Dirty Money: U.S. Banks and the Climate Crisis

Banks Continue to Put Billions Into Oil and Gas — Is It a Smart Investment?

Some experts say banks should be financing renewables at a much higher rate, for climate and ROI reasons.

The oil company CEO was practically giddy, she was so excited about its record earnings. On a call with shareholders and analysts on March 31, Occidental Petroleum’s Vicki Hollub bragged that the century-old oil giant was hitting new production records at its drilling sites in the Rockies, helping it build “the strongest foundation for free cash flow generation in Oxy’s history.”

The boasting highlighted an incredible run for the industry: Five of the biggest — U.S. giants ExxonMobil, Chevron, Shell, and TotalEnergies, plus British giant BP — more than doubled their profits in 2022, with a cumulative profit of $200 billion, much of that in cash or cash equivalents. To illustrate the resurgence of the sector, Chevron and Exxon together are sitting on $48 billion in such assets, compared to $10 billion in early 2021.

The surge in oil and gas profits is made possible in part by generous financing from banks, which provided $673 billion to the fossil fuel industry last year, according to the annual Banking on Climate Chaos report, authored by nonprofits including the Rainforest Action Network and the Sierra Club. Overall, the share of bank finance going to renewable energy rather than fossil fuels has hardly changed in the last six years.

Banks lending to oil and gas companies insist that it’s necessary given global energy needs. And while there is a growing divide within the banking world over whether to continue financing fossil-fuel projects, only one major global bank — France’s state-owned La Banque Postale — has committed to halt financing oil and gas companies by 2030. Recently, HSBC, the seventh largest bank in the world, announced that it will no longer finance new oil and gas projects, though it will continue to finance existing projects. And a number of more climate-conscious “green” banks such as Germany’s GLS Bank quit the Net-Zero Banking Alliance in protest over its decision not to impose stronger restrictions on fossil-fuel financing.

Banks are increasingly pressured by lawmakers from energy-producing states like Alaska and Wyoming to keep supporting the fossil fuel industry.

During a recent Citigroup shareholder meeting, in which resolutions calling for the bank to wind down its financing of fossil fuel activity were soundly defeated, CEO Jane Fraser said, “We simply don’t yet have affordable alternatives at [the] scale and reliability that is required” to get the economy to shift away from fossil fuels. In general, banks justify their continued financing of such activity by emphasizing that the energy companies they support can play a major role in the world’s transition to a green economy. In addition, even though they face shareholder resolutions proposed by environmental activist groups like the Sierra Club and the Sisters of St. Joseph of Peace to ramp down such lending, banks are also increasingly pressured by lawmakers from energy-producing states like Alaska and Wyoming to keep supporting the industry.

So is financing of fossil fuel production a better investment for banks than financing renewables?

On a short-term basis under certain conditions — such as the demand spike caused by the pandemic and the war in Ukraine — fossil fuel production can be more profitable, enriching financial institutions that make loans and underwrite loans to oil and gas companies. But some energy experts say that green energy is a better financial bet over the long term as it scales up, costs keep dropping and climate change creates more demand for clean energy around the globe.

“It’s not necessarily more profitable, but it’s a better investment,” says Rachel Kyte, dean of the Fletcher School at Tufts University. She notes that once demand slows and the world continues its decarbonization efforts, “You don’t want to be holding a lot of carbon.” From a risk perspective, “Renewables is becoming much more attractive,” says Kyte, pointing to a recent report by the International Renewable Energy Association that shows renewables represented 83% of capacity additions and 40% of installed power generation globally in 2022 — marking the largest-ever annual increase in renewable energy capacity.

In addition, banks and financial institutions face long-term risks by continuing to provide financing to fossil fuel companies. Not only does such financing undermine banks’ net-zero commitments but it exposes investors to material dangers. Banks face financial losses due to the massive damage to people and property of climate change-related events such as hurricanes, wildfires and drought. In addition, fossil fuel reserves risk becoming stranded assets as countries restrict extraction activity. Such stranded assets — oil fields, gas reserves or their exploitation rights, coal mines — “would translate into credit and liquidity risk for banks that lend to fossil fuel businesses and other financial institutions that invest in these businesses,” according to a recent report by the European Parliament. The volatility of the sector, with the potential for abrupt and coordinated spikes in carbon prices, could also pose a systemic risk. Climate change “is a credit risk concern for banks and they have to consider the risk derived from fossil fuels when taking investment decisions and in their credit-granting processes.”

