Former Obama official Cass Sunstein explains in a recent article what a “wing nut” is: anyone, right or left, with “a dogmatic commitment to an extreme political view” that is “false and at least a bit crazy.” Wing-nuts, he says, “impugn” the “motivations” or the “good faith” of people with whom they disagree, rather than confront their actual arguments.

Sure, you may say, that’s fair: an equal- opportunity definition of “wing nut.” Who wouldn’t want to join Sunstein in occupying the moderate middle and calling out the intolerant and the uninformed at both ends of the political spectrum, the people, as he says, who call Barack Obama a socialist or George W. Bush a fascist?

The question, though, is how does Sunstein use this even-handed rhetorical stand against “wing nuts”?

To know, we don’t have to look any further than Sunstein’s third example of a wing nut: someone who believes “that big banks run the Department of the Treasury.” Now,

» Read more about: The Moderate Middle’s Dirty Little Secret »

Eric Garcetti has enormous potential to be one of L.A.’s great mayors. He is young (just 42), full of energy, experienced in politics and government, passionate about L.A., brimming with policy ideas, compassionate toward the disadvantaged and a great communicator and explainer. I saw many of these traits up-close when I co-taught a course with him at Occidental College in 2000, and have watched him blossom as he joined the City Council and served as its president.

Now he faces the daunting challenges of running America’s second-biggest, and most diverse, city.

No mayor can succeed unless he or she attends to the routine civic housekeeping tasks that residents expect from municipal governments – fix the potholes, keep traffic flowing, maintain public safety, keep the parks and playgrounds clean and in good repair.

But Garcetti didn’t run for mayor just to be a caretaker. He promised more.

This post originally appeared on Dog Park Media.

The East, just out this weekend, is a movie ostensibly about radical anarcho-environmentalists that has little to say about radicalism, anarchism, or environmentalism. It’s not a bad movie; as a suspenseful drama it’s entertaining. But that’s part of the problem. The entertainment comes first, and second, and third, and the politics last. This is one of those “I want to entertain my audience, but also make them think” movies in which politics ends up providing little more than a cardboard backdrop to what is finally a conventional thriller.

Fair warning: this will include every imaginable spoiler.

The first strategy The East uses to push politics to the background is to make the radicals’ targets as uncomplicated as imaginable. “The East” (the name of the radicals’ semi-revolutionary cell) first goes after a drug company marketing a product that is not only dangerous but reliably so;

Two State Senators held a press conference this morning outside Déjà Vu Showgirls, one of two Sacramento-area strip clubs that the Frying Pan News documented as benefitting from a controversial tax credit program. State Sens. Jerry Hill, D-San Mateo, and Anthony Cannella, R-Ceres, urged fellow legislators to join them in reforming California’s enterprise zone program.

Criticism of the enterprise zone program, which our Gary Cohn recently investigated, seems to be gathering attention. Documents received last week by Frying Pan News showed that Déjà Vu Showgirls and Gold Club Centerfolds received a combined two dozen vouchers for tax credits of up to $37,000 per employee, despite paying most of them around $9 per hour. The program also requires no evidence of job creation. In his piece “How Enterprise Zones Are Killing the California Dream,” Cohn quotes two Californians who had been laid off while their former employers received credits for their lower-paid replacements.

» Read more about: Heat Grows on “California Dream Killer” Tax Program »

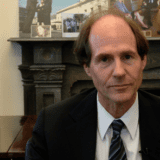

Vivian Rothstein was one of four recipients of a “Giant of Justice” award from Clergy and Laity United for Economic Justice Los Angeles (CLUE-LA) last week. She’s a longtime friend and mentor of mine, and was introduced at the breakfast by a longtime friend and mentor of hers, Rev. Jim Lawson. In his intro, Lawson invoked the concept of the “beloved community,” a well-worn phrase whose meaning is often either trivialized or simply lost. So much a part of the civil rights movement from which Vivian’s activism sprung, the idea of a beloved community is what Vivian has imparted to so many of us – that organizing must be rooted in a basic decency and love, and in being so rooted, is transformative well beyond whatever immediate victories, however substantial, may be achieved. We’ve reprinted her speech because it is a such a remarkably well-told story.

