Labor & Economy

Ending Bush Tax Cuts Would Affect Few Small Businesses

Republicans pride themselves of being the champions of small business owners. But it’s helpful to clarify what actually is their definition of a small business.

The Center on Budget and Policy Priorities (CBPP) released a report that shows only 2.5 percent of small business owners would be affected by allowing the Bush tax cuts to expire on the wealthiest taxpayers (top two marginal tax rates).

CBPP writes:

“The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners—as would 237 of the nation’s 400 wealthiest people.”

Did you catch that? The definition is so broad 237 of the nation’s 400 wealthiest people are considered small business owners.

CBPP explains this often-cited claim that allowing the Bush tax cuts to expire on upper income earners is so exaggerated it includes:

any taxpayer who receives any income from any “pass-through” entity (that is, an entity that does not pay corporate income tax on its profits but instead passes them through to its owners, who pay tax at the individual rates).

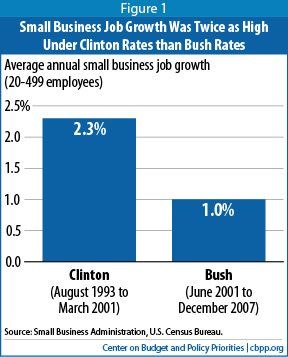

It is interesting to note that small business growth during the Clinton rates was twice as high as under the Bush-era tax rates.

Read the entire report here.

(This post first appeared on the AFL-CIO’s Web site.)

-

Column - State of InequalityJanuary 29, 2026

Column - State of InequalityJanuary 29, 2026Are California’s Billionaires Crying Wolf?

-

Latest NewsFebruary 3, 2026

Latest NewsFebruary 3, 2026Amid the Violent Minnesota Raids, ICE Arrests Over 100 Refugees, Ships Many to Texas

-

Dirty MoneyJanuary 30, 2026

Dirty MoneyJanuary 30, 2026Amid Climate Crisis, Insurers’ Increased Use of AI Raises Concern For Policyholders

-

Featured VideoFebruary 4, 2026

Featured VideoFebruary 4, 2026Protesters Turn to Economic Disruption to Fight ICE

-

The SlickFebruary 2, 2026

The SlickFebruary 2, 2026Colorado May Ask Big Oil to Leave Millions of Dollars in the Ground

-

Column - State of InequalityFebruary 5, 2026

Column - State of InequalityFebruary 5, 2026Lawsuits Push Back on Trump’s Attack on Child Care

-

Column - California UncoveredFebruary 6, 2026

Column - California UncoveredFebruary 6, 2026What It’s Like On the Front Line as Health Care Cuts Start to Hit

-

The SlickFebruary 10, 2026

The SlickFebruary 10, 2026New Mexico Again Debates Greenhouse Gas Reductions as Snow Melts