Education

Students Graduate into Debt

“Work hard. Get good grades. Go to a good school and you will be successful.” Our generation has been told time and again that through hard work and dedication, we will be able to live happy lives, have secure jobs, and start families built on comfortable finances. But on the day of action around student debt, it [was] clear we need more than these easy answers to help Millennials cope with the growing burden of education costs.

I come from a middle class family. Both of my parents served in the Marine Corps and got good jobs. My father works in law enforcement, and my mother is a teacher. They taught me that if I put in hard work, I would reap the results. So, I graduated at the top of my class in high school and went to a top (public) university. I worked all four years of college and graduated on time. Two days after graduation I started working at a good job.

By all measures, I did everything “by the book.” I even saved up some money to make early down payments on the student loans that I accrued during school. Over the past four months, I have paid off more than was required by law, and currently I am paying more on the principal than on the interest. One would think that I would be in pretty good shape.

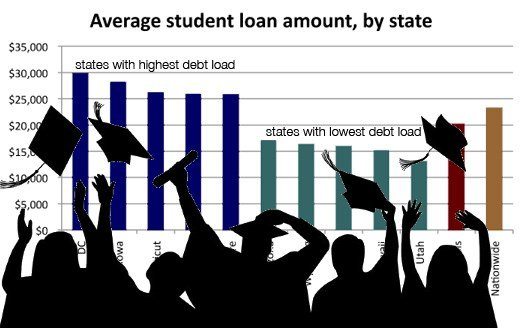

But with $26,000 in debt, only slightly above average, I will still be making these payments for the next decade of my life. They will be as regular as my electric bill and rent. They will be considered before I think about how and when to start my family or buy a house.

I am one of the lucky ones: employed with enough spare cash to make student loan payments. So many other recent college graduates are not in the same position.

Student loan debt is one of the biggest economic and social justice issues this nation faces today. An entire generation of young, educated workers is being saddled with financial burdens that will follow them for the foreseeable future.

Recognizing this, the Roosevelt Institute | Campus Network joined with the United States Student Association to make proactive recommendations for addressing the student loan debt crisis. Our report, A New Deal for Students, offers policies by students and for students, past and present.

In this report, students outline their arguments for a better system for financing higher education. Policy recommendations range from tax incentives for students committed to staying in their home states to raising the federal minimum range to supporting new graduates to teach in rural areas.

What we want is a real debate and, above all else, action by our lawmakers on this critical financial issue affecting millions of young Americans.

(Joelle Gamble is the Roosevelt Institute | Campus Network’s National Field Strategist. Her post first appeared on the institute’s ND2.0 blog and is republished with permission.)

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Dirty MoneyJanuary 30, 2026

Dirty MoneyJanuary 30, 2026Amid Climate Crisis, Insurers’ Increased Use of AI Raises Concern For Policyholders

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit

-

The SlickFebruary 10, 2026

The SlickFebruary 10, 2026New Mexico Again Debates Greenhouse Gas Reductions as Snow Melts

-

Latest NewsFebruary 12, 2026

Latest NewsFebruary 12, 2026Trump Administration ‘Wanted to Use Us as a Trophy,’ Says School Board Member Arrested Over Church Protest