Labor & Economy

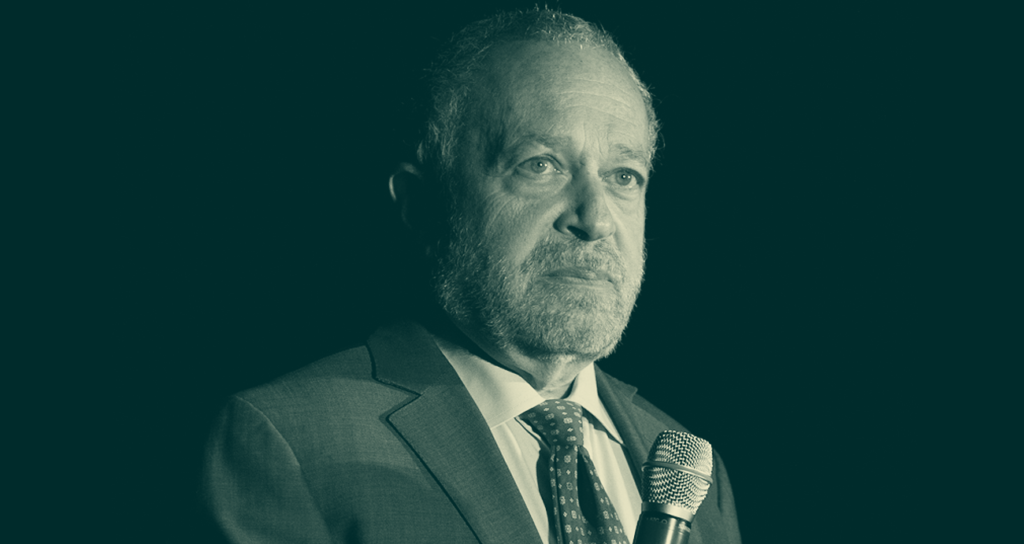

Robert Reich on Trump’s ‘Dangerous Tax Bill’

“All of this rhetoric about a middle-class tax cut,” Robert Reich tells Capital & Main, “is just an absurd lie when you look at the numbers.”

In little more than six months the Republican-proposed tax bill has grown from a one-page White House press release promising financial relief for middle-class Americans to a colossal amoeba containing everything from massive corporate tax cuts to the repeal of Obamacare. Capital & Main’s Jessica Goodheart recently spoke to economist Robert Reich for part of an upcoming series on corporate responsibility. During Goodheart’s interview, Reich spoke about the current tax proposal that many experts see as a dire threat to the very households its sponsors are pledging to protect. Reich’s comments are excerpted below.

Jessica Goodheart: Do you think that reform-minded CEOs are taking any risks?

Robert Reich: If CEOs were really courageous . . . they would be speaking out right now against the shortsighted and dangerous tax bill that is coming through Congress, even though their own corporations might benefit. Over the long term, everyone will lose.

Some have suggested that the anti-free trade, nationalist movement that Donald Trump represents at home might place pressure on corporate leaders to address the widening wealth and income gap. Do you see that as a possibility?

Reich: Some leading corporations could decide to support specific public policies and reduce inequality, such as higher minimum wages, a bigger earned income tax credit, maybe even a universal basic income. They’re not going to do it individually, as companies, but they might come together and act politically, and lend their political clout to this kind of legislation.

What do you think the prospects for that are right now?

Reich: It’s hard to say. The Republican Party is split between its corporate and Wall Street wing, and its Steve Bannon/nationalist/Trump wing. For the time being, those two wings have come together around getting tax cuts for the corporate, Wall Street wing. What will the Bannon/nationalist/Trump wing want in return? Will they be satisfied with Trump’s tweets and nationalist tantrums? I don’t know.

What role are corporations playing in tax reform efforts, both visible and not visible, to the public?

Reich: Well, most of it’s invisible. Right now, there are lobbyists swarming over Capitol Hill, trying to get the largest tax breaks they possibly can for their companies and industries. You have large business groups like the Chamber of Commerce, Business Roundtable and others who are trying to keep the direction of the bill going in very large tax breaks for corporations, overall.

What the public sees and hears is just the talking points that Republican leaders have put out there in order to mollify the public, and to disguise what’s really going on. All of this rhetoric about a middle-class tax cut is just an absurd lie when you look at the numbers. I mean, the longer this goes on, the more likely it is that most Americans will discover the truth — which is why the Republican leadership wants to move quickly, and get this done before Christmas.

On Monday, Trump tweeted a request that the repeal of the Obamacare health insurance mandate be included in the tax reform proposal. How would that impact Americans, and how do you think it affects the prospect of the bill’s passage?

Reich: The removal of the health mandate would cause four million Americans to lose coverage in the first year, 13 million by 2027, according to the nonpartisan Congressional Budget Office. I don’t see how Senators Susan Collins, Lisa Murkowski and John McCain — who voted against repeal of the Affordable Care Act — could possibly vote for the tax bill with this poison pill inside it.

Yesterday, Trump economic adviser Gary Cohn received a tepid response after asking CEOs at a Wall Street Journal conference whether the tax reform bill would cause them to spend more on growth. Does that surprise you?

Reich: It doesn’t surprise me, because American corporations are flush with cash. If they wanted to invest more in growth, they could have done so already. They’re using their profits to buy back their shares of stock, and pad executive pay. That’s what they’ll do with even more profits that come their way because of the tax cut.

Copyright Capital & Main

-

The SlickJanuary 23, 2026

The SlickJanuary 23, 2026Yes, the Energy Transition Is Coming. But ‘Probably Not’ in Our Lifetime.

-

The SlickJanuary 27, 2026

The SlickJanuary 27, 2026The One Big Beautiful Prediction: The Energy Transition Is Still Alive

-

Column - State of InequalityJanuary 29, 2026

Column - State of InequalityJanuary 29, 2026Are California’s Billionaires Crying Wolf?

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Dirty MoneyJanuary 30, 2026

Dirty MoneyJanuary 30, 2026Amid Climate Crisis, Insurers’ Increased Use of AI Raises Concern For Policyholders

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care