Even on purely market-based terms, with no long-term consideration of environmental consequences, it’s a smarter bet to invest in renewables, says Tom Sanzillo, director of financial analysis for the Institute for Energy Economics and Financial Analysis (IEEFA). “They needed very high prices to get out of trouble, and very high prices are unsustainable,” he says, referring to the last decade when oil and gas prices were in decline. “Nobody expects those profits to continue.” Already, prices have dropped in recent months, as have oil company profits.

“There is clear evidence that renewable energy is cost effective and will be a good investment over time.”

~ Rachel Kyte, dean, Fletcher School at Tufts University

As the climate crisis worsens, the risks of oil and gas investments keep increasing. In addition to the cyclical nature of the business, which is prone to booms and busts, the uncertainty of oil and gas exploration, and safety concerns around its products’ flammability and toxicity, have become more pronounced in recent decades. As governments accelerate their decarbonization efforts, the demand for oil and gas will likely decrease in coming years.

Such a decline in demand poses risks for banks and lending institutions, as highlighted by the uncertain future for liquified natural gas (LNG). A glut of proposed projects threatens oversupply and many of them are unlikely to be fully financed. In fact, the fuel’s high prices have earned it a reputation as “the globe’s most expensive and unreliable energy commodity,” says Clark Williams-Derry of the Institute for Energy Economics and Financial Analysis. Even if some of those projects are completed, recovering billions in investment in the next few decades is a risky proposition, according to the Global Energy Monitor. “Ultimately, investments in clean energy are likely to be less risky and more sustainable.”

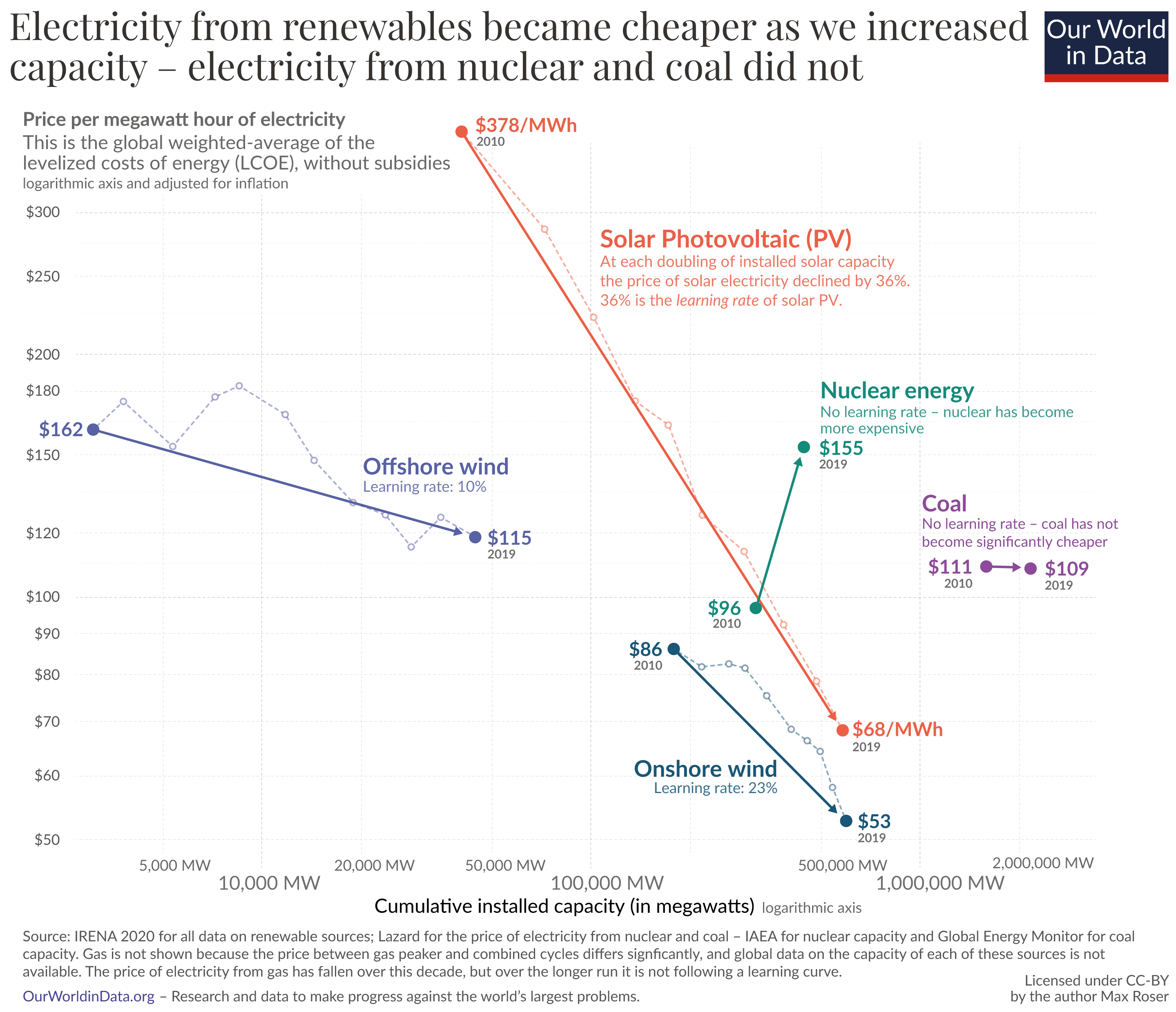

Though the oil and gas giants remain profitable right now, power from new fossil fuels is more expensive than new renewables in most of the world. That’s due to advances in renewables technology — with each doubling of their installed capacity, their prices drop by about half, say energy researchers.

One of the best examples of renewable technology’s growth trend is solar power. Back in 1956, the cost of a single watt of solar voltaic capacity was $1,865 (adjusted for inflation) — at that price, a solar panel today would cost more than half a million dollars. Thus, solar was once so prohibitively expensive compared to fossil fuels that it could not compete and had a difficult time attracting investors.

Since then, the price has plummeted to 38 cents per watt, due to myriad advances across the board — from more efficient factories and engineering developments that improved the production processes of the silicon ingots and wafers to cheaper raw materials and technological improvements that made the panels more efficient.

“There is clear evidence that renewable energy is cost effective and will be a good investment over time,” says Kyte. “These are still markets which are at the beginning of their journey.”

Plus, there are numerous incentives for banks to reap billions from the financing of green energy. Prepaid muni bonds, which are set up to help local utilities buy decades worth of renewable electricity — “good for the environment, but even better for the banks that will profit from cheap financing, trading profits and federal tax breaks,” according to Forbes — are a hot trend in finance.

Despite recent political headwinds in certain states where Republican governors have bashed banks for their socially responsible investing, ESG remains an enormous and expanding business. Global ESG-related assets have grown from $2.2 trillion in 2015 to $18.4 trillion in 2021, with sustainable bonds making up a major part of that total. From 2020 to 2022, $85 billion worth of sustainable bonds were issued in the U.S.

Banks still dominate the financing of the sector, with 20% of oil and gas companies in a recent Haynes and Boone survey saying they would get loans from banks, followed by alternative sources such as private equity and pensions funds. Overall, banks remain the biggest source of external financing for oil and gas companies. Yet the industry is expecting to see banks tighten access to loans in the coming year — with banks projecting gas prices to tumble in coming months.

In the end, it’s all about money and time, says Paul Rissman, clinical professor at NYU Stern School of Business, who says that “banks will finance anything they can make money off of — fossil fuels, renewables, etc.” They are certainly aware of the future risks of such investments, but “their reasoning is that the average loan term is about five to seven years, and they think they have plenty of time to stop financing fossil fuels if they need to.”

Copyright 2023 Capital & Main

-

Latest NewsApril 8, 2024

Latest NewsApril 8, 2024Report: Banks Should Set Stricter Climate Goals for Agriculture Clients

-

Latest NewsApril 22, 2024

Latest NewsApril 22, 2024Oil Companies Must Set Aside More Money to Plug Wells, a New Rule Says. But It Won’t Be Enough.

-

Striking BackMarch 25, 2024

Striking BackMarch 25, 2024Unionizing Planned Parenthood

-

California UncoveredApril 9, 2024

California UncoveredApril 9, 2024700,000 Undocumented Californians Recently Became Eligible for Medi-Cal. Many May Be Afraid to Sign Up.

-

Feet to the FireApril 22, 2024

Feet to the FireApril 22, 2024Regional U.S. Banks Sharply Expand Lending to Oil and Gas Projects

-

Class WarMarch 26, 2024

Class WarMarch 26, 2024‘They Don’t Want to Teach Black History’

-

Latest NewsApril 10, 2024

Latest NewsApril 10, 2024The Transatlantic Battle to Stop Methane Gas Exports From South Texas

-

Latest NewsApril 23, 2024

Latest NewsApril 23, 2024A Whole-Person Approach to Combating Homelessness