Labor & Economy

Wall Street’s Ambulance Chasers

Eight years ago the world changed. The financial crisis kicked off a recession that left deep scars on the U.S. economy, including making it tougher for many cities and counties to pay for basic public goods like infrastructure and emergency services.

Eight years ago the world changed. The financial crisis kicked off a recession that left deep scars on the U.S. economy, including making it tougher for many cities and counties to pay for basic public goods like infrastructure and emergency services.

In a jarring investigation, The New York Times has exposed how a little known part of Wall Street has benefited from our slow recovery. As public budgets have tightened, investors operating with little transparency or oversight have increasingly taken over many public services Americans rely on every day, like ambulances and even firefighting.

The Times details three ambulance companies that filed for bankruptcy after being acquired by Wall Street private equity firms. Cities like Mt. Vernon, NY and Tacoma, WA, had contracted with the companies in an effort to save money. The companies cut costs, implemented aggressive billing tactics and squeezed workers. Paramedics employed by one of the companies had to secretly swipe medical supplies from a hospital because their ambulances were low on critical medications. Another company sent a bill for hundreds of dollars to an infant girl born in one of its ambulances, threatening that an unpaid bill would hurt her credit.

Government contractors, chasing profit, often cut corners by reducing services and worker pay, and sidestepping protections for the public and the environment. Privatization threatens the quality and accessibility of our public goods, and the good-paying, middle-class jobs they provide.

As the Times shows, private equity firms up the ante: “Unlike other for-profit companies, which often have years of experience making a product or offering a service, private equity is primarily skilled in making money.”

Private equity firms are complicated and shrouded in secrecy—you may have heard of “shadow banking,” they’re part of that—but one thing’s for sure: Their interests, like any government contractor looking to profit, often run counter to the public interest.

-

Column - State of InequalityJanuary 22, 2026

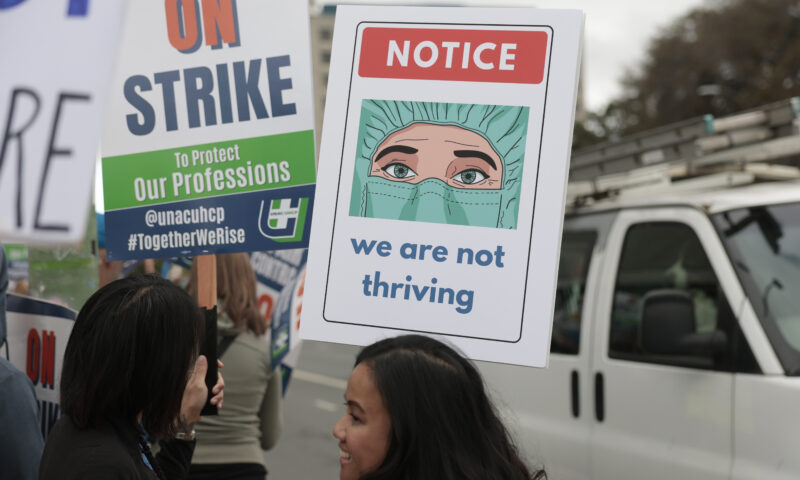

Column - State of InequalityJanuary 22, 2026On Eve of Strike, Kaiser Nurses Sound Alarm on Patient Care

-

Latest NewsJanuary 16, 2026

Latest NewsJanuary 16, 2026Homes That Survived the 2025 L.A. Fires Are Still Contaminated

-

The SlickJanuary 20, 2026

The SlickJanuary 20, 2026The Rio Grande Was Once an Inviting River. It’s Now a Militarized Border.

-

Latest NewsJanuary 21, 2026

Latest NewsJanuary 21, 2026Honduran Grandfather Who Died in ICE Custody Told Family He’d Felt Ill For Weeks

-

The SlickJanuary 19, 2026

The SlickJanuary 19, 2026Seven Years on, New Mexico Still Hasn’t Codified Governor’s Climate Goals

-

Latest NewsJanuary 22, 2026

Latest NewsJanuary 22, 2026‘A Fraudulent Scheme’: New Mexico Sues Texas Oil Companies for Walking Away From Their Leaking Wells

-

The SlickJanuary 23, 2026

The SlickJanuary 23, 2026Yes, the Energy Transition Is Coming. But ‘Probably Not’ in Our Lifetime.

-

The SlickJanuary 27, 2026

The SlickJanuary 27, 2026The One Big Beautiful Prediction: The Energy Transition Is Still Alive