Published on

By

The nation’s largest housing assistance program, Section 8, is a lifeline for tenants across the nation who would otherwise be priced out of expensive housing markets.

Under the program, tenants pay about a third of their income in rent, and the government subsidizes the rest. That’s life-changing in Los Angeles, where a one-bedroom apartment costs about $2,200 per month on average, and rent increases have outpaced wage growth, fueling an affordability crisis.

About 85,000 L.A. County residents rely on the Housing Choice Voucher program, as Section 8 is officially known, to afford their rent. Participants are allowed to live anywhere they choose, provided rents fall within limits set by local housing authorities.

Yet many tenants have difficulty finding landlords who will accept vouchers, even though in California and nearly two dozen other states, it’s illegal for landlords to reject Section 8 applicants solely because they pay rent with government aid. Under a California law that took effect last year, landlords also aren’t allowed to reject voucher holders based solely on their credit history. Instead, they must give them a chance to show pay stubs or other “lawful verifiable alternative evidence” they can pay their share of rent.

But some of the biggest landlords in the Los Angeles area are skirting anti-discrimination laws and turning away people seeking housing under the Section 8 program, a Capital & Main investigation found.

The yearlong investigation used public records, interviews and fair housing tests that included hundreds of inquiries to examine Section 8 voucher acceptance by some of the Los Angeles area’s largest landlords: Equity Residential, AvalonBay Communities, Essex Property Trust, Greystar, Prime Residential, G.H. Palmer Associates and Jamison Properties. While many of these landlords have national footprints, Capital & Main focused its investigation on their Los Angeles County operations.

As part of its reporting, Capital & Main hired and trained testers, who posed as Section 8 voucher holders and contacted leasing agents to ask about apartments listed on company websites.

Agents’ responses to testers’ questions suggested widespread violations of California housing law that would exclude many Section 8 voucher holders. Only one company — Jamison — categorically rejected Section 8 vouchers in many of its buildings.

In a statement, a Jamison spokesperson wrote “the management companies overseeing Jamison’s portfolio accept and welcome tenants utilizing Section 8 vouchers.”

Capital & Main based some of its findings on data collected by hired testers who called, emailed and exchanged text messages with leasing agents at 65 buildings across Los Angeles County in late 2024 and early 2025.

The U.S. Department of Justice, the California Civil Rights Department and nonprofit fair housing organizations have used such testing to ferret out evidence of illegal discrimination, and courts have held that the value the evidence testers provide outweighs the necessary deception in discovering it. Journalism organizations don’t often employ such testing, but when they have, as in a 2019 Newsday investigation of real estate agents, they have brought to light evidence of discrimination that would have otherwise remained unknown to the public. Marin County-based Fair Housing Advocates of Northern California provided training and materials for Capital & Main’s tests.

Capital & Main tested at six to nine buildings owned by each company. Then, after several Jamison agents said their buildings could not accept vouchers, Capital & Main conducted additional tests of its properties to determine how widespread such rejections were. The news organization tested only buildings with rental units priced within the limits set by the housing authorities in their areas. Testers made repeated attempts to understand leasing policies and practices at each building, sometimes reaching out several times to ensure accuracy.

The findings are also drawn from public records requests to local housing authorities for data on how many Section 8 tenants each company had. In all, the news organization reviewed documents obtained under the California Public Records Act from the Housing Authority of the City of Los Angeles, and the Los Angeles County Development Authority, which covers unincorporated L.A. County and 62 cities within the county. Housing authorities in Glendale, Pasadena, Burbank, Santa Monica, Norwalk, Torrance and Long Beach also provided records. Several local housing authorities, including those in Inglewood, Compton, Culver City, Pomona, Hawthorne, Baldwin Park and South Gate declined to provide records, citing privacy concerns, or failed to respond to Capital & Main’s requests.

Capital & Main contacted each company several times to share test results and give each an opportunity to respond to its findings and answer specific questions about its policies.

Here are the results for each company.

Jamison, a group of family-run real estate companies based in L.A.’s Koreatown, was the only landlord whose leasing agents turned away testers posing as Section 8 renters, saying they could not accept their vouchers.

