Labor & Economy

Economic Inequality: The Heart (and Kidney) of the Matter

It is widely recognized that economists are not very good at economics. That is why we are looking at a decade of economic stagnation with tens of millions of people being unemployed or underemployed in Europe and the United States.

If economists were better at economics, central banks in the United States and Europe would have recognized the housing bubbles that were driving economies in the last decade. They would have taken steps to rein them in before they grew so large that their inevitable collapse would sink the world economy.

We recently had the opportunity to see that economists are no better at moral philosophy than economics. In a recent paper, Harvard economics professor Greg Mankiw, the former chief economist to President Bush and one of the country’s most prominent conservative economists, compared progressive taxation to forcefully removing a person’s kidney for a transplant.

That is probably not how most people would view imposing a high tax rate on rich people.

However, the analogy is an interesting one; it just needs a bit more context.

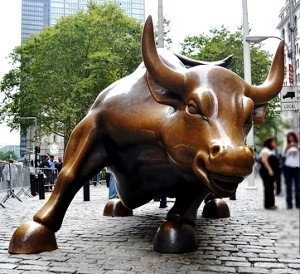

First, we have to realize all the sweet little things that the government does to make the rich even richer. Everyone’s favorite starts with the goodies we give to the boys and girls on Wall Street. It takes lots of taxpayer dollars to keep Jamie Dimon and Lloyd Blankfein in nice suits. According to an estimate from Bloomberg News, the implicit subsidy from the government’s too-big-to-fail insurance policy is worth $83 billion a year, a bit more than the $76 billion annual cost of the food stamp program.

The wizards of Wall Street also benefit from the fact that the financial industry is exempt from many of the taxes that more pedestrian businesses face. The International Monetary Fund (IMF) suggested taxes on the order of 0.2-0.3 percent of GDP ($35-$50 billion a year) to level the playing field.

Then we have the massive redistributions that go to the holders of government granted patents and copyright monopolies. The former easily cost the economy several hundred billion dollars a year. While patent monopolies can make drug companies and tech companies very rich, these monopolies are an enormous drag on the economy, slowing growth and reducing employment.

And we also have the high-end professionals like doctors, dentists and lawyers, who can often get very rich because they get to set the rules of the market. This means, for example, that while trade pressure in general is designed to force down workers’ wages by putting them in competition with low-paid counterparts in the developing world, these professionals are largely protected from such competition. In addition, they get to restrict the number of people who can become members of their profession in the United States. And they set rules that can make it illegal for other, less highly compensated workers from doing tasks for which they are entirely qualified.

But even if we ignore these and other ways in which the rich use the government to redistribute income upward, we still get to the basic issue of macroeconomic policy. Currently the U.S. economy is close to 9 million jobs below its trend level of employment. This means that if we had competent people running the Fed back in 2002 – when the housing bubble first became evident to people who follow the economy – and these competent people had taken the necessary steps to stem the growth of the bubble, another nine million people would have jobs today.

Of course, the impact on the labor market is even larger than just nine million people getting jobs. In addition, millions of people who could only find part-time jobs would instead have full-time jobs. In 2006, four million people fell into this involuntary part-time category. Currently, the number is close to eight million.

In addition, the tightness of the labor market directly affects the ability of large segments of the workforce to secure wage gains. In my forthcoming book with Jared Bernstein, we show that the ability of the bottom half of the labor force to secure wage gains depends hugely on the level of unemployment. This means that the economic mismanagement of the last decade has not only denied tens of millions of workers jobs; it has also forced down the wages of tens of millions more workers.

Now let’s get back to Greg Mankiw and the story of forced removal of kidneys. Not only has the heavy hand of the government directly transferred trillions of dollars to those at the top, it has deprived tens of millions of others of the ability to earn a decent living in the economy.

In this case, the economic mismanagement of the Greenspan gang has put large segments of the population in the situation where the rich can tell them that if they want to be able to eat, or let their kids have food to eat, then they will have to work at bad jobs at low wages. And Mankiw and his ilk want us to believe that this is fair. Needless to say, if policy became so bad that some workers had to sell kidneys for food, Mankiw would consider this fair as well. In fact, poor people sometimes do sell organs.

So, Mankiw was onto something when he discussed the government forcing people to give up kidneys. The discussion just needed a bit more context to set it right.

(Dean Baker is a macroeconomist and co-director of the Center for Economic and Policy Research in Washington, D.C. His post first appeared on Truthout and is republished with permission.)

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit

-

The SlickFebruary 10, 2026

The SlickFebruary 10, 2026New Mexico Again Debates Greenhouse Gas Reductions as Snow Melts

-

Latest NewsFebruary 12, 2026

Latest NewsFebruary 12, 2026Trump Administration ‘Wanted to Use Us as a Trophy,’ Says School Board Member Arrested Over Church Protest

-

Latest NewsFebruary 10, 2026

Latest NewsFebruary 10, 2026Louisiana Bets Big on ‘Blue Ammonia.’ Communities Along Cancer Alley Brace for the Cost.