It might surprise many to learn that business people all over America have joined the fight against economic inequality. Here are 10 notable, wealthy individuals who have advocated for ending tax cuts on the rich and increasing programs for the poor:

Morris Pearl A managing director of the multibillion dollar, multinational investment management corporation BlackRock, Inc., Pearl is a member of Patriotic Millionaires for Fiscal Strength. The group petitioned President Obama to allow the Bush-era tax cuts on incomes greater than $1 million to expire “for the economic well-being of regular Americans.”

Morris Pearl A managing director of the multibillion dollar, multinational investment management corporation BlackRock, Inc., Pearl is a member of Patriotic Millionaires for Fiscal Strength. The group petitioned President Obama to allow the Bush-era tax cuts on incomes greater than $1 million to expire “for the economic well-being of regular Americans.” Stephen M. Silberstein This former U.C.

Stephen M. Silberstein This former U.C.» Read more about: 10 Business Leaders Who Just Say No to Economic Inequality »

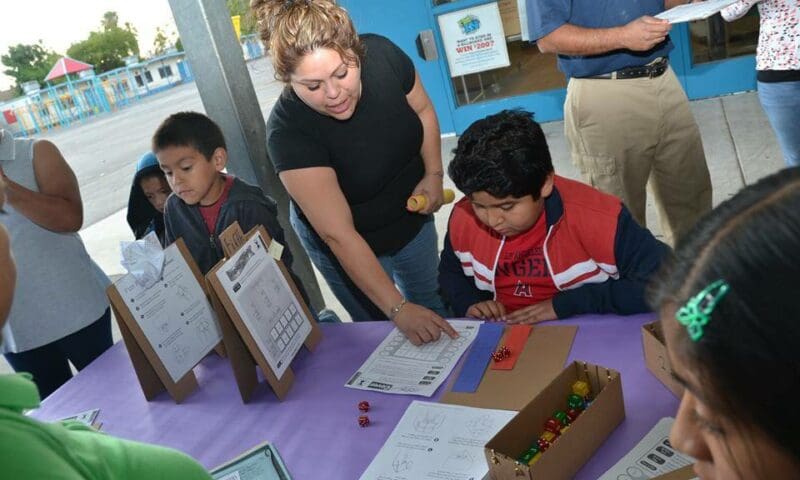

America’s education system is unequal and unfair. Students who live in wealthy communities have huge advantages that rig the system in their favor. They have more experienced teachers and a much lower student-teacher ratio. They have more modern facilities, more up-to-date computer and science equipment and more up-to-date textbooks. They have more elective courses, more music and art offerings and more extracurricular programs. They have better libraries, more guidance counselors and superior athletic facilities.

Not surprisingly, affluent students in well-off school districts have higher rates of high school graduation, college attendance and entry to the more selective colleges. This has little to do with intelligence or ability. For example, 82 percent of affluent students who had SAT scores over 1200 graduate from college. In contrast, only 44 percent of low-income students with the same high SAT scores graduate from college. This wide gap can’t be explained by differences in motivation or smarts.

» Read more about: California’s Public Schools: Separate and Definitely Unequal »

Two and a half years after the Occupy Movement jolted the country, America is once again abuzz with talk about poverty and inequality. Of course, along with a heightened focus on the problem come lots of ideas for fixing it. Some are smart, others are not, but nearly all of them share one thing in common: They are complicated.

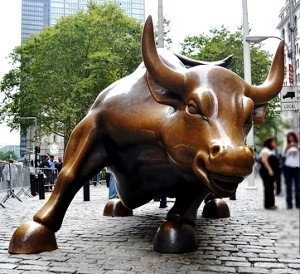

The status quo “solution” isn’t complicated – at least on paper. It’s the one proposed by former Reagan official Herbert Meyer, who, on his website The Cure for Poverty, offers a three-word remedy: the free market.

Meyer, who worked at the CIA, may have been too busy warding off the enemy to notice that market forces have enjoyed one of the most unfettered periods in recent American history, even as poverty and inequality have risen inexorably. But he is surely onto something with his one-step prescription.

So I have my own,

The conventional wisdom of capitalism is encapsulated in the phrase “trickle down.” This means the money that some very rich people have accumulated gets invested in ways that create jobs, and the money dribbles down the social pyramid, first to administrators, then white collar managers and bureaucrats, then to the assembly line or shop floor workers, then to the janitors. General Motors used to be the quintessential capitalist corporation. “What was good for General Motors,” it was believed during the Eisenhower years, “was good for the country.”

Then in the 1980s, an economist from USC sold Ronald Reagan on a re-constructed version of this model. He called it “supply side economics.” This notion claims that the more goods are available for people to buy, the more money will concentrate in the upper reaches of the rich, and somehow, this is good for the country. The Walton family heirs to the Walmart fortune are a good example of this business model.

» Read more about: Trickle Down Profits Don’t Raise Any Boats »

How will the 2016 election be framed? What will be America’s choice?

If the coverage of last week’s two big winners offers a guide, the choice will be between “pragmatism” and “ideology.”

The Washington Post called Chris Christie’s huge gubernatorial victory a “clear signal in favor of pragmatic, as opposed to ideological, governance.”

But the mainstream media used a different adjective to describe Bill de Blasio, last week’s other landslide victor. The New York Times, for example, wrote of “the rise of the left-leaning Mr. de Blasio.”

Again and again, Christie is described as the pragmatist; De Blasio, the lefty.

But these appellations ignore what’s happening to an America in which almost all the economic gains are going to the richest 1 percent, median household incomes continues to drop and the number of Americans in poverty continues to rise.

It is widely recognized that economists are not very good at economics. That is why we are looking at a decade of economic stagnation with tens of millions of people being unemployed or underemployed in Europe and the United States.

If economists were better at economics, central banks in the United States and Europe would have recognized the housing bubbles that were driving economies in the last decade. They would have taken steps to rein them in before they grew so large that their inevitable collapse would sink the world economy.

We recently had the opportunity to see that economists are no better at moral philosophy than economics. In a recent paper, Harvard economics professor Greg Mankiw, the former chief economist to President Bush and one of the country’s most prominent conservative economists, compared progressive taxation to forcefully removing a person’s kidney for a transplant.

That is probably not how most people would view imposing a high tax rate on rich people.

» Read more about: Economic Inequality: The Heart (and Kidney) of the Matter »

Last Friday, my wife, Susan, was out where Santa Monica meets Brentwood to tell the President not to approve the Keystone XL pipeline. No one caught a glimpse of him, of course. What she did see were scores of expensive cars moving down San Vicente – black, big SUVs, as usual, and top-of-the-line Mercedes and BMWs but also Jaguars, Ferraris, a Rolls, even a Lamborghini, plus others she couldn’t name. These cars begin at $75,000 and go to the mid-six figures.

Also trying to wind though the traffic maze were the workers, gardeners in small, beat-up Toyota pickups, house maids in compacts from 20 years ago, bunches of Latinas waiting at the bus stop for public transportation and delayed by the President’s presence at a fundraiser in a nearby home. The juxtaposition of the vehicles of the very wealthy and those of their servants was what she found remarkable about the experience.

» Read more about: Santa Monica’s Lethal Shootings and the Culture of Economic Desperation »

In the previous week we reposted this fact-packed, viral video (more than four million views at last count) about economic inequality in America. Its deft use of graphics makes this a handy resource — and worth a second look.

Few American economists want anything to do with social movements. Then there’s Robert Pollin, who has embraced his role as a progressive with a prolific output of books, studies and articles that make the economic case for greater equality.

Pollin, who will be honored at the L.A. Alliance for a New Economy’s (LAANE) City of Justice Awards Dinner next month, rose to prominence in the late 1990s as the most ardent academic defender of living wage laws. In recent years he has advanced the case for a new green economy based on good jobs and environmentally sensible policies.

Pollin, a professor of economics at the University of Massachusetts – Amherst and co-director of the Political Economy Research Institute, may be left of center but he is no business-bashing liberal. To the contrary, he learned from his father – the late Abe Pollin,

» Read more about: Progressive Economist Robert Pollin Gets Down to Business »

Suppose the growth of the U.S. economy slows to a trickle. I don’t mean in the next quarter or next year or even over the next decade. I mean from this time forth.

That’s the prediction of Northwestern University economist Robert Gordon in a new paper that’s become the subject of widespread commentary.

Gordon writes that three industrial revolutions have taken place over the past 250 years: the first centered on the steam engine and railroads; the second based on electric power, the internal combustion engine and indoor plumbing; and the third rooted in computers and the Internet. By substituting mechanical power for human power in the production process and by greatly speeding up transportation and communication, Gordon asserts, the second revolution raised productivity and wealth far more than did the other two.

Indeed, U.S. productivity gains and the concomitant increase in wealth have slowed in recent decades from the levels the United States historically enjoyed.

A recent story in The New York Times, back in its business section, had important news about inequality: “Income Inequality May Take Toll on Growth.” A couple of economists at the IMF reported research (here) showing that, across many countries, periods of greater income inequality tend to be followed by slow-downs in economic growth.

This is, actually, old news. About 20 years ago the research literature already showed that inequality probably damped the economy (see pp. 126ff here). But this remains important to repeat – not just because reporting the baleful effects of inequality now has the imprimatur of the IMF, but also because so many people still resist the news; they insist instead on believing the opposite, that inequality stimulates the economy, to the benefit of everyone. And, of course, this insistence has political implications right now.

» Read more about: Growth Is the Price of Income Inequality »