For all the right reasons, the conversation about the Donald Trump-led budget reconciliation centers on massive Medicaid funding reductions and the long-term damage they’ll do to public health. With some 15 million Californians relying on Medi-Cal, the state’s version of Medicaid, to see a doctor, that’s no thought exercise — it’s an emergency. The misery hasn’t arrived yet, but it already feels real.

There is another program, though, that is in more immediate danger of losing its punch. Without an extension of federal subsidies that are scheduled to expire this year, people who shop on the Covered California exchange for their health insurance are going to absorb premium rate hikes in the painful-to-impossible range — 75%, by one estimate.

And they are going to leave the exchange, possibly by the hundreds of thousands.

And our state will become sicker — and poorer — for it. Covered California, imperfect though it is, keeps people in health plans on at least somewhat affordable terms, when their situations otherwise might preclude that and force them into mostly awful choices.

How would I know? I was once one of them.

* * *

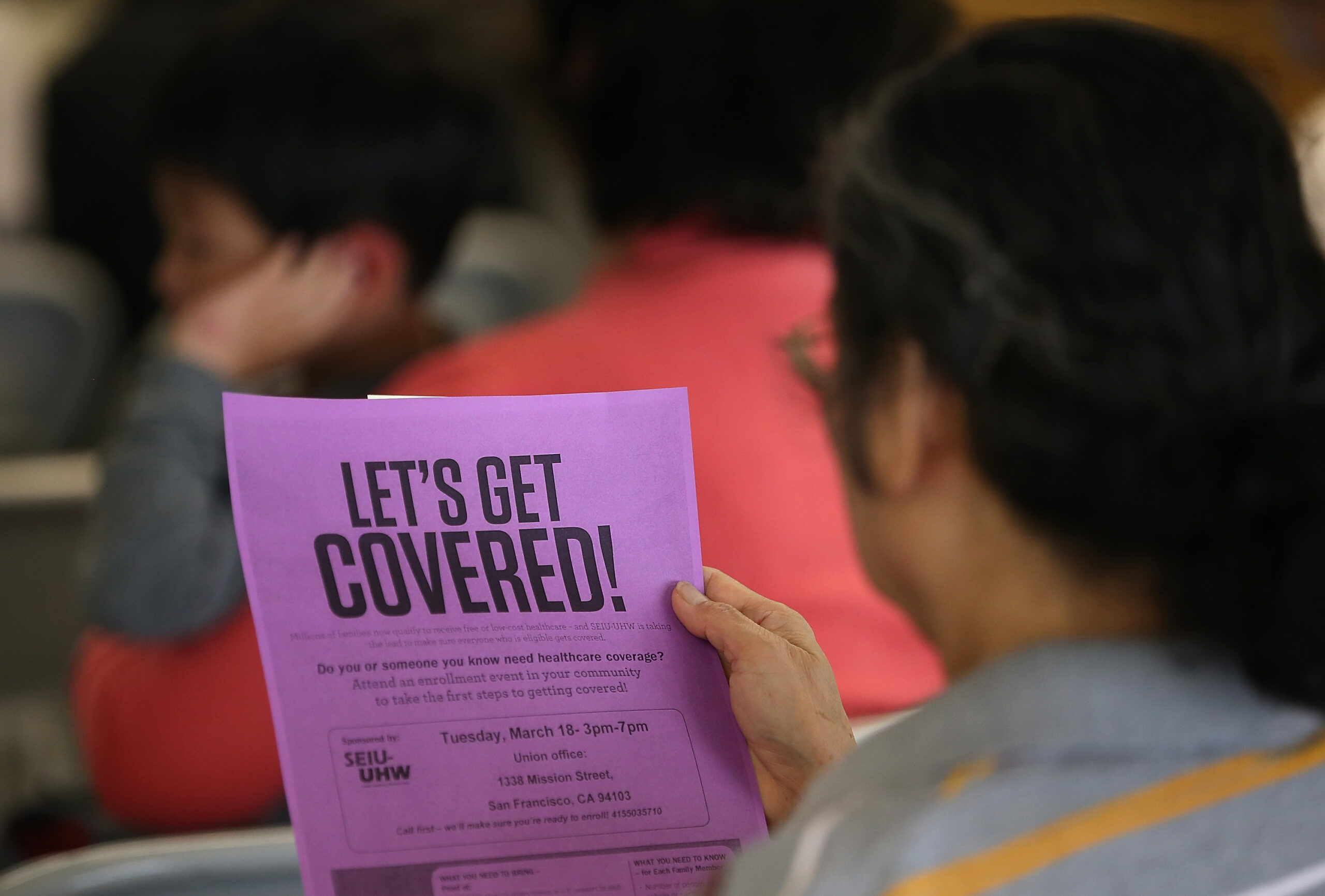

Rolled out in 2014 as part of the Affordable Care Act, Covered California — or Covered CA, as it’s commonly known — is an exchange through which people can buy health insurance when they don’t qualify for Medi-Cal, or work at a place that doesn’t offer health care, or work on their own in the gig economy.