Only one Section 8 tenant moved into a Jamison building between 2021 and 2024, according to documents Capital & Main obtained from the Housing Authority of the City of Los Angeles through a public records request.

Jamison entered the multifamily residential market in 2013 and has since built more than 6,000 residential units with at least 2,500 planned or under construction.

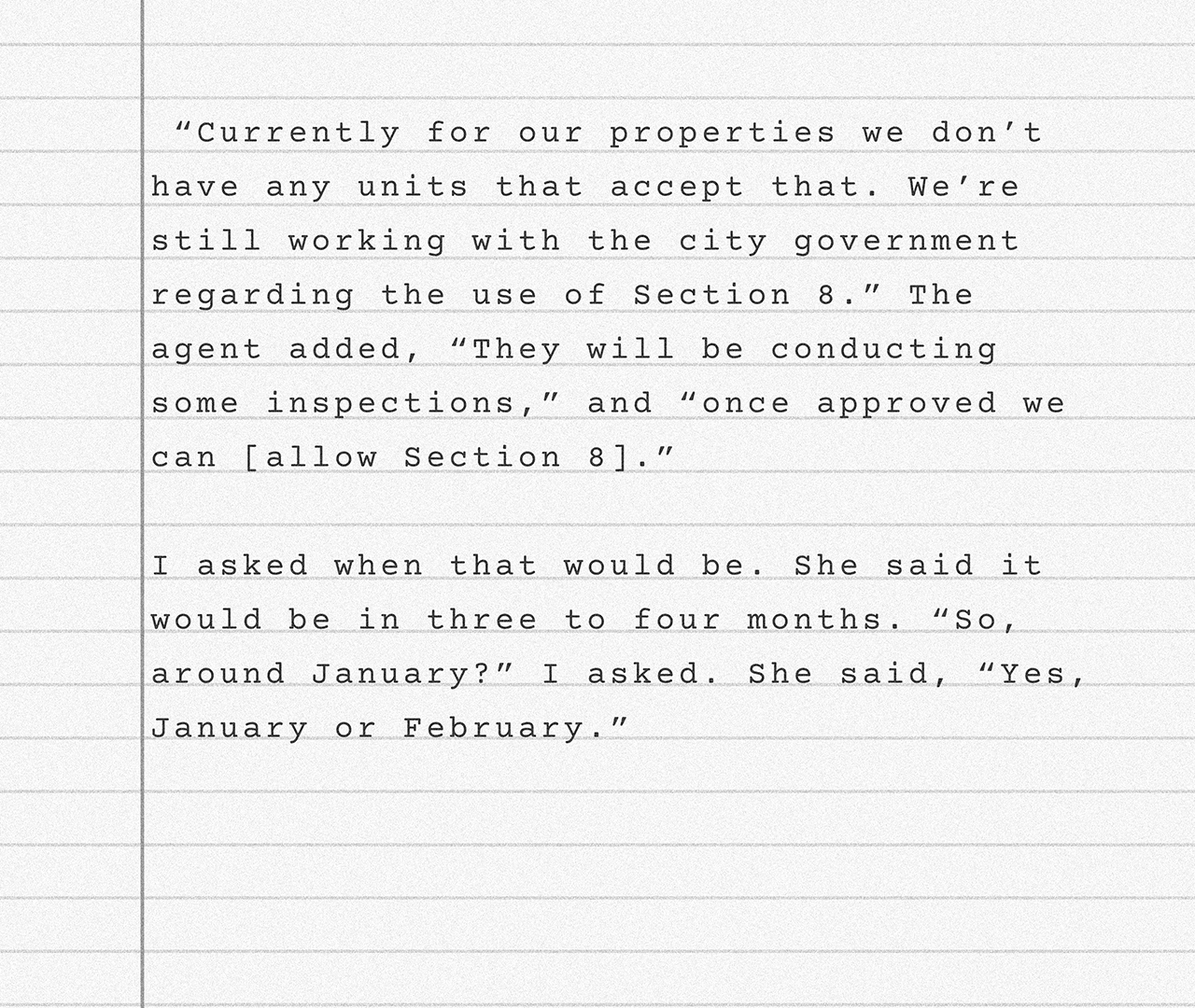

Last fall, leasing agents at some Jamison buildings told testers working for Capital & Main that they were not accepting Section 8 vouchers until they received city approvals. For example, in September 2024 notes taken by a tester show that when she called to ask if the Sienna on Serrano apartments in L.A.’s Koreatown accepted Section 8 vouchers, a leasing agent said:

The leasing agent’s statement was misleading: L.A. housing authority officials said no inspection process is required before a building can accept Section 8 tenants. Housing authorities inspect individual apartments once a Section 8 tenant has selected a unit.

In March 2025, a Capital & Main-hired tester did another round of inquiries about available apartments at 15 Jamison properties. Again, a leasing agent said the company was awaiting city approvals before it could accept Section 8 tenants.

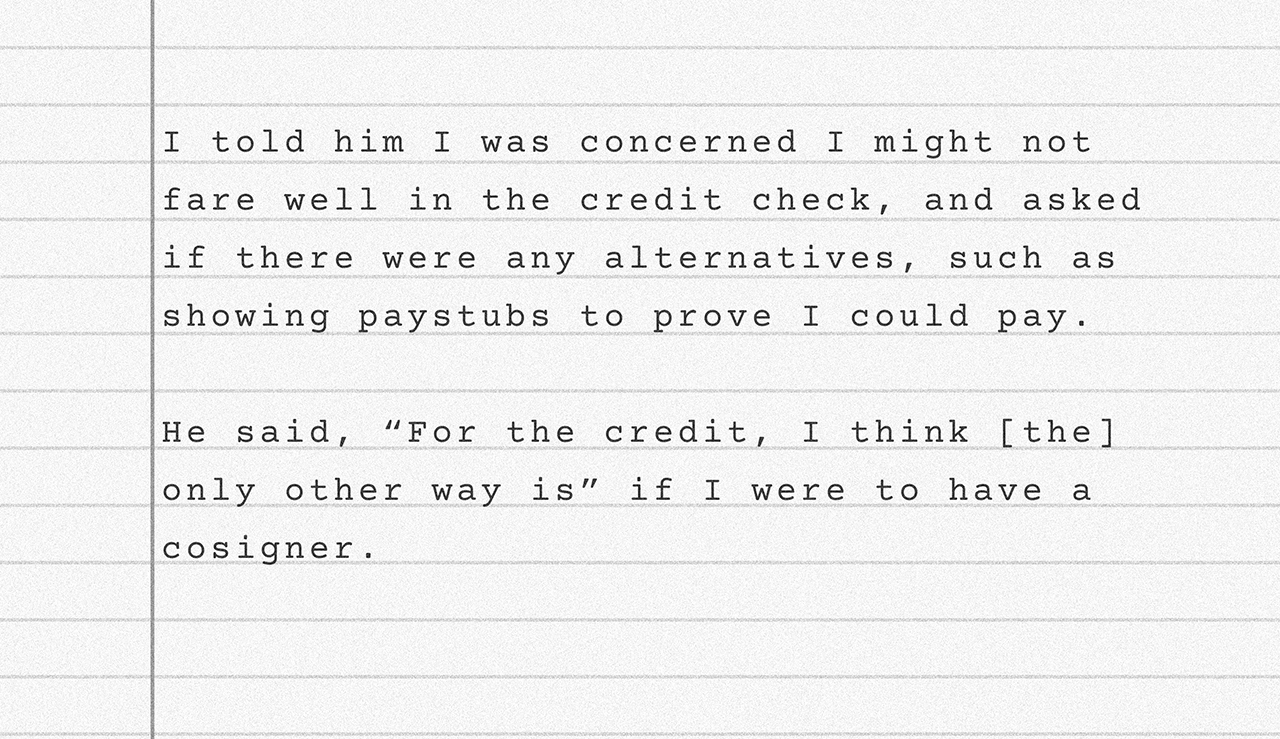

Five other Jamison leasing representatives initially said they accepted vouchers, but two of them didn’t return calls requesting information about income and credit requirements. At three of the those buildings, agents said they would reject Section 8 applicants for poor credit history, even though that’s prohibited under California law. Landlords are required to consider a Section 8 applicant’s pay stubs or proof of government benefits in lieu of credit reports to evaluate their ability to pay.

For instance, a tester who inquired by phone about rentals at the Arden and Sawyer apartments noted the following exchange with a leasing agent:

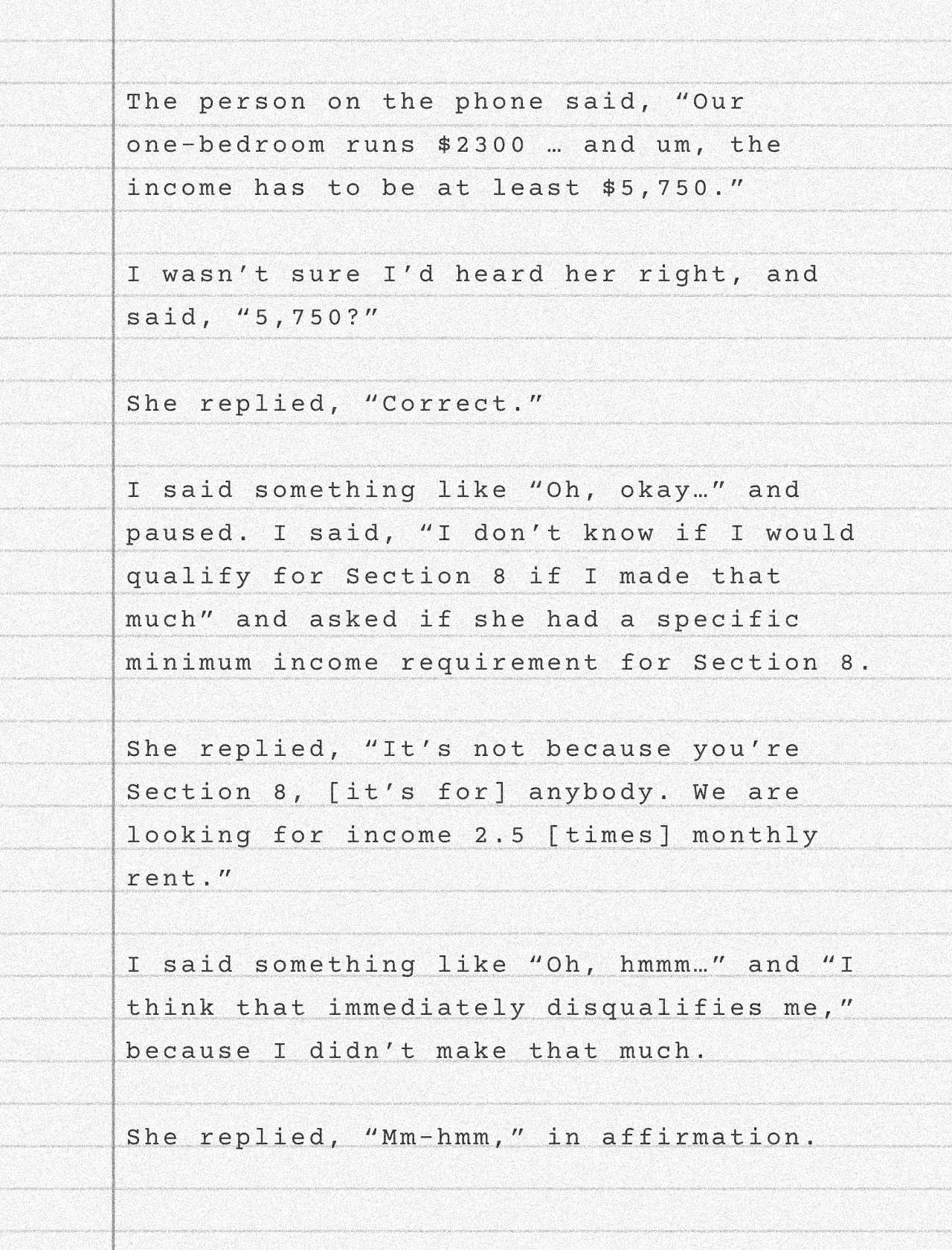

At the Westmore in L.A.’s Koreatown, a tester uncovered another apparent violation of California’s fair housing law. In an April 2025 phone call, a tester’s notes show that a leasing agent described minimum income requirements for Section 8 voucher holders that would be impossible for a Section 8 tenant to meet:

A Jamison spokesperson wrote in a statement that the management companies overseeing the company’s portfolio “take proactive steps, including engaging a broker and nonprofits, to help identify individuals and families who hold vouchers or qualify for income-restricted Affordable Housing units.”

The spokesperson said “It also appears that the tester misunderstood the income requirement stated for Section 8 tenants. The law permits an income requirement based on the tenant’s portion of the rent, not the full rental amount. All property managers overseeing these buildings have rules and procedures in place to comply with all applicable laws.”

Chicago-based Equity Residential owns nearly 15,000 apartments in about 60 properties in the Los Angeles area, its largest market. Its representatives — at eight buildings — said they accept Section 8 vouchers.

But at six of the buildings, agents told testers they wouldn’t consider alternative proof of creditworthiness in lieu of credit checks. For example, in response to a query about the Vantage Hollywood Apartments in Hollywood last September, a leasing representative said in this email exchange with a tester posing as a voucher holder that pay stubs would not be accepted as proof of creditworthiness:

The Vantage Hollywood Apartments agent and five others at Equity misstated the company’s written policy. Its online rental application says the company accepts Section 8 applicants’ pay stubs, proof of government benefits or bank statements to show ability to pay rent. “If you provide us with that documentation, we will use that documentation instead of credit history,” the application says. But even though Equity’s policy is lawful, its agents’ misstatements would violate fair housing law, said Caroline Peattie, executive director of Fair Housing Advocates of Northern California. She noted that prospective renters would likely be deterred from applying after being told their applications would almost certainly be rejected.

Equity first vice president Marty McKenna said in a statement, “We are proud of our record of providing homes for our residents who qualify for Section 8 vouchers in a region where there is a shortage of affordable housing.” McKenna didn’t respond to an interview request or comment on specific test results Capital & Main shared with the company. “We are confident that we are operating by applicable regulations regarding Section 8 vouchers,” McKenna wrote.

The California-based company, whose board of directors includes former California first lady Anne Gust Brown, appeared to comply with fair housing law at five of nine buildings testers queried.

Capital & Main testers contacted leasing representatives at nine Essex properties, all of whom said they accept Section 8 vouchers. But four of them refused to consider Section 8 voucher holders’ pay stubs or other proof of creditworthiness, even though Essex official policy is to accept such evidence in lieu of credit history. At Essex’s Santee Court in downtown Los Angeles, a leasing representative insisted that a tenant would have to pass a credit check nonetheless, according to a tester’s notes:

At the Fountain Park at Playa Vista, an agent said the building would “look at pay stubs and bank statements.” But poor credit, the agent said, would require a “guarantor” — an individual who would take legal responsibility for any unpaid rent.

Essex Property Trust representatives didn’t answer Capital & Main’s questions about their agents’ reliance on credit scores to vet applicants. But a company spokesperson said in a statement, “We have reviewed both our written policy and application process and we are in compliance with the law: all Section 8 applicants are approved based on their ability to pay their portion of the rent, not based on credit score.”

At AvalonBay Communities properties, agents said they accepted Section 8 vouchers, but some representatives of the Arlington, Virginia-based company provided incorrect information about how the program works and described credit requirements that are now prohibited by California law.

At four of the six AvalonBay Communities properties queried, agents said they would reject Section 8 applicants based on credit history. And at one property, representatives didn’t return follow-up calls about credit and income criteria.

Several AvalonBay leasing agents showed a shaky understanding of the Section 8 program, suggesting they have little experience with it. When a tester asked in a phone call last October if there was any alternative way to prove their ability to pay if they failed a credit check, an agent at eaves Los Feliz said no. The credit check was “something we can’t override,” and proving with pay stubs was not an option, the agent said.

In response to a question in a September 2024 phone call about minimum income requirements, an agent at AVA Toluca Hills erroneously responded, “Normally when you have a voucher it’s because you have no income.” (Most Section 8 voucher holders who are able to work do so.) The tester followed up with an email asking “If I failed the credit check, would I be able to prove my ability to pay another way, for example, by showing my check stubs?” The agent responded:

AvalonBay representatives didn’t respond to Capital & Main’s interview requests or written questions.

The San Francisco-based company owns and operates some 20,000 housing units on the West Coast, including the Park La Brea apartments in L.A.’s Miracle Mile, the largest apartment complex west of the Mississippi, with more than 4,000 apartments.

Capital & Main’s hired testers contacted leasing agents at five Prime Residential complexes. All said they accept Section 8 vouchers. At Park La Brea, an agent said in a September 2024 text message that they relied on credit history to screen all applicants:

At four other Prime buildings, leasing agents said they didn’t know if credit history would disqualify Section 8 applicants until after credit and background checks were completed.

Prime Residential declined an interview request, but said in a statement, “We work hard to comply with all applicable state and federal fair housing laws, including seeking alternative evidence of ability to pay rent and never denying Section 8 voucher holders based on credit. As part of our efforts to help people take advantage of rental assistance programs, leasing agents and other staff at our properties receive annual training on relevant laws and Prime policies.”

Charleston, South Carolina-based Greystar is the largest landlord in the U.S. Leasing agents at all nine Greystar buildings contacted by testers said they accepted Section 8 vouchers. But only two agents said they would consider pay stubs, proof of government benefits or other documents as evidence of a voucher holder’s ability to pay rent. Leasing agents at Desmond didn’t return follow-up calls from a tester inquiring about the building’s credit check requirement. The La Plaza Village, built in partnership with the Cesar Chavez Foundation and managed by Greystar, was built to bring homes to “residents who need them most,” according to a 2019 Chavez Foundation news release. A La Plaza agent said the building didn’t require a specific credit score and that applicants could fail credit checks if their records included evictions or money owed to previous landlords. However, the agent said they would not accept a Section 8 applicant’s alternative evidence of creditworthiness, as this tester’s notes of a September 2024 phone call with a leasing staffer show:

At the Eden, in downtown Los Angeles, a leasing agent told a tester in a September 2024 phone call that there was a “waitlist” for Section 8 tenants. However the law prohibits landlords from limiting the number of Section 8 participants in a property. Here’s how the tester recorded it in their notes:

A Greystar representative said in a statement, “We remain committed to fair housing practices and to ensuring that all applicants are evaluated consistently and in accordance with the law.” The company provided Capital & Main a copy of a Greystar rental policy document that it says is given to all applicants. The document explains that “in lieu of a credit report, prospective tenants who use housing subsidies in California can show evidence of ability to pay their portion of rent.” The company’s statement said, “While Section 8 vouchers are distinct from the many other affordable housing programs, we understand that depending on how questions are asked, these programs can sometimes be conflated.”

Geoffrey Palmer, a competitive polo player and a major campaign donor to President Donald Trump, owns G.H. Palmer Associates, based in Beverly Hills. Palmer has built a reputation for hostility toward government housing programs. Nevertheless, his company appeared more welcoming than any other to Section 8 tenants, based on Capital & Main’s test results.

Leasing agents at all seven Palmer properties testers contacted said they accept Section 8 vouchers. They also showed familiarity with the program, and easily answered their questions about minimum income and credit requirements. Still, at one complex, the Riverpark Apartments, a leasing agent said Section 8 applicants could not provide pay stubs in lieu of passing a credit check. In a September 2024 phone call, according to a Capital & Main tester’s notes:

Neither Palmer nor members of the company’s executive team responded to Capital & Main’s written questions or a request to discuss the company’s Section 8 policies.

This reporting was supported by a grant from the Fund for Investigative Journalism.

Annakai Hayakawa Geshlider, Arlen Levy, Jeremy Lindenfeld, Maison Tran, Emily Elena Dugdale and Lita Martinez contributed to this story.

This story is the second in a series.

Part 1: This Big L.A. Landlord Turned Away People Seeking Section 8 Housing

Part 3: Credit History Remains an Obstacle for Section 8 Tenants, Despite Anti-Discrimination Law

Copyright Capital & Main 2025