This article originally appeared in The Nation.

In The Democracy Project: A History, A Crisis, A Movement (Spiegel & Grau, 2013), David Graeber’s engaging new book on Occupy Wall Street, the author writes of the dismal culture in Washington during the summer of 2011, a few months before the occupation of Zucotti Park:

Republicans were threatening to cause the US government to default in order to force massive cuts in social services intended to head off a largely imaginary debt crisis…President Obama, in turn, had decided the way to appear reasonable in comparison and thus seem as his advisors liked to put it ‘the only adult in the room’ was not to point out that the entire debate was founded on false economic premises, but to prepare a milder, ‘compromise’ version of the exact same program—as if the best way to expose a lunatic is to pretend that 50 percent of his delusions are actually true….

» Read more about: The Anarchy Project: David Graeber’s Occupy Wall Street »

The political leadership of Los Angeles is changing hands in a month – bringing tremendous challenge and opportunity.

One of the greatest opportunities, for our Mayor-elect and the biggest batch of new City Council members we’ve had in over a decade, is finishing the transformation of our archaic commercial waste and recycling system into a highly effective national model. I say finish because we’re almost there.

Why is this important?

Well, for starters, we’re running out of space to deal with our waste. For decades, as a city and region, we’ve relied on a constellation of toxic landfills, many of which have closed. The largest of those, Puente Hills, is set to close next year, which is going to create a genuine problem for the region, particularly cities like Los Angeles that throw the most away.

Now,

» Read more about: Don’t Waste This Opportunity, Los Angeles »

There are no Walmart stores in San Francisco. And yet, four members of the company’s board of directors are influential Bay Area residents. On May 29, a group of Walmart workers assembled outside the residence of Yahoo! CEO Marissa Mayer, a Walmart director, who has a 38th floor penthouse apartment above the Four Seasons on Market Street in San Francisco.

Donning bright green T-shirts and chanting, “Stand up, live better,” the workers were gearing up to join roughly 100 members of OUR Walmart, a nationwide organization of Walmart associates, in going on strike and caravanning to Bentonville, AR, where the retailer will hold its annual shareholder meeting June 7.

OUR Walmart’s stated concerns include things like giving employees the option of working full-time, and providing a level of wages and benefits that ensures employees aren’t forced to rely on government assistance to get by.

Dominic Ware,

» Read more about: Walmart Workers Strike, Rally Outside Marissa Mayer’s SF Penthouse »

The success of Measure R, passed by voters in 2008, the “30-10” plan to accelerate implementation of our transit revolution, and the 66 percent “yes” vote on Measure J each demonstrates that Los Angeles voters are ready to invest in a transportation transformation. There is an opportunity now and a coalition partnership available that’s too good to waste. Together with Mayor Eric Garcetti we must continue cultivating this voter trust and this partnership of labor, business, environmental, community groups and elected officials who share a common vision — of a Los Angeles with a clean public transportation system that is both robust and financially sound, and that has a vigorous economy with prosperity that is widely shared.

As Mayor Antonio Villaraigosa has demonstrated so clearly, we can think big about solutions to our challenges as a region — and we can expect to succeed.

» Read more about: Transportation and the New Mayor: The Path Forward »

A friendly and regular reader of this blog wrote me that she recently spent a week sitting in on the trial of a teenaged girl in Compton who was tried for murder and will likely spend the rest of her life in prison. She regularly responds to my essays and often asks me to explain exactly what we can do to change the circumstances of injustice that I write about. Such situations seem – like that of the young girl whose trial she watched – impossible to affect, much less fix.

Still, my reader’s question remains a fair one, and I have given it a lot of thought. I know what I do, and it ranges on a continuum from action at a distance to action up close. On that first end of the scale, I make it a practice to sign every petition that crosses my path.

» Read more about: Living in a World Without Justice: What We Can Do »