Feet to the Fire

New Mexico’s Hydrogen Plans in Turmoil; Newsom Focuses on Oil Wells

California closes loopholes on polluting wells, but still lets companies avoid capping idled wells.

Welcome to “Feet to the Fire: Big Oil and the Climate Crisis,” a biweekly newsletter in which we share our latest reporting on how the fossil fuel industry is driving climate change and influencing climate policy in five of the nation’s most important oil-and-gas-producing states. In addition, we shine a spotlight on the financing of the fossil fuel industry, holding banks and other financial institutions accountable for their role and providing you with updates on their activities.

Click here to subscribe to the newsletter in Substack.

New Mexico’s ambitions for hydrogen production in the state experienced a roller-coaster ride, with a panel recommending money for such projects, the federal government rejecting a state-led regional hydrogen hub proposal, and a state agency releasing an optimistic outlook for the carbon sequestration needed for hydrogen production. Amid all the whiplash, Gov. Michelle Lujan Grisham recently flew to Australia with an oil and gas lobbyist and the head of a natural gas industry group to speak at a hydrogen conference. At the Asia-Pacific Hydrogen 2023 Summit, the governor’s office announced that Australian company Star Scientific had pledged to build a research and manufacturing facility in Albuquerque, though it did not respond to Capital & Main’s request for a copy of the agreement in time for publication, reports The Slick’s Jerry Redfern.

California Gov. Gavin Newsom made headlines by signing a law that aims to close loopholes that have long allowed oil drillers to walk away from abandoned and orphaned wells — those that often emit harmful pollutants into the air — without sealing them off. Now buyers of wells will be required to put up a cleanup bond before the sale is approved. But the Orphan Well Prevention Act does little to deal with idled wells — unplugged but still claimed by an operator — that remain dormant but leak climate-warming methane and toxic fumes. For a fee of a few hundred dollars a year paid to the state, drillers can leave such wells uncapped, putting low-income communities at risk of pollution. “Lawmakers should build on this momentum and pass a bill that attacks the root of the problem by forcing the oil industry to clean up all its wells instead of pushing that burden onto California taxpayers or allowing wells to leak dangerous air pollution for decades,” Kassie Siegel, director of the Center for Biological Diversity’s Climate Law Institute, told The Slick’s Aaron Cantú.

Banks Plowed $150B Into Energy Giants Whose “Carbon Bomb” Projects Threaten the Planet

