Labor & Economy

The Elephant in the Room — Raising the Gas Tax

We all want safe roads and bridges—free of debris, potholes and cracks. How do we intend to pay for this? (Insert the sound of crickets here.)

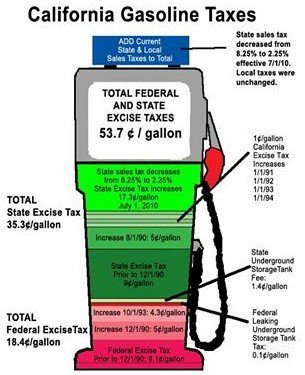

Our roads and bridges don’t actually pay for themselves. Currently, the state and the federal government collect $.357 (set to increase to $.360 on July 1) and $.182, respectively, from every gallon of gas we purchase to pay for road maintenance, modernization and new facilities. However, the pot of money that goes towards building and maintaining our roads and bridges has gotten smaller and smaller over the last three decades for several reasons:

1. Cars have become more fuel efficient

The U.S. Environmental Protection Agency (EPA) has continued to set higher standards for auto manufacturers to improve the fuel efficiency of cars. Over the last decade, in part due to CAFE (Corporate Average Fuel Economy) standards, auto manufacturers have unveiled more attractive hybrid and alternative-fuel vehicles, making it much easier to choose between an SUV and a Prius. High gas prices have also led to Americans making wiser choices when purchasing a new car.

2. People are driving less

Over the last 20 years, the U.S economy has experienced high levels of volatility, in addition to geopolitical conflict that directly affects how oil is extracted (think Middle East). The Great Recession had a significant impact on fuel tax revenues due to the twin problems of high unemployment and high gas prices. The yo-yo effect of gas prices has forced many Americans to explore other modes of transportation for work or play – bicycles, public transit and even walking!

3. The federal fuel tax has not seen an increase in 1993, and is not indexed to inflation.

Imagine walking to a convenience store in 2012 and paying 1993 prices for a chocolate bar. Sounds like a real bargain, right?

Which leads us to our current dilemma: How do we fix this?

The recently approved 2012-2035 Regional Transportation Plan/Sustainable Cities Strategy (RTP/SCS), released by the Southern California Council of Governments, has proposed a new and innovative way to address our dire funding situation. The RTP/SCS looks to the VMT (Vehicle Miles Traveled) as a more appropriate method of determining the real cost of using and maintaining our roads and bridges. Since excise fuel taxes are just another name for user fees, the more you drive, the more you should pay, right? But this requires the state legislature and our local elected officials to be more proactive and think outside the box.

Raising gasoline taxes is considered a serious political risk at a time when gas prices remain high and our economy remains sluggish. However, we are taking a bigger economic risk by not having drivers pay for the real cost of driving. Because fuel taxes have not been raised, the only thing we’ve managed to do is rack up more debt. Currently, the feds are diverting general fund revenues in order to close the funding gap. This is putting pressure on other essential services and programs funded by the federal government. According to the Congressional Budget Office (CBO), a 25-cent increase in gas taxes would cut the federal deficit by more than $291 billion over the next 10 years. Republicans, are you listening? Now that would make a dent in our federal deficit.

Where does the money go? Here’s a handy diagram that breaks it down

-

Latest NewsDecember 10, 2025

Latest NewsDecember 10, 2025Capital & Main, L.A. Times Win Sidney Award for Reporting on Child Farmworkers

-

StrandedDecember 9, 2025

StrandedDecember 9, 2025Giving Up on the Dream: Asylum Seekers Try Other Options in Mexico

-

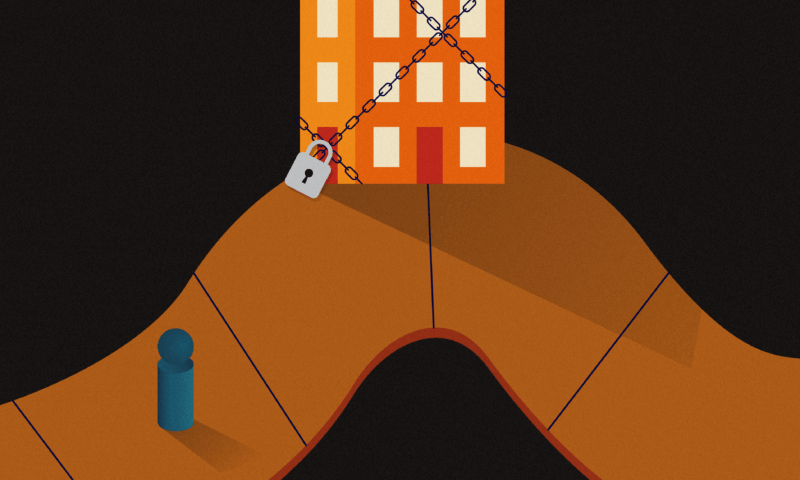

Locked OutDecember 16, 2025

Locked OutDecember 16, 2025This Big L.A. Landlord Turned Away People Seeking Section 8 Housing

-

Column - California UncoveredDecember 12, 2025

Column - California UncoveredDecember 12, 2025They Power the U.S. Economy, But Will Struggle to Afford Health Care

-

The SlickDecember 19, 2025

The SlickDecember 19, 2025‘The Poor Are in a Very Bad State’: Climate Change Accelerates California’s Cost-of-Living Crisis

-

Locked OutDecember 23, 2025

Locked OutDecember 23, 2025Section 8 Housing Assistance in Jeopardy From Proposed Cuts and Restrictions

-

Column - State of InequalityDecember 11, 2025

Column - State of InequalityDecember 11, 2025A Little Place Called Home?

-

Locked OutDecember 17, 2025

Locked OutDecember 17, 2025Credit History Remains an Obstacle for Section 8 Tenants, Despite Anti-Discrimination Law