Labor & Economy

Finance the Future By Investing in Change

A quarter of all working Americans have no savings, and half die with less than $10,000 in financial assets. Nevertheless, some of us will have a small nest egg, and where to put that bit of money can be a challenge. Even for many socially minded people what we know we’ve learned from “talking to Chuck.” But there are alternatives and they matter.

I first became aware of other ways to think about investments when I realized my denomination’s retirement fund screens its portfolio for tobacco, alcohol, gambling and guns. Many other faith communities with substantial funds do also. There are also a number of public mutual funds that have significant track records in screening for social responsibility issues. Some invest in alternative energy. Some avoid military contractors. Some look for environmentally enhancing product lines. Others invest in locally owned small businesses or in organic food sources. And some do a combination of all those.

Alternative investment funds also make decisions based on preferences for businesses that:

- Follow fair labor practices

- Adhere to fair trade standards

- Curb greenhouse gas emissions

- Reduce toxic waste

- Make transportation decisions based on their effects on climate

- Reduce fuel consumption

- Donate to organizations whose missions they value

In case you think this is a small sector, it now amounts to about 11 per cent of all U.S. investments under professional management. That’s a whopping $3.74 trillion in assets!

Not only do some of those investment funds screen for socially responsible goals, many of them actively lobby large corporations to improve their behavior. By buying small amounts of stock in a misbehaving company, they take the opportunity to enter into dialogue through proxy voting, letter writing, filing shareholder resolutions and holding direct conversations with management. They use their financial purchasing power to pursue values consistent with our values.

For example, advocates used their financial clout in a campaign to get Hershey to stop child labor practices by buying only fair trade chocolate. First the advocacy groups formed a coalition to organize mass protests through letter-writing, petitions, Facebook, phone messages and emails. After focusing on a media campaign, the coalition engaged social responsibility funds that bought shares of the company and brought pressure through ownership. Finally, they turned their increasing clout on stores that sold the non-fair trade products. When those businesses joined the campaign, Hershey caved. Now the company has agreed to certify that 100 percent of its cocoa will be fair trade – no child labor – by 2020.

That’s a long struggle with many players. But every struggle for justice requires exactly that kind of persistence as well as broad support. One of the keys here was social responsibility investment funds. They were also important players in convincing 15 million people to switch their banking habits from the big banks to locally owned, community-lending businesses and credit unions. The alternative movement has now created a Blue-Green coalition – putting unions and environmental advocates on the same team.

If you still think this is a fringe economy, look at the growth in just the field of green investment. Since 2002 fair trade food sales grew from 9.8 million pounds of coffee, cocoa and tea to 152 million pounds. Organic food sales went from $7.4 billion to $29 billion. Organic non-food items went from just $4 million to $2.2 billion. And in less than 10 years green building construction starts increased from $3 billion to $54 billion worth. That’s huge growth and indicates the measure of future investment opportunities for your retirement dollars.

And here’s the bottom line: If you read the annual returns for mutual funds, compare the results of the social responsibility groups against the mainstream investment firms. Almost always, whatever their investment strategy and however the economy is doing, the responsibility funds earn as much or better than their conventional counterparts. Chuck should be listening to that.

-

Latest NewsJanuary 8, 2026

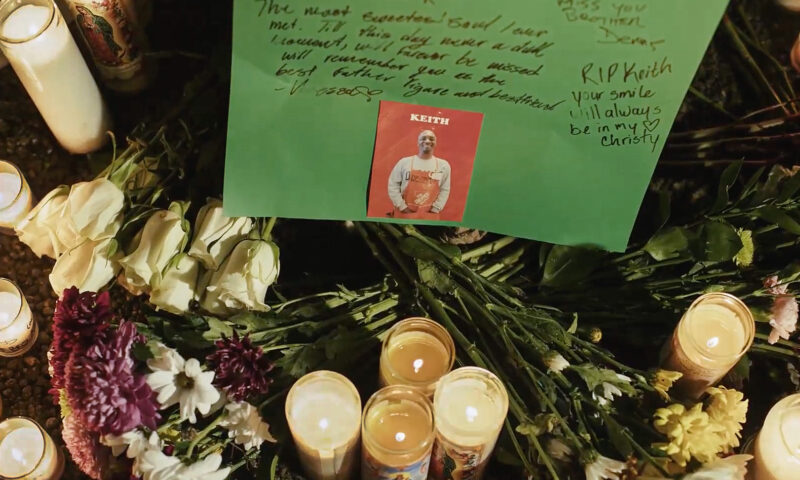

Latest NewsJanuary 8, 2026Why No Charges? Friends, Family of Man Killed by Off-Duty ICE Officer Ask After New Year’s Eve Shooting.

-

Latest NewsDecember 30, 2025

Latest NewsDecember 30, 2025From Fire to ICE: The Year in Video

-

Column - State of InequalityJanuary 1, 2026

Column - State of InequalityJanuary 1, 2026Still the Golden State?

-

The SlickJanuary 12, 2026

The SlickJanuary 12, 2026Will an Old Pennsylvania Coal Town Get a Reboot From AI?

-

Pain & ProfitJanuary 7, 2026

Pain & ProfitJanuary 7, 2026Trump’s Biggest Inaugural Donor Benefits from Policy Changes That Raise Worker Safety Concerns

-

Latest NewsJanuary 6, 2026

Latest NewsJanuary 6, 2026In a Time of Extreme Peril, Burmese Journalists Tell Stories From the Shadows

-

Latest NewsJanuary 13, 2026

Latest NewsJanuary 13, 2026Straight Out of Project 2025: Trump’s Immigration Plan Was Clear

-

Column - State of InequalityJanuary 8, 2026

Column - State of InequalityJanuary 8, 2026Can California’s New Immigrant Laws Help — and Hold Up in Court?