Election 2018

Are Prop. 10’s Big-Money Foes Making California’s Housing Problem Worse?

Co-published by The American Prospect

Topping the list of corporate anti-rent control donors are some of the country’s largest landlords — many funded by Wall Street investment dollars — whose bottom lines could be negatively affected by Prop. 10’s passage.

A significant amount of No on Prop. 10’s $65 million war chest comes from large, publicly traded real estate investment trusts.

Co-published by The American Prospect

One of California’s most hotly contested ballot measures, Proposition 10, would repeal the 23-year-old Costa-Hawkins Rental Housing Act that restricts a city’s ability to apply rent control to post-1995 construction and exempts single-family homes from regulation. Proposition 10’s opponents claim it will worsen the state’s housing crisis, which has left teachers, blue-collar workers and retirees struggling to keep roofs over their heads. To that end, the No on Prop. 10 campaign has deployed an ensemble of small property owners, non-profit housing developers and veterans as spokespeople against the measure.

More Ballot Measure Stories Here

However, topping the list of No on Prop. 10’s big donors are some of the country’s largest landlords — many funded by Wall Street investment dollars — whose bottom lines could be negatively affected by Prop. 10’s passage. The No campaign’s $65 million war chest is more than two-and-a-half times as much as the $25 million raised by Prop. 10 supporters, according to the California Secretary of State’s office. A significant amount of the No funding comes from large, publicly traded real estate investment trusts like the ones highlighted on a recent tour held by tenant activists in downtown Los Angeles.

Despite their affordable housing message, some No on Prop. 10 donors have long records of opposing efforts to include affordable housing in their developments.

New York-based Blackstone Group heads the list of these donors, contributing $5.6 million to defeat the measure which, if passed, would let cities enact laws to stabilize rent increases on a broader range of buildings and limit how much a landlord could increase rents when a new tenant moves in. Invitation Homes Inc., the investment vehicle created by Blackstone in 2016, owns more than 80,000 single-family homes nationwide and kicked in almost $1.3 million.

Despite their affordable housing message, these and some other No on Prop. 10 donors have long records of opposing efforts to include affordable housing in their developments, or employ business models that critics claim exacerbate the housing crisis. Some focus on high-end rentals that tenant advocates say do little to address the affordability crisis plaguing California’s job-rich urban areas. Others have been criticized for raising rents on the properties they acquire in an effort to pump up hefty returns for investors.

Also Read “California Workers and Retirees Are Unwittingly Financing an Anti-Rent-Control Campaign”

Steven Maviglio, a spokesperson for the campaign to defeat Proposition 10, claims that real estate investment trusts (REITs), which earn money for their shareholders through rental income and property value increases, only account for a tiny percentage of the state’s residential rental market. “REITs own .004 percent of California’s rental housing,” he wrote in an email, a statistic he attributes to the California Apartment Association.

On an August call with investors, Invitation Homes CEO Fred Tuomi argued that increasing housing supply — as opposed to regulating rents — was the answer to the affordability crisis facing California, where more than half of renter households pay more than a third of their incomes toward housing. “We just need more supply when it’s needed and, most importantly, where it’s needed and [at] the price points that it’s needed,” Tuomi said.

Equity Residential CEO: “Regardless of [Proposition 10’s] outcome, we will continue to fight attempts at the local level to enact rent control.”

But increasing the supply is not part of the business model of Invitation Homes, which focuses on property management and acquisition. In the aftermath of the 2008 housing collapse, the company scooped up tens of thousands of foreclosed single-family homes, mainly near Sunbelt cities, crowding out mom and pop landlords, imposing steep rent increases on tenants, and skimping on maintenance in order to generate large returns for investors, according to a report released early this year by the Alliance of Californians for Community Empowerment (ACCE) and two other advocacy organizations, and a separate Reuters investigation published in July.

In a written statement to Capital & Main, Invitation Homes countered that its residents “give us high ratings for customer service” and “stay 50 percent longer compared to the apartment industry,” adding that the company invests $22,000 per home in renovations. (Maviglio said that No on Prop. 10’s other corporate donors had no comment for this story.)

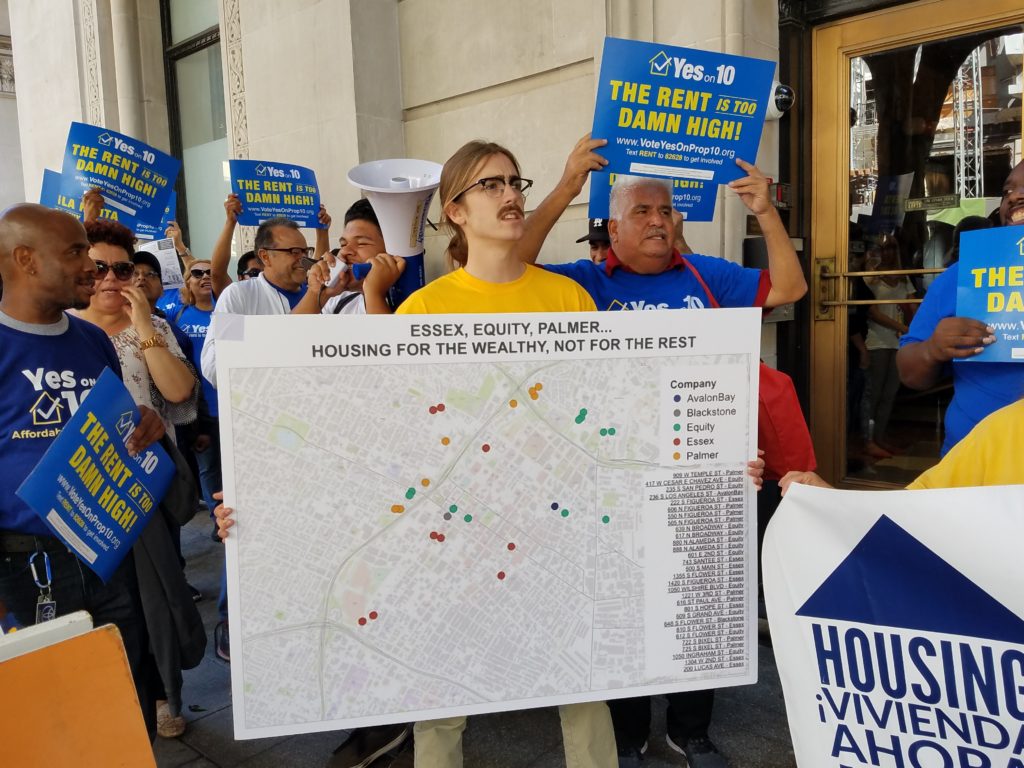

On October 10 in downtown Los Angeles, about 60 housing activists, replete with colorful T-shirts and noisemakers, held a “tour of the housing tyrants” that included stops at luxury apartments they said were owned in whole or in part by Blackstone Group and Essex Property Trust — two companies that are helping to fund the effort to defeat the rent control measure. The marchers’ “The rent is too damn high” chant attracted the attention of office workers and drivers stuck in lunchtime traffic.

Sheri Eddings, who is 55, joined the battle for rent control in response to letters she received from Invitation Homes demanding $500 rent increases after her two-year leases expired, first in 2015 and then in 2017. Each time, Invitation Homes has been willing to negotiate with her to reduce the increase, she says. But she would like to be able to count on staying in the South Los Angeles County neighborhood where her grandchildren live. “I don’t know what’s going to happen in 2019,” she said at the tenant action.

Sheri Eddings, who is 55, joined the battle for rent control in response to letters she received from Invitation Homes demanding $500 rent increases after her two-year leases expired, first in 2015 and then in 2017. Each time, Invitation Homes has been willing to negotiate with her to reduce the increase, she says. But she would like to be able to count on staying in the South Los Angeles County neighborhood where her grandchildren live. “I don’t know what’s going to happen in 2019,” she said at the tenant action.

One stop on the activists’ tour was Essex Property Trust’s owned Gas Company Lofts, which offers studios for about $2,000 per month and two-bedroom apartments for more than $3,500. To date, the San Mateo-based real estate investment trust has donated $4.8 million to defeat Proposition 10.

The vast majority of the company’s more than 60,000 apartment units are located in the Bay Area and Southern California. During an August 2 quarterly earnings call, Essex CEO Michael Schall told investors that the company would be “favoring market rents instead of favoring occupancy” for the next year, suggesting the company is choosing to leave units vacant in the hope of locking in higher rents.

Public policies, says ACCE’s Amy Schur, are only encouraging high-end housing where developers “can make the most money” instead of “ensuring that they contribute toward addressing housing needs of the state, which include housing that average working families can afford.” ACCE is part of the coalition advocating for passage of the ballot measure and was an organizer of the October 10 tour.

Another big Wall Street donor, Chicago-based Equity Residential, has so far invested more than $3.7 million to the No on Proposition 10 campaign. The REIT is focused on acquiring, managing—and, to a lesser extent, developing — housing in walkable urban markets favored by millennials, according to its filings with the Securities and Exchange Commission.

