Labor & Economy

The Rich Played Santa to Themselves — On Taxpayers' Dime

A record number of billionaires are dodging potential tax increases by taking taxpayer-subsidized Christmas bonuses from companies they control. Their windfall stems from a Bush administration tax loophole known as “qualified dividends.” This scheme, completely legal thanks to Bush-era tax cuts, will expire December 31. It lets some wealthy heirs and other stockholders pay taxes on at less than half the rate you and I pay on wages or interest income.

At least 150 corporations are helping rich shareholders shelter $20 billion in corporate earnings by issuing “special dividends” before year’s end. Additional last minute tax avoidance schemes will cut taxes for other One Percenters, including corporate lawyers and private equity investors.

Edwin Durgy, who monitors “America’s billionaires and how they got that way” for Forbes, identified 10 top tax avoiders who together stand to gain more than $500 million. They are:

- Republican mega-funder Sheldon Adelson, who lost big on his gamble funding the Mitt Romney presidential campaign, is the biggest winner in this tax avoidance sweepstakes. His Las Vegas Sands Corp. is scheduled to hand him more than $1 billion in after-tax dividends on December 18. He will save at least $328 million in taxes.

- Albert Chao, James Chao and Dorothy Jenkins – heirs to the Westlake Chemical Corp. founded by their father – voted themselves dividends providing $49.8 million in tax savings.

- Though “Fun for All, All for Fun” is the Carnival Cruise Lines’ slogan, this holiday season CEO Micky Arison is having fun for himself at our expense. Just before Thanksgiving, he avoided $15.7 million in potential taxes when he netted $47 million on his firm’s special dividend. And this is on top of the huge tax savings Carnival claims by registering its vessels in the Bahamas, Liberia and other tax havens. Click here for a leading maritime lawyer’s review of Arison’s long and colorful tax-dodging history, and here to see what happened when Miami’s 99 Percent took to the streets opposing Carnival’s tax schemes.

- Hospital magnate Thomas Frist Jr.’s HCA holdings plans to borrow $1 billion to fund a special dividend payable before year’s end. His financial health will improve by $40 million.

- Early special dividends are Mmm Mmm Good for the three heirs to the Campbell Soup fortune, Mary Alice Dorrance Malone, Bennett Dorrance and Charlotte Colket Weber, who will save $18 Million.

- Oracle Corporation’s Larry Ellison has computed a different path to the same tax-avoiding result. He will benefit by about $56.5 million from the company’s plan to issue 2013’s dividends in 2012.

- This tax avoidance gold rush began just a few weeks ago, after President Obama won re-election. No surprise here: the “qualified dividends” loophole was one of Romney’s personal favorites. In 2010, he used it to shield $3.3 million in income from full taxation.

This post first appeared on Good Jobs LA‘s The 1% this Week blog and is republished with permission.

-

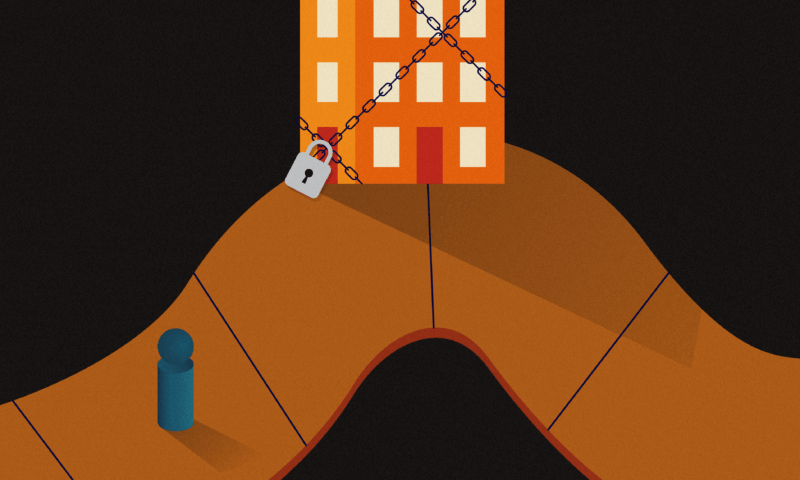

Locked OutDecember 16, 2025

Locked OutDecember 16, 2025This Big L.A. Landlord Turned Away People Seeking Section 8 Housing

-

Locked OutDecember 23, 2025

Locked OutDecember 23, 2025Section 8 Housing Assistance in Jeopardy From Proposed Cuts and Restrictions

-

The SlickDecember 19, 2025

The SlickDecember 19, 2025‘The Poor Are in a Very Bad State’: Climate Change Accelerates California’s Cost-of-Living Crisis

-

Locked OutDecember 17, 2025

Locked OutDecember 17, 2025Credit History Remains an Obstacle for Section 8 Tenants, Despite Anti-Discrimination Law

-

Latest NewsDecember 22, 2025

Latest NewsDecember 22, 2025Trump’s War on ICE-Fearing Catholics

-

Column - State of InequalityDecember 18, 2025

Column - State of InequalityDecember 18, 2025Beyond Hollywood, Rob Reiner Created Opportunity for Young Children Out of a Massive Health Crisis

-

Striking BackDecember 17, 2025

Striking BackDecember 17, 2025‘There’s Power in Numbers’

-

Column - State of InequalityDecember 24, 2025

Column - State of InequalityDecember 24, 2025Where Will Gov. Newsom’s Evolution on Health Care Leave Californians?