Considering that 90% of California’s private businesses have fewer than 20 employees, this matters. Establishments don’t have to offer health insurance in this state unless they have the equivalent of 50 or more full-time employees. That’s one of several reasons Covered CA’s enrollment reached nearly 2 million early this year, including more than 345,000 new sign-ups in the last open enrollment period alone.

In all, Covered CA officials estimate that more than 6.3 million Californians have had marketplace coverage since 2014 — the precise goal of the Obama administration when it included the health exchange in the Affordable Care Act, which Congress passed in 2010.

Covered CA fills more than one niche, but it’s especially important for those who can’t otherwise afford health care because they aren’t eligible for Medi-Cal. Let’s look at that for a moment. If you work part-time hours — say, 30 a week — in California and are paid the rock-bottom hourly state minimum of $16.50, you still earn way too much to qualify for Medi-Cal, whose annual income threshold for a single person is $21,597. That’s even though your wages are levels below what you actually need to afford the basics of living in California. Medi-Cal is an absolutely critical service in the state, but its eligibility restrictions are real.

Further, as Covered CA’s executive director told the Los Angeles Times, a quarter of the people who use the exchange are sole proprietors. “That’s everything from mom-and-pop Etsy shops to a consultant [to] a highly educated tech worker in San Francisco doing contract work,” said the director, Jessica Altman. “We really have that full spectrum.”

* * *

For a while, that included me. When a corporate job ended a few years ago and I became an independent contractor, I nervously shopped for a family health policy. After a terrifying tour through the insurance sites, I landed on Covered CA and eventually found a major-carrier policy at a price that, while painful, didn’t threaten to bankrupt anyone.

The reason? Those federal subsidies — and especially the enhanced subsidies that took effect in 2021 as part of the American Rescue Plan and were renewed through 2025 as part of the Inflation Reduction Act.

The federal money dramatically lowers the monthly premiums for the health policies purchased on the exchange, not just in California but for nearly 24 million Americans. The funds, technically tax credits, generally get paid directly to the insurers — so yes, those mega-corporations still collect their whopper premiums, an apparent incentive for them to participate on the exchange. But every subsidy dollar is also a dollar less that a struggling person or family has to pay. It all depends upon income levels — as you earn more, your subsidy shrinks — but in California, nearly 90% of Covered CA users receive at least some discount on their premiums.

The program has grown because it helps. No one who’s registered through its website will tell you it’s an effortless process, but it does work to put people and families into health plans. Covered CA officials say the federal subsidies have helped create four straight years of enrollment growth, as well as a reduction in California’s uninsured rate to 6.4% by 2023. When the program launched in 2014, that rate was 17.2%.

Despite the program’s success, the GOP’s giant spending and tax bill makes no provision for extending the subsidies. Without further action by Congress between now and the end of the year (and let’s call that doubtful), premium payments on the exchange will rise by an average of over 75%, according to the health policy and research group KFF.

* * *

In California, that will lead to an estimated 660,000 people either dropping off Covered CA because of the cost or being stripped of the right to use it, the program’s officials told me this week. In addition to not extending the subsidies, the GOP’s budget reconciliation adds layers of red tape for those participating on the exchange, shortens the enrollment period and denies access to a bunch of groups that used to be eligible. That list includes lawfully present immigrants such as those with work and student visas, asylees and victims of trafficking.

State officials have attempted to keep users’ costs down by eliminating deductibles on several of Covered CA’s mid-level “silver” plans, the most commonly selected. (On some other plans, the deductible can hit an eye-watering $11,600 for a family.) Beyond that, the state has allotted $190 million in one-time additional funding to help offset the looming cuts.

Those measures help, but they don’t compare with the impact of the federal enhancements that have made it possible for millions of Californians to access health care over the past several years. The potential shrinking of Covered CA and its benefits puts more people at risk, pure and simple. There is absolutely no good to come of it.

Copyright 2025 Capital & Main

Locked OutDecember 23, 2025

Locked OutDecember 23, 2025

The SlickDecember 19, 2025

The SlickDecember 19, 2025

Locked OutDecember 17, 2025

Locked OutDecember 17, 2025

Latest NewsDecember 22, 2025

Latest NewsDecember 22, 2025

Column - State of InequalityDecember 18, 2025

Column - State of InequalityDecember 18, 2025

Striking BackDecember 17, 2025

Striking BackDecember 17, 2025

Column - State of InequalityDecember 24, 2025

Column - State of InequalityDecember 24, 2025

Latest NewsDecember 29, 2025

Latest NewsDecember 29, 2025