The company’s leadership has engaged in local and statewide rent control battles before. Equity Residential’s board chair is billionaire Sam Zell, whose heavily leveraged acquisition of the Tribune Co. was followed by bankruptcy and mass layoffs. His Equity LifeStyle Properties, another real estate investment trust (formerly Manufactured Home Communities), began to acquire mobile home parks across California more than two decades ago, and proceeded to bring costly legal actions against small cities that housed the parks in an effort to do away with local rent control laws. The leadership of its sister company, Equity Residential, apparently shares that combative spirit.

These Corporate Landlords Have Each Donated

More than $2 Million to Defeat Proposition 10

| Contribution | Contribution |

| Blackstone Group* | $5,575,497 |

| Essex Property Trust | $4,816,200 |

| Michael K. Hayde, including Western National Group & Affiliated Entities | $4,761,840 |

| Equity Residential | $3,724,900 |

| AvalonBay Communities Inc. | $3,006,100 |

| Geoffrey H. Palmer, owner of G.H. Palmer and Associates | $2,000,000 |

Source: California Secretary of State, downloaded October 22.

*Invitation Homes Inc., created by and partially owned by Blackstone Group, contributed another $1,286,250 to the effort to defeat Proposition 10.

“Regardless of the outcome [of Proposition 10], we will continue to fight attempts at the local level to enact rent control,” president and CEO David Neithercut told investors on a call this past July, during a discussion about Costa-Hawkins. About 45 percent of the company’s 79,000 apartments are located in California.

Interestingly, on that same call Neithercut proposed “inclusionary zoning” as part of an alternative “basket of solutions” to the state’s affordable housing crisis. Such zoning requires developers to set aside a certain number of units in their projects for low-income tenants.

Neithercut’s endorsement of inclusionary zoning might signal a shift for Equity Residential, which sought to wriggle out of a requirement that it keep a portion of a downtown San Francisco building’s units affordable five years ago. The company attempted to raise the rents on 33 low-income occupants of apartments on Geary Street, a move that would “almost certainly have forced many tenants from their homes,” had not the city of San Francisco sued, according to a statement issued at the time by city attorney Dennis Herrera, who settled with Equity for $95,000. (The company had reneged on an agreement with the city to keep a percentage of units affordable when the complex was built in exchange for tax-exempt bond financing for the project.)

Meanwhile, No on Prop. 10 donor Geoffrey Palmer’s hardball lawsuit against the city of Los Angeles resulted in a 2009 court ruling that for eight years discouraged cities from adopting inclusionary zoning laws. That prohibition ended with the so-called Palmer fix last year, a state bill that restored cities’ ability to require set-asides if they also offered developers alternative ways to comply with the law. (Palmer, who is well known in Southern California for his fortress-like apartment complexes with Italianate names like the Medici and the Lorenzo, is an avid Donald Trump supporter and has given $2 million to defeat Proposition 10.)

Perhaps it’s not surprising to find major landlords opposing Proposition 10. But will the ballot measure upend the housing market as they contend?

Anya Lawler, policy advocate for the Western Center on Law & Poverty, a Proposition 10 supporter, says rent control is an important tool for tenants but downplays any disruptive impact the repeal of Costa-Hawkins would immediately have in California. Proposition 10’s passage won’t guarantee the enactment of any local law, she says, nor will it be a cure-all for California’s housing woes, which have been decades in the making.

“Rent control ordinances need to be negotiated locally because every housing market is different, and communities have different needs,” says Lawler, who adds that stakeholders, including property owners, will need to be consulted. The idea that the repeal of the Costa-Hawkins law will lead to “draconian rent control policies” is not rooted in “political reality.”

Lawler’s sentiments are echoed by corporate housing executives, at least in their conversations with their own investors. Asked if his company would redline cities due to a rent control, Essex’s Schall stressed, during his August 2 call, that “rent control is only one factor” that the company considers when making investment decisions.

“We’re going to seek areas that have the best dynamic – the best supply-demand dynamic,” he said. “And right now we believe that’s in California, in the various markets that we’re in.”

Capital & Main’s contributors include groups supporting Proposition 10. This website is not funded by commercial entities that stand to profit from the outcome of the ballot initiative.

Copyright Capital & Main

-

The SlickJanuary 27, 2026

The SlickJanuary 27, 2026The One Big Beautiful Prediction: The Energy Transition Is Still Alive

-

Column - State of InequalityJanuary 29, 2026

Column - State of InequalityJanuary 29, 2026Are California’s Billionaires Crying Wolf?

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Dirty MoneyJanuary 30, 2026

Dirty MoneyJanuary 30, 2026Amid Climate Crisis, Insurers’ Increased Use of AI Raises Concern For Policyholders

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit