Labor & Economy

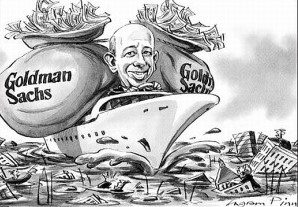

Tricking Taxpayers and Truck Drivers: Goldman Sachs Brings Wall Street to the Waterfront

What’s fueling the ire behind the Occupy Wall Street protests that have spread from Manhattan’s financial district to cities in every state of the country and around the world? For starters, a certain corporation that 99 percent of us bailed out received $23 billion from the government but only paid one percent of its 2008 income in taxes after raking in $2.3 billion in profit.

And a new Salon.com story by Andrew Leonard, “Employers’ New Ruse: ‘Independent Contracting,” may help expose another master scheme in which Lloyd Blankfein and Goldman Sachs’ tax-avoidance maneuvering runs amok, only this time, the industry they’re manipulating isn’t banking – it’s global shipping transportation and the tens of thousands of port truck drivers that keep our economy moving.

Salon.com tells the story of Leonardo Mejia, a truck driver for Shipper’s Transport Express, a subsidiary of the massive container terminal operator SSA Marine. Mr. Mejia is one of the nation’s port truck drivers whose employer treats them, for tax purposes, as the boss – even as they boss them around just like the rest of America’s employees. In other words, his company simply hands him a 1099 rather than a W-2, and voila! – bye-bye pesky payroll taxes and business expenses.

Misclassification, as it’s more wonkily known in Department of Labor and union parlance, cost the U.S. government an estimated $54 billion in underreported employment taxes, according to a 2009 report by the Treasury Inspector General for Tax Administration.

What the story doesn’t report, is that Goldman Sachs owns half of the global supply chain giant that Mr. Mejia hauls for, one of the world’s largest transportation and shipping outfits in the U.S. – and the entire planet.

Home foreclosures aren’t enough, apparently. U.S. port truck drivers like Mr. Mejia are facing “foreclosures on wheels” at the hands of Goldman Sachs-owned SSA Marine. Here’s a snippet:

Mejia is part of the shadow economy…purposefully created from the top down, its growth driven by employers increasingly eager to shed costly, legally mandated commitments to their employees.

On an economy-wide scale, the calculated misclassification of employees as independent contractors is a nightmare for workers. It removes the normal protections employers are legally required to give their employees without offering any real freedom in exchange. The practice is also a disaster for governments struggling to balance their budgets, depriving both federal and state governments of billions of dollars in tax revenue.

“It’s a great scheme. The boss pretends their employee is his or her own boss to skirt taxes and force business costs onto the workers, and then the real boss bosses that worker around just like every other employer,” said Dr. David Bensman of Rutgers University, a co-author of a groundbreaking research report, The Big Rig: Poverty, Pollution and the Misclassification of Truck Drivers at America’s Ports, which concluded the typical port truck driver is truly an employee.

“Gaming the system, Goldman Sachs’ Wall Street style is not welcome at our trade hubs, one of the state’s most valuable economic engines,” wrote California Assemblymember Sandre` Swanson in an Oakland Tribune editorial. “World-class ports are vital to our economic progress. We cannot permit Wall Street-style trickery to stand in our way.”

And if you’re a part of the 99% that’s fed up with Goldman Sachs anti-worker, tax-avoidance games at our country’s ports then sign your name to the growing list of Americans who are doing something about it.

This article was also posted on www.cleanandsafeports.org.

-

Column - State of InequalityJanuary 22, 2026

Column - State of InequalityJanuary 22, 2026On Eve of Strike, Kaiser Nurses Sound Alarm on Patient Care

-

The SlickJanuary 20, 2026

The SlickJanuary 20, 2026The Rio Grande Was Once an Inviting River. It’s Now a Militarized Border.

-

Latest NewsJanuary 21, 2026

Latest NewsJanuary 21, 2026Honduran Grandfather Who Died in ICE Custody Told Family He’d Felt Ill For Weeks

-

Latest NewsJanuary 22, 2026

Latest NewsJanuary 22, 2026‘A Fraudulent Scheme’: New Mexico Sues Texas Oil Companies for Walking Away From Their Leaking Wells

-

The SlickJanuary 23, 2026

The SlickJanuary 23, 2026Yes, the Energy Transition Is Coming. But ‘Probably Not’ in Our Lifetime.

-

The SlickJanuary 27, 2026

The SlickJanuary 27, 2026The One Big Beautiful Prediction: The Energy Transition Is Still Alive

-

Column - State of InequalityJanuary 29, 2026

Column - State of InequalityJanuary 29, 2026Are California’s Billionaires Crying Wolf?

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas