 percent of affluent students who had SAT scores over 1200 graduate from college. In contrast, only 44 percent of low-income students with the same high SAT scores graduate from college. This wide gap can’t be explained by differences in motivation or smarts.

» Read more about: California’s Public Schools: Separate and Definitely Unequal »

Some of us, who as kids read Edward Everett Hale’s short story, “The Man Without a Country,” might wonder if its cautionary lesson about the dangers of renouncing citizenship could be applied to American corporations. They, after all, have been declared “people” by the Supreme Court – and so if companies, like the Army officer in Hale’s story, turn their backs on their country, do they lose their right to ever set foot on its soil again?

The question begs an answer as the new corporate fad of “inversion” takes off. This is the practice of an American corporation purchasing a smaller foreign one that makes the same products in order to claim the national “citizenship” of the purchased company. By doing so, the U.S. company dodges a tax bill from Uncle Sam without its CEO having to learn a single word of the language of his or her company’s adopted country.

» Read more about: Corporations Avoid Taxes With Inversion Scam »

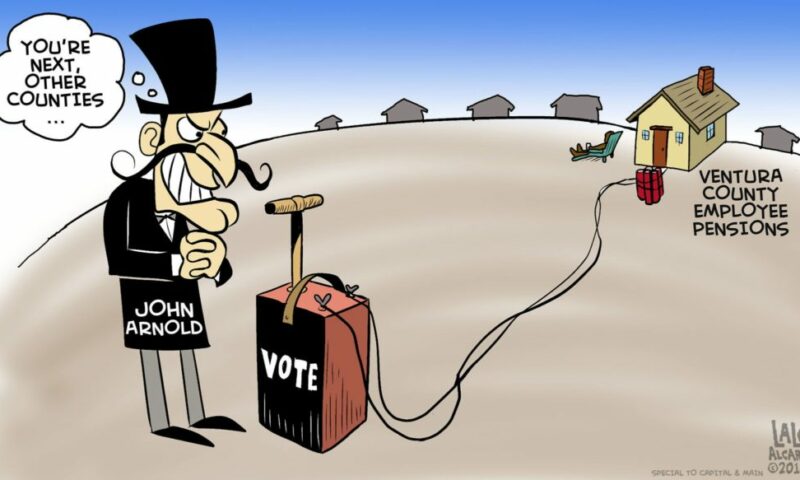

Jon Coupal is nothing if not blunt when he describes one motive behind a Ventura County ballot measure that would replace the “defined benefit” pensions currently enjoyed by county employees and replace them with 401(k)-type plans for all future hires.

“This is meant to be a template for other counties,” Coupal tells Capital & Main. By that, the Howard Jarvis Taxpayers Association’s president means the measure’s conservative and libertarian backers see the “Sustainable Retirement System Initiative” as the newest and most promising weapon in their assault on California’s public employee retirement plans. Having failed to place similar measures on state ballots in 2012 and 2014, a coalition of wealthy individuals, anti-tax activists and government privatizers has seized on an aspect of California law that allows 20 counties to fashion their own public employee retirement policies apart from the CalPERS system that administers such policies for nearly all of the state’s remaining 38 counties.

» Read more about: Domino Effect: Pension Cutters Gamble on a California Ballot Measure »

It was an incredibly busy and rewarding time last week at Netroots Nation in Detroit. Sifting mentally through the countless conversations, workshops, speeches, text messages, Tweets, business cards and campaign “swag” I’ve accumulated, I struggled to find a common thread.

Then I visited the Detroit Industry Murals — one of Diego Rivera’s most famous works of art. Rivera’s amazing fresco murals reflect ideas of duality: contrasting managers and workers, mechanized industry and the natural world, and the positive and destructive potential of science and technology. Rivera beautifully illustrated these concepts between 1932 and 1933 by painting images of biochemical weapons and passenger planes, female fertility figures with South and North American characteristics, doves and hawks, orderly production lines and fiery furnaces.

Then, it clicked. For me, Netroots Nation 2014 has been about the duality of art and war.

» Read more about: Netroots Nation in Detroit: The Art of War and the War of Art »

Talk about a big tent: Carolyn Finney’s new book looks at some important but unexplored terrain in our national parks and conservation movements – the relative absence of African Americans. Black Faces, White Spaces: Reimagining the Relationship of African Americans draws upon the legacy of slavery, Jim Crow laws, pop culture and the environmental justice movement to pose some provocative questions about the racialization of nature.

Was it a coincidence that Congress passed the Wilderness Act in 1964 – the same year as the signing of the Civil Rights Act? Why have environmental groups such as the Sierra Club and Audubon Society remained overwhelmingly white in their memberships? How are African Americans changing the dynamics of environmental preservation?

Finney, an assistant professor with U.C. Berkeley’s Environmental Science Department, will discuss her book and its findings on Tuesday, July 22, 7 p.m., at a signing at Eso Won Books,

» Read more about: Carolyn Finney Discusses ‘Black Faces, White Spaces’ »

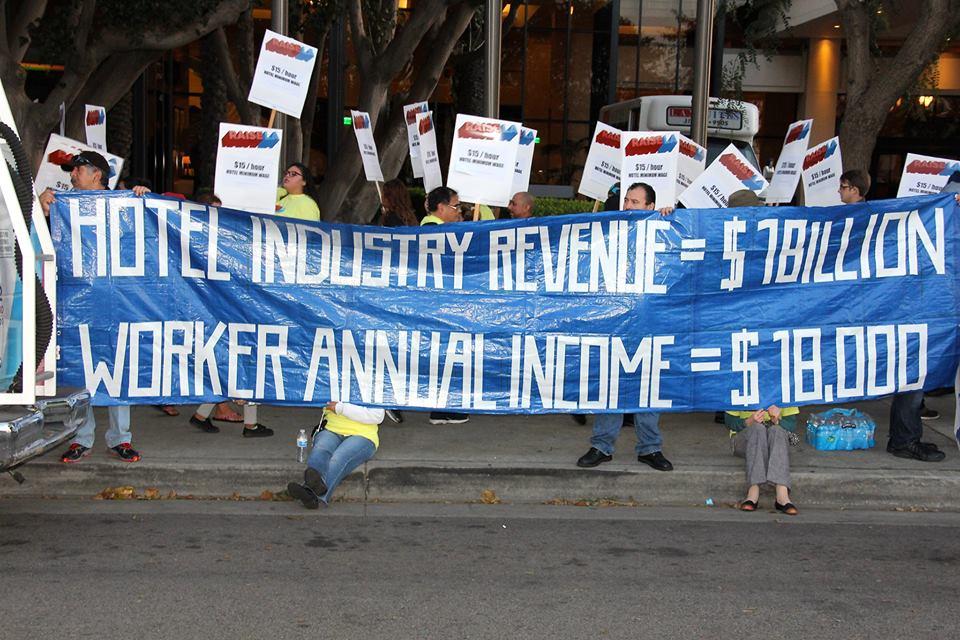

When asked by the Los Angeles Times to explain the movement to raise the minimum wage for the city’s hotel workers, one worker said, “At $15 [an hour], we can make it. We can live just a little bit better, not drowning all the time.”

It’s no surprise that hotel workers would be in favor of having raising their hourly minimum wage raised from $9 to $15.37, as is currently being proposed. Nor is it surprising that they’ve found support from the extensive network of liberal organizations and labor unions in the L.A. area. Less predictably, however, many members of L.A.’s business community, ranging from 750 small business owners to shopping mall developers Rick Caruso and the Westfield Group, have endorsed the proposed legislation as well.

In a letter to Councilmember Mike Bonin, Westfield co-CEO Peter Lowy indicated his organization’s support for such a measure. Lowy described Westfield’s experience with the living wage requirements currently in place at Los Angeles International Airport and said that “the continued growth and prosperity of this City is vital not only to [Westfield’s] centers,

» Read more about: L.A. Hotel Workers Move Closer to $15.37 Hourly Minimum Wage »

Isabel Mejia was 17 years old when she arrived in the United States from El Salvador, having fled her home country for reasons even the most hardened immigration opponent might have trouble dismissing. Some local gang members had decided to conscript her as the “gang’s girlfriend” — to force her into a life of sexual slavery. At home, the situation was no better: She had been a victim of domestic sexual violence. Faced with rape, death or flight, she chose to flee.

Today, Isabel (not her real name), now 18, lives in a small apartment in Southern California with her aunt. Her respite is only temporary. After crossing over the Mexican border into Texas, she had been captured by Border Patrol agents and held in a Houston detention facility before being released into her aunt’s care. Some time in the next few months, she will go before an immigration judge and, with the assistance of a pro bono attorney,

As a nation we often talk about the importance of educating our children, but sometimes we talk the talk more than we walk the walk. In Michigan, a year-long investigation conducted by the Detroit Free Press showed that Michigan taxpayers pour nearly $1 billion a year into charter schools but fail to hold the schools accountable.

The investigation found that the lack of oversight allowed charter schools to cheat students out of a good education. The Free Press found “wasteful spending, conflicts of interest, poor performing schools and a failure to close the worst of the worst.”

In Michigan, specifically, the Free Press reports: