Labor & Economy

Eyewitness: Working Inside an Inland Empire Warehouse

(This article was reported in partnership with the Investigative Fund of the Nation Institute. It first appeared on The Nation’s website and is republished with permission.)

The call from the temp agency comes in late October. I’ve passed the drug test, cleared the background check, sat down for a quick interview—“Can you lift fifty-pound boxes?”—and completed a worksheet of basic math problems. Now there’s a job. A warehouse just outside the city of Ontario, about forty miles east of Los Angeles, needs more bodies to meet the holiday crush.

They do work for Walmart, Best Buy, “all sorts of big companies,” says the female voice on the line. Orientation starts at 8:15 am; pay is $9 an hour. “Make sure you’re early.” Before hanging up she repeats the order. “Be early.”

On an overcast Tuesday, I pull into the parking lot, fifteen minutes ahead of schedule. Looming to my left is a giant rectangle of windowless cement. At 800,000 square feet, the warehouse is the size of Madison Square Garden, big enough that any misplaced products are as good as lost. I get my picture snapped for an ID badge and join thirty other new hires in the cafeteria. It is a diverse group, evenly divided by gender, mostly Latino but with a fair number of whites and blacks. As we sit, several men swap rumors of better opportunities elsewhere: a warehouse where pay starts at $12 an hour, another with productivity bonuses that can boost hourly wages to $15. But those are direct hire positions, and hard to land. During my job search, each warehouse I visited gave directions to the nearest temp agency.

After waiting twenty minutes, we are ushered into a room upstairs. A woman from the agency hands each of us a time sheet. For the sign-in, she tells us to write 8:30. “I know you were told to be here at 8:15,” she says, anticipating a protest that never comes, “but that was just to make sure you got here early.”

And, like that, fifteen minutes are lopped from our paycheck. It’s a small but important lesson in what it means to be a “flexible” worker. We are not in control here. Shifts may last four hours, eight hours or twelve; start times will bounce around as well. I’m originally hired for a shift that begins at 7 am, but that later moves up an hour, to 8, and then, in a rush to move goods out the door, to four o’clock in the morning. In the online world of holiday shopping, where demand can surge and retreat with the click of (many) buttons, workers must respond in real time, shoving other commitments aside. For people without cars, the ever-changing schedule makes it hard to coordinate transportation. One middle-aged woman, caught off guard on a day we’re dismissed at noon, will spend three hours walking the eight miles home. That she returns for the next shift—rubbing her feet and complaining under her breath—is a testament to her “flexibility,” to how far she’s learned to bend in the new economy.

A man I’ll call Brian (I’ve changed the names of people at the warehouse) takes over. He works for Ingram Micro, the warehouse operator, which he tells us is a “pretty big company.” (In fact, it’s the largest distributor of electronics in the world, with $37.8 billion in revenue last year.) Brian has a boyish face, wears an orange polo shirt and does his best to inject some passion into the room. “You guys are here to work—that’s awesome!” he calls. Blank stares. “We want people who want to be here!” Some fidgeting. He seems to be a nice enough guy, but it’s a tough crowd for a pep talk.

So down to business. Lesson number one: safety is a top priority of Ingram Micro. “We are constantly having people get hurt because they are working too fast,” Brian says. “You don’t get paid enough to get hurt.” (Someone behind me mutters, “You got that right.”) Brian walks us through the proper way to pick up boxes, and holds up a poster that illustrates safe stretching techniques.

But it’s a complicated message Brian is preaching. Why, after all, are people working too fast? Why did the employee in Brian’s lead anecdote try to slide under the conveyor belt—busting his head open in the process—instead of simply walking around?

Well, there’s this: the output for each employee, tracked at every moment via our scanning guns, will be posted daily. “All supervisors see are numbers, numbers, numbers,” he tells us. “So are we going to push you to work faster and be more productive?” The man to my left dutifully nods. “Yes, we are. Does the company expect you to pick up and carry fifty-pound boxes? Yes, it does.” Pause. “But we don’t expect you to carry them half a mile.”

Before we’re dismissed, the temp agency staffer returns with some final words of advice. Anyone who misses a shift on Thanksgiving, Black Friday, Cyber Monday or Christmas Eve is out. Anyone who isn’t performing at 100 percent efficiency by the third week will be given one week to improve, and then is out. On the bright side, a few “top performers”—perhaps 150 of the 800 temps they’ll hire by Thanksgiving—may get to stick around after the holiday season and avoid the mass layoffs. “Some people even get hired permanently by Ingram Micro,” she says. Such a promotion, she tells us, would include raises and benefits. The emphasis is hers. She makes the words sound like exotic treats.

But we shouldn’t get ahead of ourselves. Just this morning, she let someone go who was performing only at 20 percent. It won’t be easy to meet our efficiency goals, she acknowledges. “It sounds like a lot,” she tells us, “but it’s possible.”

* * *

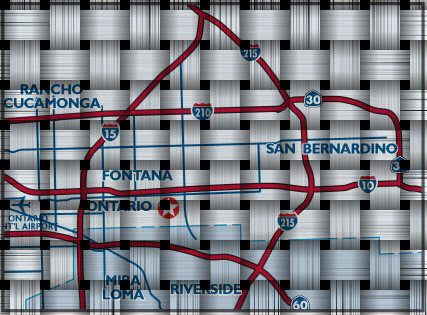

With a day off before work begins, I use the time to tour the area. The warehouse sits in the middle of the Inland Empire, a sprawling and fast-growing region that includes Riverside and San Bernardino counties. Of late, the area is best known for having taken the Great Recession square on the nose. The housing bust left the region short more than 70,000 construction jobs and with some of the highest foreclosure rates in the nation. Signs of recovery are hard to spot. Today, nearly one in five Inland Empire residents lives in poverty—highest among the nation’s twenty-five largest metropolitan areas—with unemployment at 10.4 percent.

It is against this bleak backdrop that a fantastic warehouse boom is under way. No area in the country is experiencing faster industrial growth, with warehouses occupying more than 400 million square feet, about the size of 7,000 football fields. The primary reason for the boom: Los Angeles is crowded, but the Inland Empire, in the words of John Husing—an economist with the Inland Empire Economic Partnership—has plenty of “dirt.” Land is cheap and plentiful, allowing for structures large enough to handle the flow of goods arriving from overseas. More than 40 percent of US imports pass through the Long Beach and Los Angeles ports, and three-quarters of those products enter Inland Empire warehouses, where they are unloaded, reloaded and shipped out again. If you own stuff made in China—the phone in your pocket, the shoes on your feet—chances are good that some of it passed through an Inland Empire warehouse.

The newest surge of growth is being driven by fulfillment centers catering to online shoppers. In 2012, the US e-commerce market accounted for $365 billion in sales, growing at a rate seven times faster than US retail spending. Just last year, Amazon moved into its first Inland Empire facility and recently announced a second. Despite the sluggish overall economy, demand is so high that most of the new construction is speculative. As one broker told the Los Angeles Times, “The Inland Empire is to industrial real estate what downtown Manhattan is to office real estate.”

On the ground, the results of all this activity aren’t especially pretty. Warehouses have about as much character as giant curbs—some are half a mile long—and have been plopped down along dusty roads in the desert. On my driving tour, I repeatedly get lost in the swirl of industrial parks, my only traffic companions the endless stream of big rigs going to and fro. But these parks are more than just aesthetic hazards. Air quality here is among the very worst in the nation—thanks in part to the diesel exhaust—leading stunted lung growth among local children.

For some, after the loss of so many good-paying construction jobs and decades of manufacturing decline, the logistics industry represents the region’s best shot at prosperity. Economist John Husing has studied the region for decades. During an interview, he notes that the majority of the jobs are available to people with high school diplomas or less, and that—unlike fast food work, for example—they can put folks on the path to the middle class. State data find that the average wage for logistics workers in the Inland Empire is nearly $45,000.

But Juan De Lara, an assistant professor at the University of Southern California, contends that such a rosy conclusion comes from conflating the white-collar jobs in the industry—managers and logisticians, for example—with most other warehouse employees: the folks who snag your online orders from shelves, load boxes onto pallets or drive those goods away on forklifts. Isolating for these positions, De Lara arrived at a median annual income of just $22,000. And it’s worse for temporary employees, who make up a significant portion of the workforce, especially during the holiday rush. For warehouse temps—like the crew of thirty folks I’ve joined at Ingram Micro—annual median wages come to a mere $10,067. Even a typical farmworker makes more.

The growth of temp work isn’t limited to warehouses, of course. Over the last several decades, cost-cutting companies have transformed many stable blue-collar jobs into temp positions, complete with sporadic hours, low pay and no benefits. Manufacturing has been hit especially hard: only one in forty-three manufacturing positions was temporary in 1989; by 2006, the figure had risen to one in eleven. And alongside the hollowing out of blue-collar jobs has been an explosion of low-wage jobs generally. According to the National Employment Law Project, such low-wage positions are responsible for three-fifths of all new jobs created since the recession.

* * *

Early the next morning we shuffle into a small warehouse across the street from the main building. Although many of us have been hired to work in the larger facility, we’re needed right now for what is being called the “Apple project.” We empty our pockets and pass through a security checkpoint, following a supervisor along a path of yellow lines. Men and women zoom past on forklifts and cherry-pickers, beeping incessantly as they carry pallets of boxes to load onto towering metal shelves. On the way, I chat with a blond woman who previously worked as a security guard for $9 an hour. Covering the graveyard shift, she arrived home just as her husband was heading to work, which left her in charge of their three young children. “Didn’t sleep too much,” she says.

We stop at a clearing in the middle of the warehouse, in front of three assembly lines. Surrounding the lines are boxes filled with thousands of Apple’s newest release, the iPad Air.

The iPads are fresh from China, looking sleek in shrink wrap. Our task is to box the units for individual shipping. At the front of the line, an address label is scanned and slapped onto a slender cardboard box, and the iPad is stuffed inside with extra padding for the edges. The boxes are then sent through a taping machine and loaded onto pallets for shipping.

I take a slot at one of the taping stations next to Mike, an older man with an impressive white beard. Soon hundreds of boxes are headed our way on rollers, and we fold the top and bottom flaps rapidly and shove them into the taping machine. It’s easy work, until it’s not. Despite our frenetic pace, boxes pile up behind us, each representing a customer eager to receive the newest Apple toy, which goes on sale tomorrow. Even in the cold building, sweat begins beading on my forehead. After an hour my hands are stiff. The rough edges of the cardboard leave painful nicks along my index fingers. By noon they’ll be bleeding.

Seeing the overflowing line, a supervisor bounces over, eager to motivate. “Come on, tapers, I need you to go faster!” Mike—who I’ve learned is no stranger to warehouse work—locks eyes with him, keeps his face blank, says nothing, maintains his pace. It’s subtle, but I’m witnessing a conversation of sorts. The supervisor backs off. Score one for the temps.

The iPads we’re packing are the 64GB models and sell for $699 at Apple.com. At $9 an hour, that’s about two weeks of our paycheck. This fact doesn’t seem to be lost on the security guards, one of whom paces around our line for nearly an hour. Each time I look up, his eyes are locked on us, causing me to wonder if in the chaos of packing I’ve somehow lodged an iPad in my rear pocket. “Go ask him what the fuck his problem is,” Mike says to me, a bit too loudly.

Our first break comes thanks to a malfunctioning label machine, which a supervisor scurries over to attempt to fix. (The slow speed of the printer allows for impromptu breaks throughout the week. “We want to work faster,” a supervisor tells me, sounding apologetic, “but we can only go as fast as the labels print.”) On the way out we run the security gantlet again. This time I set off the sensor with the plate and screws in my collarbone from a bike accident. I raise my arms to be wanded down and am told to take off my shoes and shake them out. Finally free to go, I grab my things. “Hey wait,” calls the guard. “Can you open your wallet for me?” I open it, show him the only contraband I’m carrying is a dollar bill, and finally make it to the break room. “This place isn’t playing,” says a temp who watched the ordeal.

* * *

If warehouse jobs serve as pathways to the middle class, someone forgot to hand out road maps to my co-workers. During my time at Ingram Micro—which is divided between getting the iPad Airs out the door and packing boxes full of products mostly destined for Walmart.com customers—I’ll learn that many of my co-workers have spent years bouncing from one temp assignment to the next. “They say they might keep you on past the holidays,” a woman named Martha tells me, “but they never do.” It makes for stressful living—weeks of steady, if low-paid, work can be followed by weeks, or months, of next to nothing—but in a region with high unemployment, there aren’t many other options. Temp work is the main game in town. One count puts the number of staffing agencies in Ontario at 275.

In the smaller warehouse, our shifts are dedicated to the iPad Air launch. A supervisor usually paces the floor while we work, occasionally calling us together to tell us to pick up the pace, or informing us of our output. (“You’ve done 18,000 units—good job!” he says after one shift, a rare word of praise.) Except when we’re waiting for pallets to arrive, we’re constantly in motion. The burliest folks in our group, men with veined forearms who drink workout shakes during breaks, take the assignment in stride. But others—like me—are soon complaining about sore hands and wrists, along with aching feet. As the line hums, workers steal a second here or there to stretch their hands and grimace. But the boxes don’t stop, and neither do we.

“Years ago, I made $12 an hour at a warehouse,” says Carlos, an immigrant from Mexico City, during a break. “Now look at what they’re paying.” To make ends meet, he picks up side jobs as a carpet cleaner, while his wife works at a Ross distribution center in nearby Moreno Valley, earning just $9 an hour as well. “That’s why you’ve got people going back to Mexico. The jobs here don’t pay enough.” Learning new skills can help, a little. At Ingram Micro, temps trained to drive forklifts earn $10 an hour.

The fluctuating schedule makes any work-life balance nearly impossible. At the end of one shift, we’re told to report the next day, a Saturday, at 4 am. Although there is some grumbling—“I didn’t sign up for this,” one woman complains—everyone is lined up for roll call the following morning. I stand next to Carlos, who looks exhausted. Last night, he had taken his two kids to Disneyland. He got home from the amusement park at 2 am, dressed for work and headed back out the door. “Time goes by really fast when you have kids,” he tells me, saying he has no regrets about the decision. “This is the time to be with them.”

* * *

The problems of warehouse work—the low wages, the mad pace—are all too familiar to Javier Rodriguez. Originally from Mexico, he found construction work in the Inland Empire and for a time was pulling in $25 an hour. But jobs dried up after the housing bust. He wound up as a temp at a nearby warehouse in 2012, driving a forklift for $10 an hour, when a group of blue-shirted workers stormed into the building.

“I was watching and wondering, ‘Who are they?’” remembers Rodriguez. “That’s when the rumors and stories started that they were with the union.”

The rumors turned out to be true, and Rodriguez signed up right away. He worked at a warehouse operated by a company named NFI, dedicated to moving Walmart goods. “You feel like you’re doing a good job, but they are always putting pressure on you to go faster,” he says. A supervisor insulted him; the heat in summer was unbearable; the water given to workers wasn’t clean. And, of course, the low wages. To make ends meet, Rodriguez had taken on a second warehouse job, and was putting in seventy hours a week. “I’d only get to see my wife and kids on the weekend,” he says.

The blue-shirted workers were members of Warehouse Workers United, a project launched in 2009 by the Change to Win labor coalition. The group seeks to get an organizing toehold in the fast-growing industry and has filed numerous lawsuits against warehouse operators, alleging rampant wage theft and dangerous workplace conditions. But WWU aims to broaden the target, moving up the supply food chain to the companies that use warehouses—known as “third party logistics providers” (3PLs)—to transport their goods. And they’re starting with the biggest target of all: Walmart. Their efforts got a big boost earlier this year, when a federal judge allowed the retail giant to be added to a class-action suit alleging widespread wage theft against Schneider Logistics and three staffing companies, in a warehouse exclusively dedicated to Walmart merchandise.

“When workers began coming to us and complaining, the common thread was Walmart,” says Guadalupe Palma, WWU’s campaign director. “As the biggest retailer, they have a responsibility to improve the conditions. These could easily be good jobs.”

But there are significant challenges to organizing the industry. “Because of the temp nature of work, it’s very easy for a worker who speaks out to be retaliated against,” says Palma. “They might not be called back to work the following day, or have their hours decreased.” That’s exactly what happened to Rodriguez, according to the WWU. After he spoke to the media and participated in strikes over unsafe workplace conditions—leading Cal/OSHA to fine the warehouse nearly $30,000—he was fired earlier this year. Federal charges have been filed against the company, alleging retaliation, and an investigation is under way.

Though out of work, Rodriguez is surprisingly upbeat. “The warehouses aren’t bad,” he tells me. “If they treat people better and pay us what we’re owed, the work could be very good. It is honest work. The workers are very dedicated. But right now, others are getting rich off jobs that pay us misery wages.”

* * *

One morning I am told to report to the larger warehouse. I wait for a supervisor near the security checkpoint, in front of a digital display that lists the number of days since an accident. Today it reads: 4.

When I follow the supervisor through the vast building, it’s easy to see how people can get hurt here. In the “picking module,” employees dart around snapping up products for online orders, a slip away from a sprained ankle or worse. (“Work there if you want to lose weight,” someone tells me.) Shelves tower overhead, filled with pallets loaded with heavy boxes. They fall, you’re crushed. I will witness one such near miss, when a heavy box topples from a raised forklift, sending a loud boom through the building. Thankfully, no one was underneath. As we make our way to the rear, we have to sidestep workers driving forklifts and cherry-pickers—the latter used to reach the highest shelves—zipping around the tight spaces.

We head up a flight of stairs to the packing area. A series of conveyor belts are filled with boxes, most reading Walmart.com on the side. The boxes, filled with an endless array of products, must be stuffed with brown packing paper, folded and shoved through a taping machine, after which they’ll continue on their journey through the building. Initially, the pace seems sustainable. Every three seconds or so a new box arrives, and I feel oddly content with the small role I’m playing to keep the online shopping beast humming along. Electric blankets and Teenage Mutant Ninja Turtles. Diaper Genies and vibrating baby chairs. Backpacks, keyboards, extension cords. Some of the product combinations are intriguing: the person, for example, who needs a tent and a printer cartridge. Judging by the sheer number of items for kids—My Little Pony, Elmo, a host of characters I’m too out of the loop to identify—by early November parents are already deep into Christmas shopping.

Then comes a collection of toy cars that, no matter how hard I try, refuse to fit into the box they’ve been assigned. I put the carton aside, several precious minutes wasted, and see that my conveyor belt is really backed up. I know such a sight often prompts a visit from a supervisor, so I begin to hustle.

The boxes start flying by. Pack-fold-tape, pack-fold-tape. At this speed, my powers of observation have left. No longer do I care about the product, or pause to imagine the customer; my thoughts, such as they are, tend toward “Here comes another box of crap.” This goes on for how long I don’t know, but at some point I realize that a light is blinking. I look up. I’ve been so focused on dispatching the boxes, I’ve failed to realize that the conveyor has jammed in front. As far as I can see, the packed and taped boxes are frozen in place, some mashed together in a way that is unlikely to cause “customer delight,” which is the number-one goal here at Ingram Micro. I look around for guidance. Not a supervisor in sight. My hands are bleeding again, rubbed raw by the cardboard. Unsure what else to do, I take my break and go to the bathroom to wash off. Unlike my co-workers, I can afford to get fired.

* * *

On the final day of the iPad project, a young worker to my right calls my name. We’re both doing the same job at the end of parallel lines: grabbing boxed iPads after they’ve gone through the taping machine and stacking them on pallets, to be loaded onto trucks and delivered to customers. There’s a sign on the taping machine, warning us to keep our hands away. Previously, an extension allowed the iPads to exit the taping machine and land on a platform. But today the extension has disappeared, and we have to snag the boxes as they emerge from the machine to keep the precious cargo from falling to the ground.

“Yo, Gabe, can I get some help?” I scamper over. While grabbing an iPad, his sweatshirt cuff has become trapped in the revolving gears of the belt, threatening to suck his hand into churning metal. As he yanks, I pull the machine in the opposite direction, and after a moment of struggle he’s free. A few seconds of “fuck that was close” breathing follows. His wrist is bright red. Then he rolls up his sleeves and, seeing more iPads on the way, gets back to work.

(Gabriel Thompson is the author of Working in the Shadows . He is working on a biography of Fred Ross—the legendary organizer who trained Cesar Chavez—titled, America’s Social Arsonist.)

-

The SlickJanuary 27, 2026

The SlickJanuary 27, 2026The One Big Beautiful Prediction: The Energy Transition Is Still Alive

-

Column - State of InequalityJanuary 29, 2026

Column - State of InequalityJanuary 29, 2026Are California’s Billionaires Crying Wolf?

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Dirty MoneyJanuary 30, 2026

Dirty MoneyJanuary 30, 2026Amid Climate Crisis, Insurers’ Increased Use of AI Raises Concern For Policyholders

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit