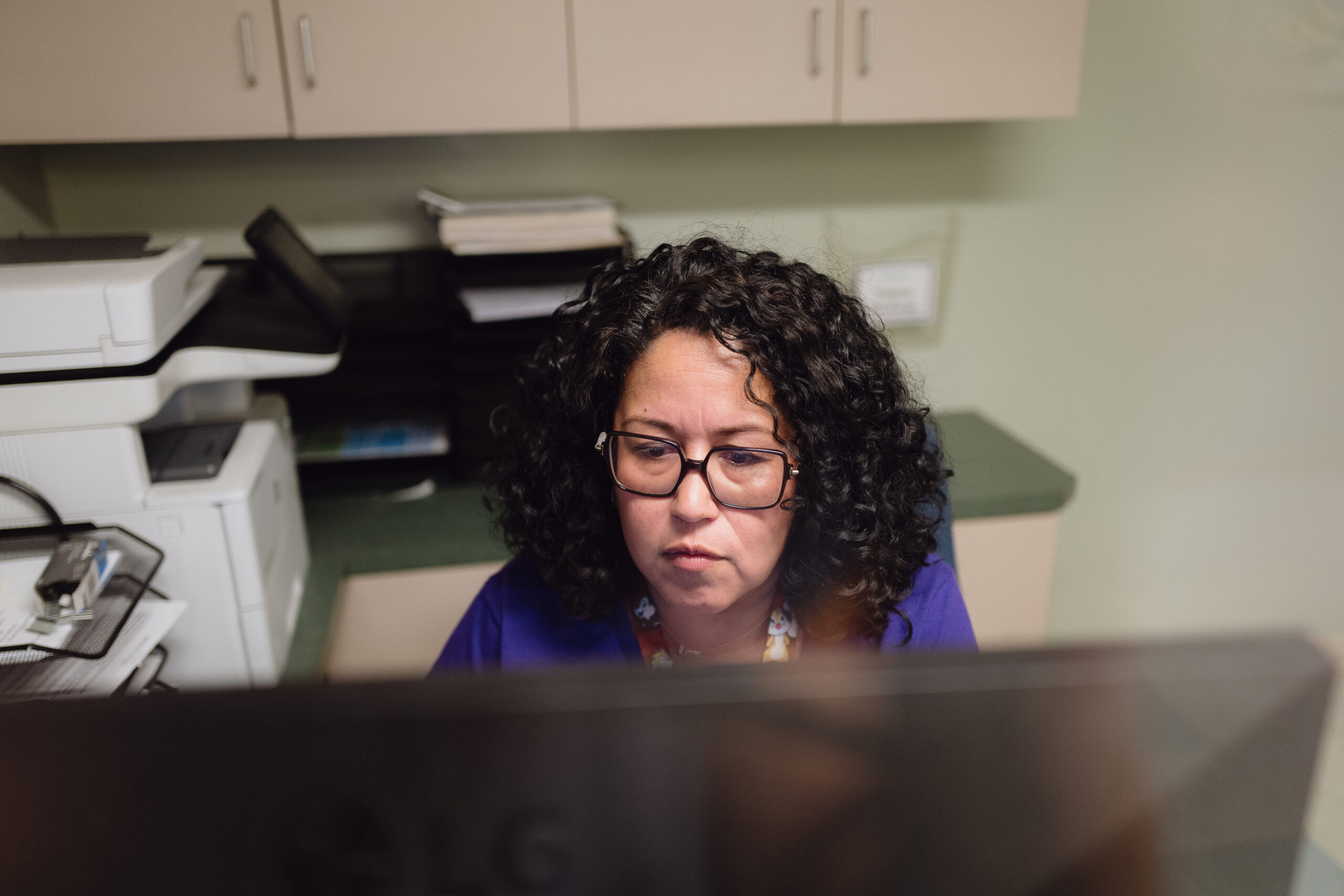

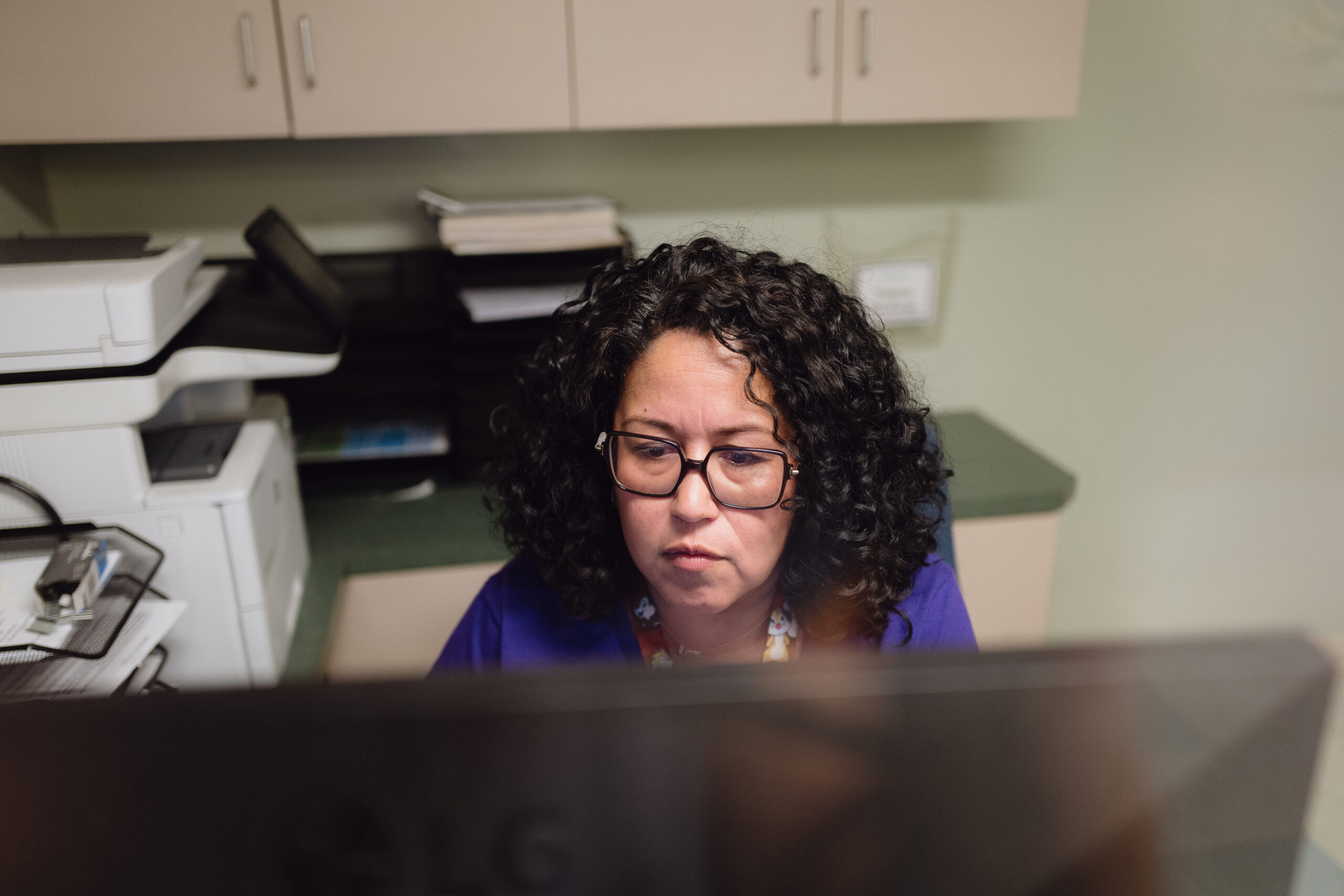

For 23 years, Pattie Lopez has helped patients qualify for public health coverage at Venice Family Clinic in Los Angeles.

But in the last six months, her meetings with clients have become increasingly discouraging. She has been fielding an outpouring of questions and fears as they navigate a dizzying array of cuts and eligibility changes to Medi-Cal, the state’s Medicaid health insurance program for low-income residents, and Covered California, the state’s health insurance exchange.

The volume and scope of cuts and restrictions are unlike anything else she has seen in all of her time at the clinic, said Lopez, who now oversees health insurance enrollment at the clinic, which has several locations in L.A. County.

For patients juggling jobs, kids, rent and their own health, all these changes can feel like trying to solve a puzzle without all the pieces. Lopez sees the stress first-hand: the frantic calls, the tears, the desperate need for health care. She is empathetic. She started navigating health care long before it became her job. As a child, she translated health system information for her mother, who only spoke Spanish. Now, she is determined to find every little bit of coverage a client might qualify for. When it’s not possible, she reassures clients they can still be seen at the clinic regardless of income or immigration status.

Lopez has hundreds of stories about clients, but several stay with her.

A young woman whose premiums rise by more than 300%. A man hoping to get coverage this year but realizing he could not afford the higher premiums. Immigrants losing coverage altogether. And seniors distraught about new eligibility rules that could impact their coverage.

“It’s challenging. It’s upsetting. You don’t know what else to do,” Lopez said. “We are in the business of giving hope, but sometimes we are having really tough conversations.”

Pattie Lopez.

* * *

The rollbacks began last year because of federal Medicaid cuts enacted under President Donald Trump’s “Big Beautiful Bill,” which restructured Medicaid spending and eligibility nationwide. About 70 million people nationwide are enrolled in Medicaid. In California, nearly 15 million residents rely on Medi-Cal. The changes to Covered California plans revolve around increased premiums and expired subsidies in 2026.

