Labor & Economy

Goldman Sachs Appeal: The Plan to Privatize Public Goods

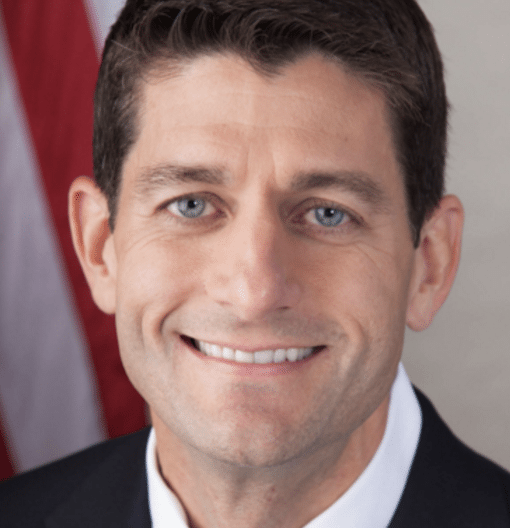

House Speaker Paul Ryan recently released a new “anti-poverty” plan that would only make it tougher for poor and working families to get by.

House Speaker Paul Ryan recently released a new “anti-poverty” plan that would only make it tougher for poor and working families to get by. As expected, the plan cuts from public programs that help low- and moderate-income Americans, while protecting tax cuts for the very wealthy. Senator Elizabeth Warren wrote, “It looks more like an agenda for creating poverty than reducing it.”

But one section of the plan has received less attention than it deserves.

Deep in Ryan’s proposal is a push for something called “Social Impact Financing,” also known as “Pay for Success” or “Social Impact Bonds.” Ryan’s not alone — some local and state governments are showing interest in these types of financing schemes. Pay for Success is complicated, but long story short: It’s an alternative to funding social services the tried-and-true way, with public spending.

In place of public money, these schemes rely on capital from investors, such as Goldman Sachs or Bank of America. The investors provide up-front funds for critical preventive services, like Pre-K school or prisoner rehabilitation, with the expectation of a return on their investment. The idea is to bring the virtues of private markets to government, or as Ryan’s plan puts it, “drive innovation and competition in the social-service sector.”

But as we’ve seen in many public goods, competition can be damaging. For example, unregulated charter school growth is disrupting public school systems across the country and putting many into fiscal crisis.

Without careful consideration, this sort of financing could introduce a number of risks into public spending, including perverse incentives, a failure to serve the neediest cases (called “creaming”), or a distortion of success measures. It also could limit our imagination about solutions to social problems like extreme poverty and homelessness — due to the way they’re structured, Pay for Success programs typically do not address the complex root causes of many of our social problems. Experiments are already raising eyebrows: initial results from a Goldman Sachs-funded early education program in Utah have come under serious question.

In the Public Interest recently released a tool to help advocates better understand these new alternatives to public financing. With A Guide for Evaluating Pay for Success Programs and Social Impact Bonds in hand, communities can ask tough questions about Pay for Success’ impact on the public, especially on our most vulnerable populations.

Ultimately, these schemes allow us to continue to underinvest in public goods and services, a root cause of many of our social problems. Poor and working families deserve much better. Prevention-focused public funding is much simpler and cheaper than kicking the can further down the road.

(This column is cross-posted on the Huffington Post.)

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit

-

The SlickFebruary 10, 2026

The SlickFebruary 10, 2026New Mexico Again Debates Greenhouse Gas Reductions as Snow Melts

-

Latest NewsFebruary 12, 2026

Latest NewsFebruary 12, 2026Trump Administration ‘Wanted to Use Us as a Trophy,’ Says School Board Member Arrested Over Church Protest

-

Latest NewsFebruary 10, 2026

Latest NewsFebruary 10, 2026Louisiana Bets Big on ‘Blue Ammonia.’ Communities Along Cancer Alley Brace for the Cost.