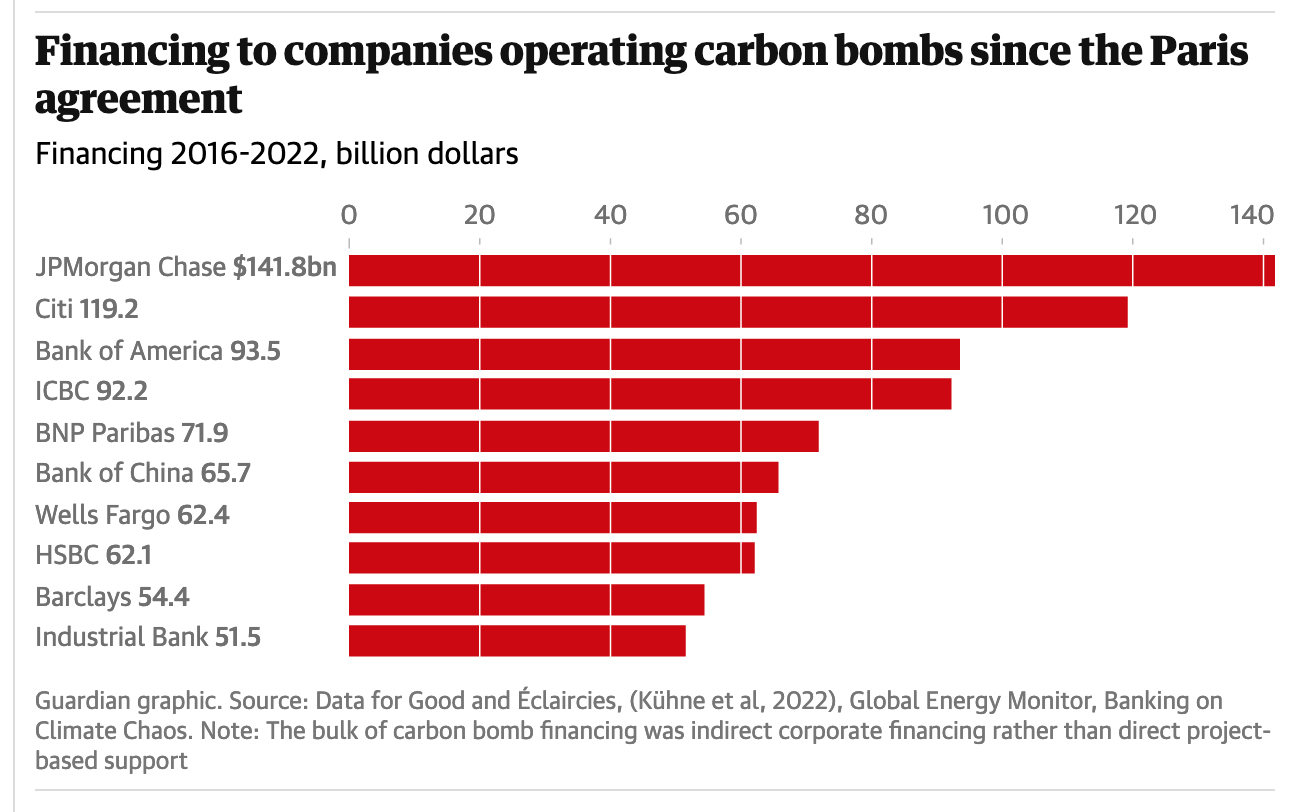

The world’s biggest banks, including JPMorgan Chase, Citibank, Bank of America and Wells Fargo, gave more than $150 billion in financing last year to companies running “carbon bomb” projects — fossil fuel extraction operations that each emit more than one gigaton of carbon dioxide into the atmosphere, The Guardian reports.

The projects, totaling 425 around the globe, are the single biggest sources of fuels that emit greenhouse gases when burned, and were first identified in 2022 and later mapped by French nonprofits Data for Good and Éclaircies. Between 2016 and 2022, banks gave $1.8 trillion in financing to companies running such “carbon bombs.” In response, a spokesperson for JPMorgan told The Guardian: “We are taking pragmatic steps to meet our 2030 emission intensity reduction targets in the six sectors that account for the majority of global emissions, while helping the world meet its energy needs securely and affordably.”

Ending Subsidies for Foreign Fossil Fuel Projects Is on the Horizon for U.K. and EU

The European Union and the United Kingdom are close to finalizing proposals to end subsidies for foreign oil and gas and coal projects, and plan to discuss those plans at a closed-door meeting of the Organisation for Economic Co-operation and Development (OECD) in France this month. Between 2018 and 2020, OECD countries’ export credit agencies spent $41 billion annually to support fossil fuel projects around the globe, reports the Financial Times.

In the wake of the report, a coalition of climate groups — including Oil Change International, Climate Action California and Friends of the Earth — published an open letter urging countries that pledged at the United Nations COP26 climate summit in Glasgow to cut off such subsidies to follow through on those promises. In the letter, the coalition wrote: “Ending OECD oil and gas support is critical to limit global heating to 1.5° C. … And yet, the OECD export credit agencies (ECAs) currently provide five times as much financing for fossil fuels as for clean energy every year.”

Oil Refiners Are Having a Harder Time Getting Access to Financing, Warn Energy Execs

“If you have the word ‘refinery’ anywhere in your title, you’re not going to get finance,” Alwyn Bowden, the CEO of Malaysia’s Pengerang Energy Complex told the Asian Downstream Summit in Singapore, describing the challenges facing his peers. Despite a recent spike in demand for crude oil, banks are increasingly avoiding such financing and are pressuring plant owners to show that they are making gains toward their net-zero emissions goals. As a result, the refining system is being squeezed and is at risk of price volatility.

African Oil Players Look Beyond Global Banks for Sources of Financing

Given energy poverty in Africa and the Ukraine war making clear the relevance of a secure energy supply, participants at this year’s Africa Oil Week had a clear message: “The continent must fully develop its abundant oil and gas resources,” wrote analysts at Wood Mackenzie consulting firm. With major banks pulling back from fossil fuel financing, African energy producers need to look for innovative sources of finance lending from African-focused banks, traders who offer production-based financing by underwriting debt, and support from multilateral lenders and development institutions such as the African Export-Import Bank.

New Tool Could Make It Easier to Assess Banks’ Exposure to Climate Risk

A new tool could make it easier to assess financial institutions based on their exposure to climate-related risk. Once a certain loan-to-value threshold is reached, based on the amount of fossil fuel production that is financed by the bank, the tool would trigger a capital surcharge. The tool, developed by consumer group Finance Watch, is similar to those used in the real estate market to improve the accuracy of determining the probability of default on loan repayments. The group’s last proposal, a one-for-one rule that would require banks and insurers to hold one euro for every euro used to finance new fossil fuel production, was rejected by European financial institutions. “Producing biased analyses that underestimate future costs is no longer an option. Adapt economic models or they’ll undermine both climate change mitigation and adaptation,” says Thierry Philipponnat, chief economist at Finance Watch.

Copyright 2023 Capital & Main

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit

-

The SlickFebruary 10, 2026

The SlickFebruary 10, 2026New Mexico Again Debates Greenhouse Gas Reductions as Snow Melts

-

Latest NewsFebruary 12, 2026

Latest NewsFebruary 12, 2026Trump Administration ‘Wanted to Use Us as a Trophy,’ Says School Board Member Arrested Over Church Protest

-

Latest NewsFebruary 10, 2026

Latest NewsFebruary 10, 2026Louisiana Bets Big on ‘Blue Ammonia.’ Communities Along Cancer Alley Brace for the Cost.

-

Column - State of InequalityFebruary 12, 2026

Column - State of InequalityFebruary 12, 2026They’re Organizing to Stop the Next Assault on Immigrant Families

-

The SlickFebruary 16, 2026

The SlickFebruary 16, 2026Pennsylvania Spent Big on a ‘Petrochemical Renaissance.’ It Never Arrived.

-

The SlickFebruary 17, 2026

The SlickFebruary 17, 2026More Lost ‘Horizons’: How New Mexico’s Climate Plan Flamed Out Again