For patients like those at Venice Family Clinic, the shrinking landscape of Medi-Cal is happening beneath their feet. Between federal changes and state cuts to meet federal budget projections, asset limits are returning, new work requirements are looming, and once-expanding immigrant eligibility is being restricted — all while benefits such as adult dental and certain medications are being reduced. The policies seem designed to trim enrollment among those with the fewest resources, but the short-term “savings” could be far costlier. When people lose coverage, they delay care, end up sicker and rely on emergency services, shifting costs to hospitals, clinics and taxpayers.

Places like Venice Family Clinic are where the program meets reality. Nearly half of the clinic’s budget comes from Medi-Cal reimbursements. A majority of its patients live at or below the poverty line, which is an annual income of $32,150 for a family of four, and many are immigrants. Lopez and her team are more than paper pushers; they are interpreters, advocates and problem-solvers, guiding people so they have equal access to health care.

“Health care is a human right,” Lopez said. “We provide care for the community regardless of immigration status or ability to pay.”

The clinic operates as a safety-net provider — a role shared by many free clinics, federally qualified health centers and community clinics across California that rely heavily on Medi-Cal to care for patients with limited resources.

Venice Family Clinic Simms/Mann Health and Wellness Center in Santa Monica.

Now, these clinics are trying to help patients deal with changing coverage or no coverage at all. At Venice Family Clinic a flyer is posted on the door showing a line-by-line list of how and when coverage will change.

“When I look at this list, it means more and more people will lose coverage, and that impacts us all,” Lopez said. “People are still going to be sick, and they are still going to receive care. Something that might have been prevented by having a primary care physician and insurance is more likely to lead to an emergency room visit.”

So far, children up to age 18, current and former foster youth under age 26 and pregnant individuals will continue to qualify for Medi-Cal under existing rules, regardless of assets or immigration-related changes.

According to an analysis by KFF, formerly the Kaiser Family Foundation, an estimated 7.5 million people nationwide are projected to lose Medicaid coverage or become ineligible by 2034. In California, up to 3.4 million residents could lose coverage, according to the California Budget and Policy Center.

* * *

Changes that began last year are ramping up over the next year.

At the beginning of this year, Medi-Cal reinstated asset tests for older adults and people with disabilities, and restricted new enrollment for certain immigrants. This summer more immigrants will lose dental coverage, and reimbursement rates for services provided to certain immigrants will be slashed.

Many of the changes target immigrants, who were able to gain coverage without legal status over the last decade in California. Now, those classified by the state and federal government as having unsatisfactory immigration status are losing coverage. Next year, some legal permanent residents, those with green cards, will lose access to Medi-Cal.

Another big change is the return of asset limits for older adults and those with disabilities, even if they have low incomes. The test, eliminated during the pandemic, says a single person may have no more than $130,000 in countable assets, such as retirement accounts. For married couples, the limit is $195,000.

One particularly distraught retiree called Lopez and demanded the clinic cancel his Medi-Cal even though he still qualified.

“He said he has a house and worked really hard and doesn’t want it taken away,” she said. “He was calling with a lot of distress.”

All of the changes will make it more challenging for those who qualify to keep their coverage, Lopez said. That includes a 2027 rule that will require more frequent renewals — twice a year, up from annually, by those in the program.

“It makes people scared to have to submit all of those things,” Lopez said, referring to bank statements, property records and other documents required during renewals.

People move often, they don’t receive the paper packet in the mail, they had a hard time filling out the forms, or they didn’t know they needed to complete the process. If they don’t get the forms in by the deadline they are disenrolled from the program.

“They come to us when they’ve been terminated, and we find out it’s because something was missed,” she said. “It was already a barrier to keeping coverage, and now it will come twice a year.”

Lopez works at a Venice Family Clinic location in Santa Monica.

* * *

Lopez is instrumental in helping clients get any coverage they qualify for. She works so hard for her clients because she has seen first-hand how access to Medi-Cal can save people’s lives.

She recalls a 36-year-old man who came to the clinic after multiple emergency room visits for a heart condition. The hospital referred him to the clinic.

The man lacked insurance at a job where he worked 36 hours a week so Lopez’s team helped him enroll in Medi-Cal. The clinic tried to help him with reminders but his illness made it difficult for him to manage the paperwork.

When he returned a year later to renew his coverage, she barely recognized him. He had surgery for his heart condition and was noticeably healthier.

“He was a totally different person, even in his energy and ability to keep track of the renewal,” Lopez said. “I know he’s doing better now.”

Copyright 2026 Capital & Main.

Photos by Zaydee Sanchez.

Column - State of InequalityJanuary 29, 2026

Column - State of InequalityJanuary 29, 2026

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026

Dirty MoneyJanuary 30, 2026

Dirty MoneyJanuary 30, 2026

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026

The SlickFebruary 10, 2026

The SlickFebruary 10, 2026

Latest NewsFebruary 12, 2026

Latest NewsFebruary 12, 2026